Vanguard is a poster child for passive management and is among the companies we respect the most. You’ll often hear investors/advisors parroting their use of passive funds as an end-all be-all to the world’s investment problems. And in many respects passive management is a move in the right direction; however, passive management is not the driving force here–fees and taxes are the driving force.

This simple point gets lost on people when you mention active investing. The knee-jerk reaction to active investing is that it is “evil” because it isn’t passive. This isn’t a well-thought out cost/benefit analysis.

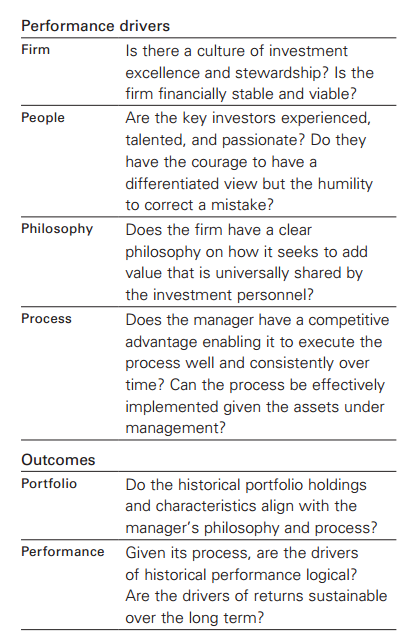

When investing in active strategies the cost/benefit analysis is much more nuanced. But instead of trying to explain this ourselves, we will defer to Vanguard. They have a wonderful white paper outlining a framework for thinking about successful active management. The summary bullet points are below:

There is strong theoretical and practical evidence that most actively managed equity funds will underperform their benchmarks.

In the end we find that low-cost active talent can achieve outperformance; and that investors, to the extent they stick with a disciplined approach, can be successful using actively managed funds.

Remarkable! Support for active management coming out of Vanguard. What next? Flying pigs?

And here is an image outlining the aspects to consider when diving down the active management rabbit hole:

Again, here is the report if you are interested in learning more.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.