Return to Buying Winners and Selling Losers: Implications for Stock Market Efficiency

- Jegadeesh and Titman

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

This paper documents that strategies that buy stocks that have performed well in the past and sell stocks that have performed poorly in the past generate significant positive returns over three- to twelve-month holding periods. The authors find that the profitability of these strategies are not due to their systematic risk or to delay ed stock price reactions to common factors. However, part of the abnormal returns generated in the first year after portfolio formation dissipates in the following two years. A similar pattern of returns around the earnings announcements of past winners and losers is also documented.

Core Idea:

The ground-breaking work of Jegadeesh and Titman (1993) attracted academic attention to “Momentum”, or “Relative Strength” strategies. You might want add this paper to your “must-read list” if you are a fan of Momentum.

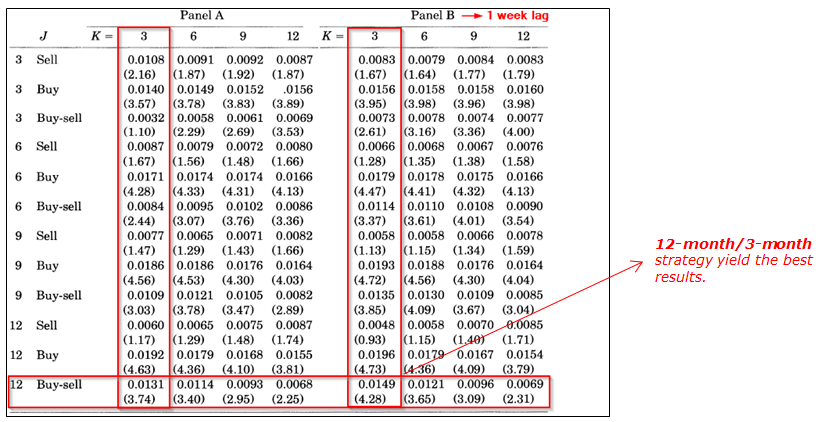

The authors demonstrate that a “Momentum” strategy (buying past “winners” and selling past “losers”, zero-cost portfolio) performs well for an intermediate-term horizon (3-12 months). They test this effect by constructing J-month/K-month strategies: select stocks based on past J months’ returns and hold the position for K months (J=3,6,9,12; K=3,6,9,12). In total they test 16 strategies.

Their main findings are:

- Selecting stocks based on past 12 months performance and holding the position for 3 months (12-month/3-month strategy, with one week lag) is the most successful strategy.

- The momentum premiums are not permanent, and they start experiencing negative abnormal returns around 12 months after the formation date, and dissipate within 2 years. These results suggest a long-term reversal.

- Seasonal effect and Earning announcement effect also found.

- Seasonal Effect: Momentum strategies experience negative returns in January, but achieve positive abnormal returns in other months. What’s more, momentum is weak in August but works particularly good in April, November, and December.

- Earning Announcement Effect: For the first 7 months after formation, past winners yield consistently higher returns around earnings announcements than do past losers. But in the following 13 months, past losers perform better.

- Profitability of these strategies are not due to their systematic risk or to lead-lag effects, but rather due to delayed price reactions to firm-specific information.

- Market underreacts to information about the short-term prospects (such as earning announcement) of firms but overreacts to information about the long-term prospects.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Click here to read our previous post:

Recommending the Trend: a Behavioral Basis for Momentum Strategies

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.