Our DO-IT-YOURSELF Investing Tool is Live!

You can build your own stock selection and asset allocation models using our DIY Investing tools.

How to Access the Tool?

Step 1: Click “Our tools” tab from our main website page.

Step 2: If you already have a username and password, please sign in. If you are new to our tool, just take 30 second to sign up and use it for free!

Step 3: Click on the “DIY Investing Tool.”

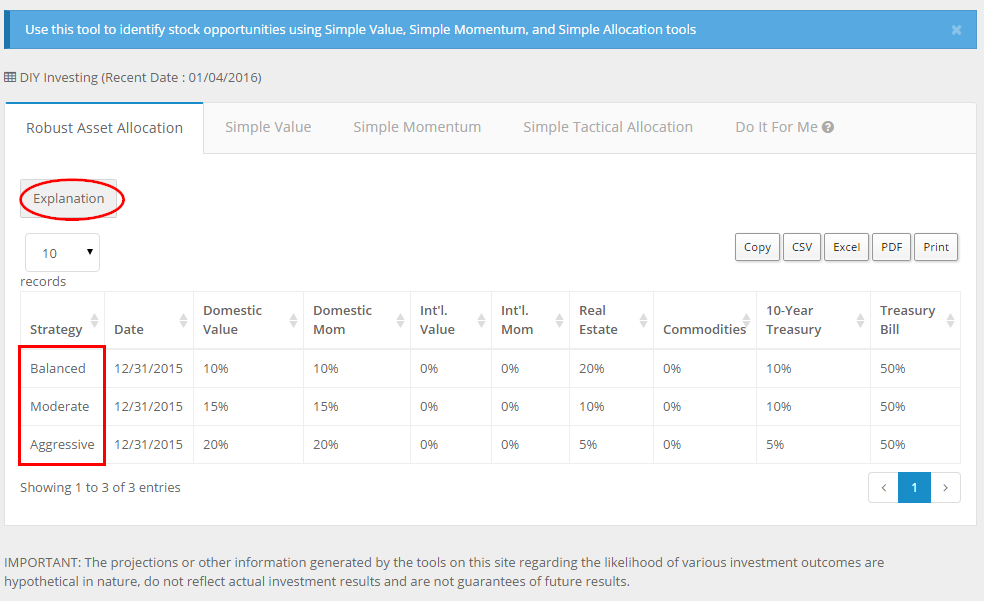

Robust Asset Allocation

Our “Robust Asset Allocation” seeks to deliver a low-complexity, high-liquidity, diversified, risk-managed retirement portfolio. This tool provides users the simple “Robust Asset Allocation” weights. Click here to read more.

Click to enlarge

Simple Value and Simple Momentum Tool

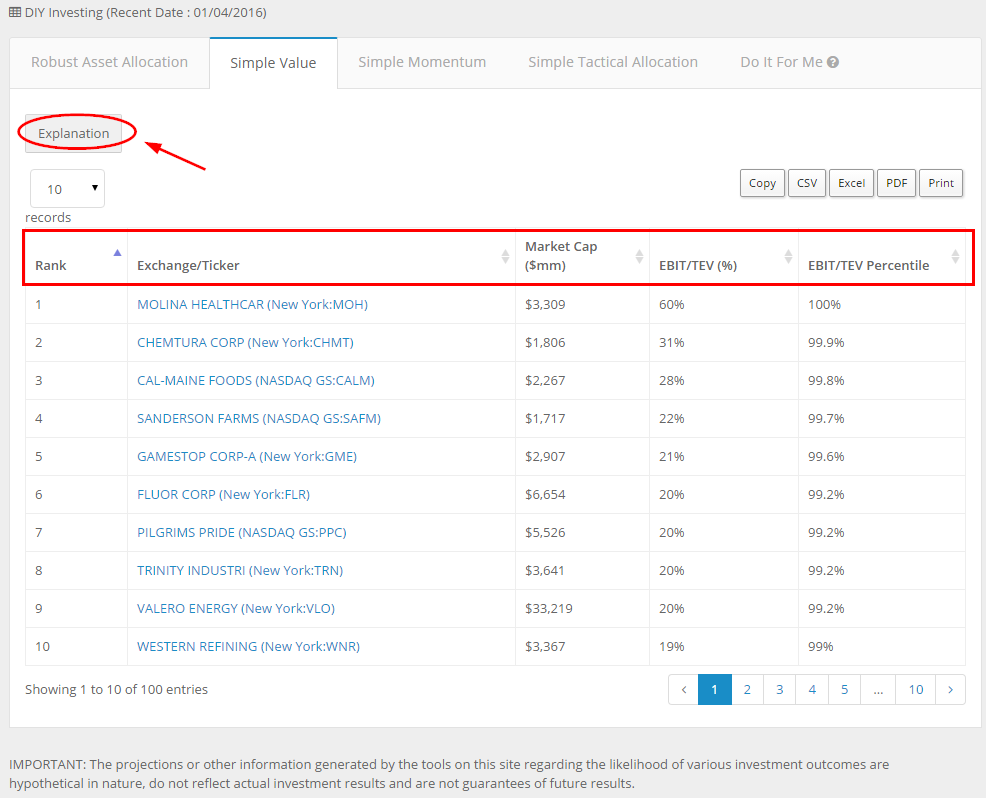

Simple Value Tool: This tool helps you identify stock opportunities using a simple value strategy. The list include the cheapest mid and large market capitalization U.S. stock names sorted on Earnings before interest and taxes (EBIT) divided by total enterprise value (TEV), or EBIT/TEV. Our own research–Quantitative Value, Horse-Race paper, and our simulation study–as well as others, have shown that enterprise multiples are one of the most effective valuation metrics.

Note: You may also hit “Market Cap” to sort these stocks by market cap, or hit “EBIT/TEV Percentile” to sort them by EBIT/TEV Percentile. The stock list is updated at the start of each month.

Click to enlarge

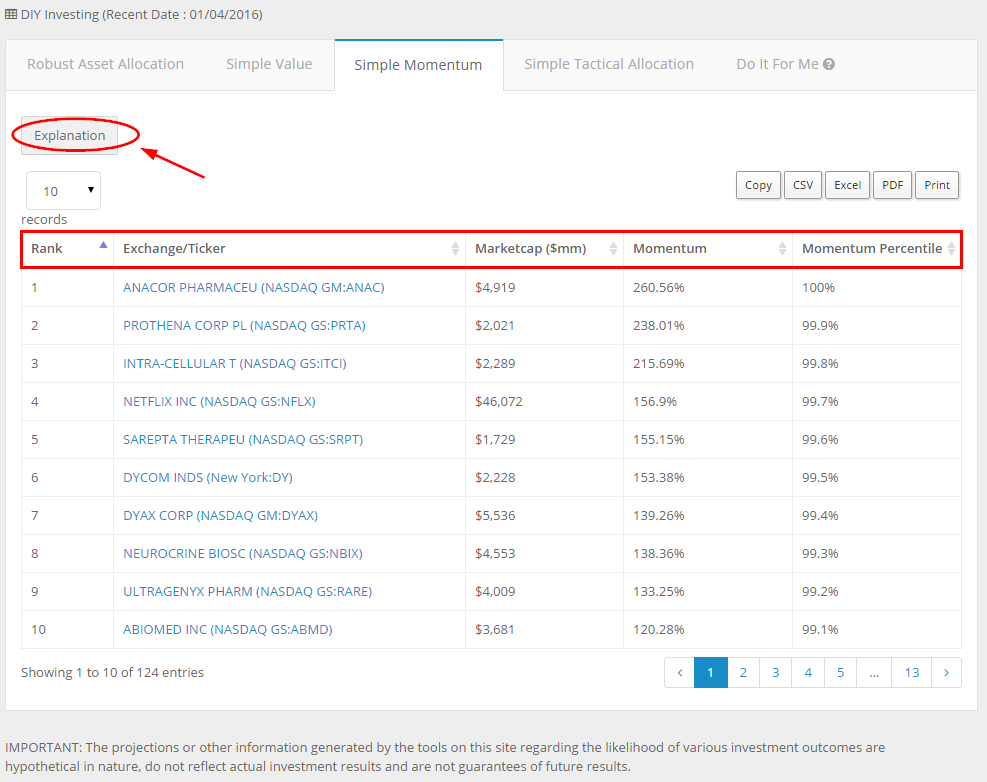

Simple Momentum Tool: This tool helps you identify stocks using a Simple Momentum Strategy. Click here to learn about Momentum. This list includes the top U.S. stocks (Mid and Large Cap) sorted on the cumulative total return from months t-2 through t-12. Names are updated each month.

Note: Similar as Simple Value, you may sort the stock names based on different metrics and download the list to your own computer.

Click to enlarge

Simple Asset Allocation Tool

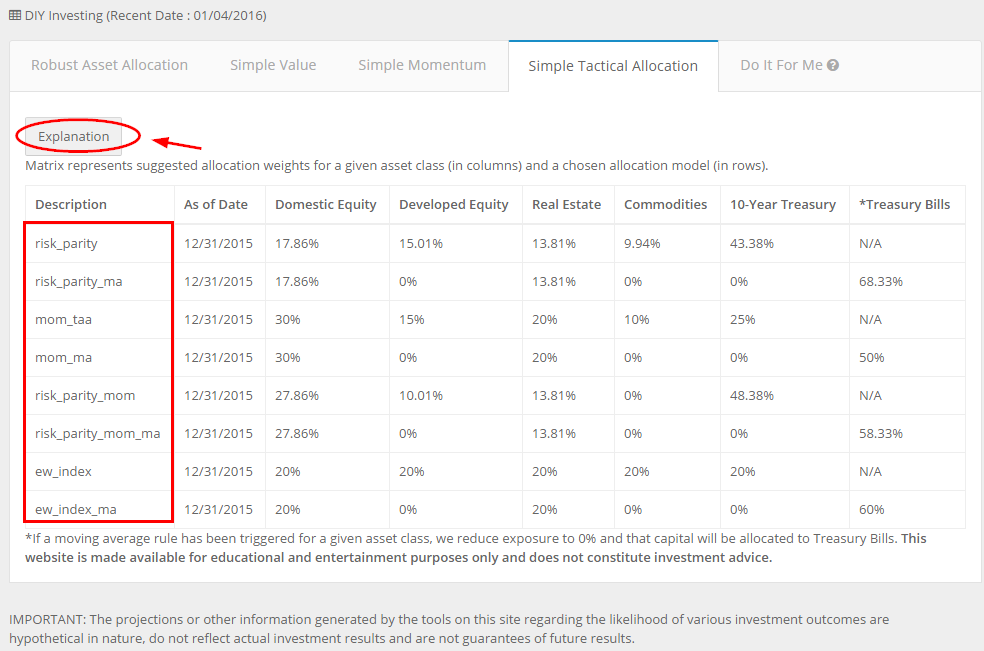

Simple Asset Allocation: This matrix provides allocation weights for a given asset class (in columns) and a chosen allocation model (in rows). The four model asset allocation strategies are “Risk parity“, “Momentum“, “Equal Weight” and “Moving-Average“. We also provide “combination” strategies that incorporate elements from several asset allocation algorithms.

A description of the asset classes and models are outlined below:

IVY 5 ASSETS

- SP500=Standard and Poors 500 Total Return Index

- EAFE=The MSCI EAFE Total Return Index

- REIT=FTSE NAREIT All Equity REIT Total Return Index

- GSCI=S&P GSCI Total Return Index

- US_10Yr=Merril Lynch US Treasury 10-Year Treasury Futures Total Return Index

MODELS

- risk_parity=unlevered risk parity for IVY 5.

- risk_parity_ma=unlevered risk parity for IVY with 12-month moving average trading rule.

- mom=equal-weight IVY 5 shifted by relative 12-month momentum.

- mom_ma=mom strategy with 12-month moving average trading rule.

- risk_parity_mom=unlevered risk parity weights for IVY 5, adjusted by relative 12-month momentum.

- risk_parity_mom_ma=unlevered risk parity weights for IVY 5, adjusted by relative 12-month momentum, with a 12-month moving average trading rule.

- ew_index=equal-weight IVY 5.

- ew_index_ma=equal-weight IVY 5 with 12-month moving average trading rule.

SOURCES

Risk Parity Background:

http://www.cfainstitute.org/learning/products/publications/faj/Pages/faj.v68.n1.1.aspx

Momentum Background:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1726443

Equal-Weight Portfolio Background:

http://www.theivyportfolio.com/

Moving-Average Background:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=962461

USING THE SIMPLE ASSET ALLOCATION WEIGHTS

All the weights are dynamic and will be updated at the beginning of each month.

The table below shows the suggested weights as of 01/04/2016, which are the weights that apply for the month of January 2016.

Click to enlarge

The DIY Investing Tool is available here.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.