The long wait is over.

Our newest book–Quantitative Momentum–is finally here.

After 2 years of research review, results replication, reverse engineering, internal idea generation, writing, editing, and final publication, we have a final product.

We think the book will help fulfill our firm mission to empower investors through education.

Others agreed: To include Cliff Asness of AQR and Narasimhan Jegadeesh of “Jegadeesh and Titman 1993.”

Cliff Asness, Managing and Founding Principal of AQR Capital Management

Systematic momentum investing, as opposed to its complementary cousin value, has not gotten the investor attention it deserves. Wes and Jack fix this problem. Anyone interested in systematic investing should read this book and add more tools to their repertoire.

Narasimhan Jegadeesh, Dean’s Distinguished Chair in Finance at Goizueta Business School

Quantitative Momentum is the story of momentum-based stock selection algorithms. Wes and Jack lucidly explain how and why these systems work.

The mission of Quantitative Momentum is as follows: identify an efficient and effective way to capture the long-term momentum premium.

- Note1: the mission parallels that of Quantitative Value, but in the context of capturing the so-called momentum anomaly.

- Note2: the long-term momentum premium may not pay in the future–even with a great process in place.

How to Purchase at a Heavy Discount to Face Value

Our firm mission is to empower investors through education. We are not in the book selling business, nor are we trying to make money selling books. We simply want to get our research in the hands of thoughtful long-term investors and investment professionals.

To keep costs low, we bought in bulk from Wiley and are reselling our inventory at cost via Amazon for $14.99 plus shipping.

Quantitative Momentum is about using Momentum for Stock-Selection

We believe our book offers readers a current and in-depth overview of how to harness momentum in the context of stock-selection. This book is not about trend-following, market-timing, relative strength asset selection, absolute momentum, dual momentum, and so forth (we leave that to Meb Faber, Gary Antonacci, Adam Butler & crew, Mike Covel, and so on). This is a book about using momentum for stock selection (the closest book to our own, which we also recommend, is Stocks on the Move by Andreas Clenow).

Also, this is not a book for investors with little motivation to understand relatively complex topics. You don’t need a CFA or a PhD, but you do need a desire to learn. In the end, while you can draw your own conclusions about how and whether to include momentum as part of your own investing style, we’re confident you’ll be a more informed investor. But don’t take our word for it. We pre-circulated the book among a group of investors and thought-leaders we really respect and admire.

Here is what they had to say about Quantitative Momentum:

Systematic momentum investing, as opposed to its complementary cousin value, has not gotten the investor attention it deserves. Wes and Jack fix this problem. Anyone interested in systematic investing should read this book and add more tools to their repertoire.

—Cliff Asness, Managing and Founding Principal of AQR Capital Management

In our own research, we have found that the predictive price return momentum pattern persists backward in time for hundreds of years in equities and for extended out of sample settings for other classes of assets. Anyone who is using, studying or incorporating momentum will find a wealth of information in the pages of Quantitative Momentum.

—Chris Geczy, Founder and CEO of Forefront Analytics

If you want to understand, explore, and ultimately exploit momentum investing, then there is no better (or faster) way to than to read Quantitative Momentum.

—Pat O’Shaughnessy, Principal and Portfolio Manager of O’Shaughnessy Asset Management

Wes and Jack do an admirable job explaining momentum principles and its behavioral basis. If you are interested in using momentum as a stock selection tool, this is a must have book.

—Gary Antonacci, author of Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk

Quantitative Momentum is the story of momentum-based stock selection algorithms. Wes and Jack lucidly explain how and why these systems work.

—Narasimhan Jegadeesh, Dean’s Distinguished Chair in Finance at Goizueta Business School

Most investors would assume the “premiere anomaly” is value, when in fact it is momentum. Let Wes and Jack take you through a MBA course on momentum that will have you saying by the end, “the trend is your friend.”

—Meb Faber, CIO of Cambria Investment Management

Wes and Jack have looked under every rock for an edge and they’ve found it with momentum. Momentum is the ‘premier anomaly,’ so no surprise this is their best book yet. Buy it and read it.

—Adam Butler, CEO of ReSolve Asset Management

In this excellent work, Wes and Jack have shed some much needed light on an often misunderstood part of investment management. They make bold statements about momentum investing and back it all up with hard facts and verifiable research. It is easy to spot books written by real market professionals with solid industry experience. This is clearly such a book and whether you’re a seasoned pro or a student of the markets, it’s one that you don’t want to miss.

—Andreas F. Clenow, CIO Acies Asset Management

Final Thoughts

But while endorsements from informed people may help, you should judge the quality of the book for yourself. Winston Churchill said, “I have nothing to offer but blood, toil, tears and sweat,” and in the end perhaps this is all we can offer as well. Although it took a lot of time and effort, we hope it contributes to our long-run mission to educate investors.

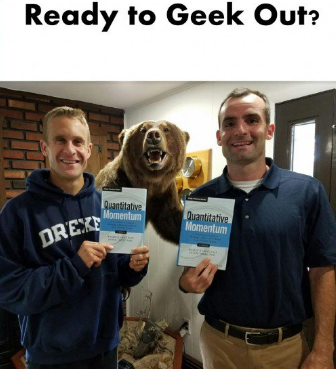

So are you ready for your deep-dive into the momentum anomaly? In short, are you ready to geek out?

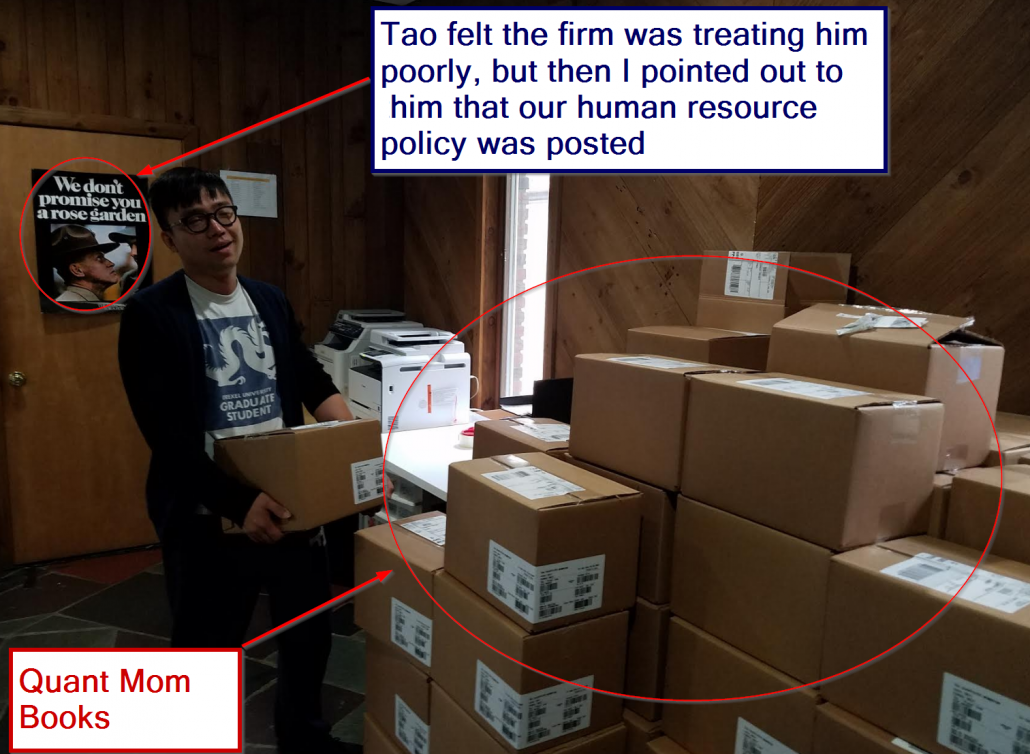

And at a very minimum, Tao Wang, a long-time partner at the firm, would appreciate the support. Tao had the unfortunate predicament of being the only able body on location when our bulk book shipment arrived! He carried a thousand books into our storage area.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.