On the Performance of Cyclically Adjusted Valuation Measures

- Gray and Vogel

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Core Idea:

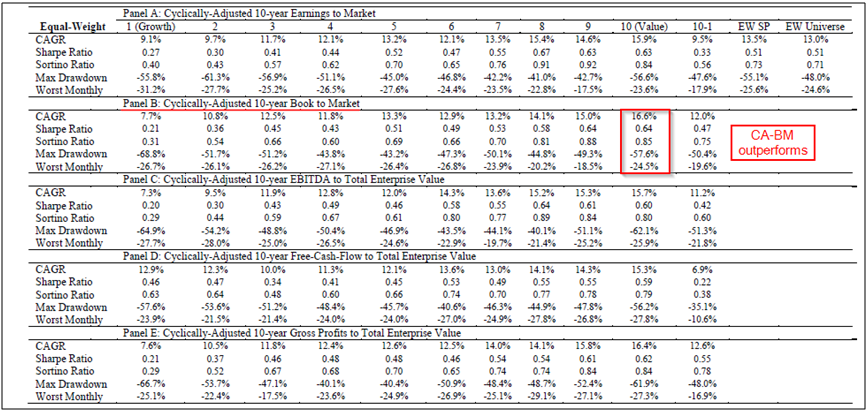

Gray and Vogel (2012) show that, with respect to stocks, Shiller’s CAPE is not the optimal way to implement a cyclically-adjusted value measure; instead, the paper finds that the Cyclically-adjusted book-to-market (CA-BM) is the best measure to predict returns based on sample from 1973 to 2012.

- While CA-BM is the marginal top performer over the past 40 years, all cyclically-adjusted value measures have outperformed market benchmarks by large margins.

- Paper also tests if integrating momentum into cyclically-adjusted measures and monthly rebalancing can enhance returns. Results show that both of these enhancements improve portfolio performance.

Alpha Highlight:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.