FORE! An analysis of CEO shirking

- Biggerstaff, Cicero and Puckett

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

Using CEO golf play as a measure of leisure, we document that there is significant variation in the amount of leisure that CEOs consume. We find that they consume more leisure when they have lower equity-based incentives. CEOs that golf frequently (i.e., those in the top quartile of golf play, who play at least 22 rounds per year) are associated with firms that have lower operating performance and firm values. Numerous tests accounting for the possible endogenous nature of these relations support a conclusion that CEO shirking causes lower firm performance. We find that boards are more likely to replace CEOs who shirk, but CEOs with longer tenures or weaker governance environments appear to avoid disciplinary consequences.

Alpha Highlight:

The authors applied a novel proxy of CEO’s leisure consumption: the amount of golf a CEO plays! The main finding of this paper is that firms with CEOs that golf frequently (i.e. those who consume more leisure time and “shirk”) have lower operating performance and firm values.

The authors argue that golfing is a good proxy for “shirking CEOs:” First, quite a lot CEOs list golf as their preferred choice for leisure (according to a 1998 Accountemps survey, 21% of CEO list golf as their preferred outlet of leisure); second, golf requires a significant time commitment (A round of golf take approximately 4 hours to complete).

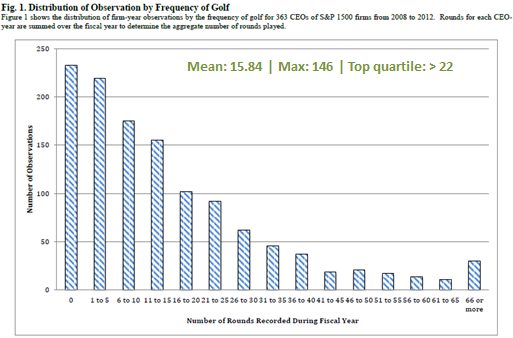

The figure below shows the distribution of CEO’s golf playing rounds from 2008 to 2012. According to the paper, the top decile of the sample plays a minimum of 37 rounds, which is roughly equivalent to 220 hours (5.5 weeks of work!).

Key findings:

The authors hand-collect golfing records for 363 S&P 1500 CEOs from a database maintained by the United States Golf Association (“USGA”) from 2008 to 2012.

The paper finds the following:

- CEOs who play more rounds of golf are associated with lower stock ownership and weak wealth-t0-performance sensitives (WPS). Thus, the paper believes that incentives are an important determinant of the amount of leisure CEOs consume.

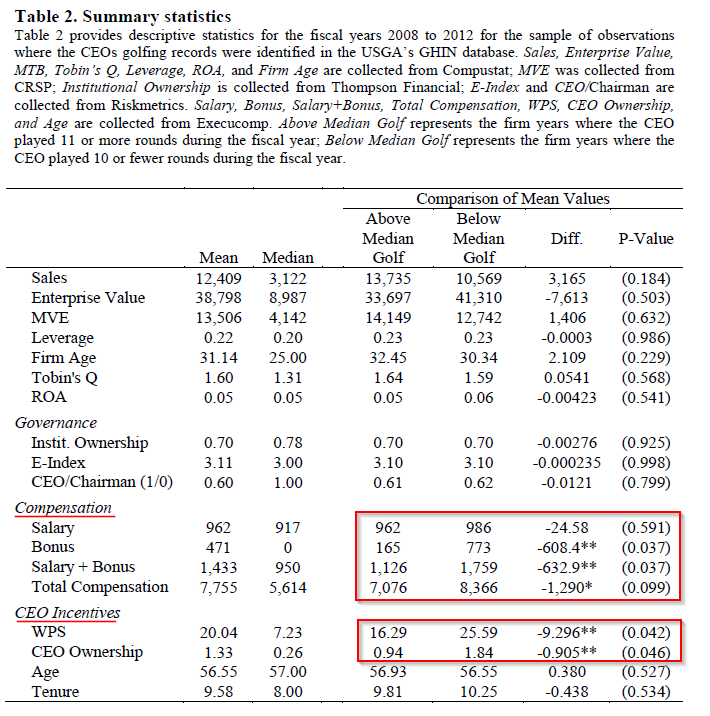

- Table 2 shows that CEOs who play golf above the median have lower WPS and stock ownership.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

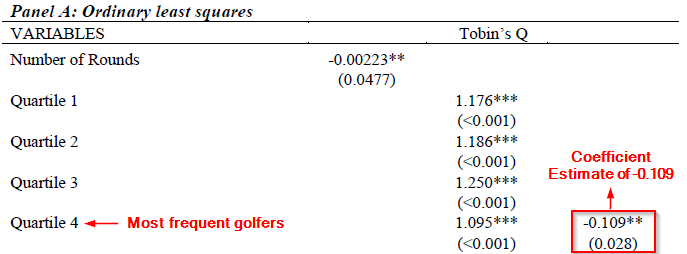

- The authors then evaluate whether firm performance suffers when CEOs consume more leisure. The main measures of performance are operating performance (ROA) and Tobin’s Q. The paper finds that Tobin’s Q is almost 10% lower for firms whose CEOs are in the top quartile of golf play (22 rounds or more per year).

- The table below highlights that the coefficient estimates of quartile 4 is -0.109 (p-value=0.028), which indicates that firms with CEOs on the top quartile active golfers are associated with a Tobin’s Q almost 10% lower than other firms in the sample. The authors also do multiple supplementary tests to exclude other possible explanations for this effect.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Summary:

Who knows if more golf CAUSES poor performance–it is simply too difficult to control for everything, despite the author’s best efforts–however, more golf is definitely correlated with poor company performance. Interesting and kinda fun. Another question is whether the CEOs who play more golf are actually better golfers.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.