Editor’s Note: The Academic Research Insight will be a weekly short-form research summary on research that is directly related to investing. Elisabetta Basilico (a PhD and a CFA!) will be driving the effort, which will supplement our long-form summaries, in-house research, and general research commentary. We look forward to empowering investors through education!

—

- Title: THE SIXTH FACTOR- A SOCIAL MEDIA FACTOR DERIVED DIRECTLY FROM MEDIA SENTIMENTS

- Authors: JIM LIEW AND TAMAS BUDAVARI

- Publication: THE JOURNAL OF PORTFOLIO MANAGEMENT, SPRING 2017 (version here)

What are the research questions?

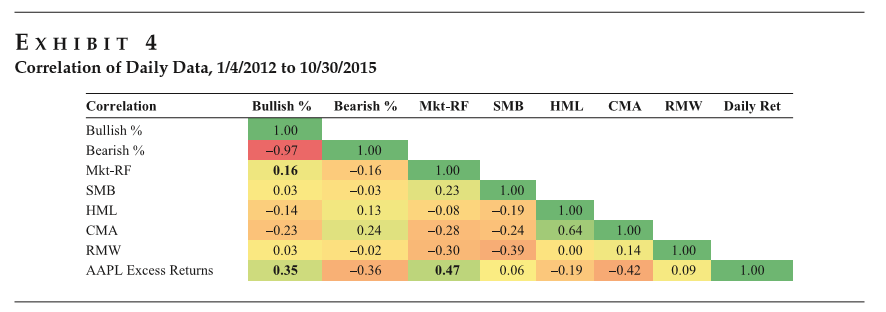

- Does the social media factor (created using tweet sentiments from StockTwits.com) explain the time-series variation in return for a sample of securities?

- Is the six factors model (the five factors Fama-French model PLUS the social media factor) better at explaining the cross-section of future returns?

What are the Academic Insights?

With the strong caveat that this study is tested on a short time frame ( January 2013-November 2015) and on a small sample ( 15 stocks), it finds that:

- YES- positive sentiment ( defined as the BULLISH percentage) on stocks is associated with positive returns

- YES- the relationship between stock twits and future returns survives beyond the presence of traditional factors ( the Fama-French five factors model)

Why does it matter?

Financial technology (fintech) is undoubtedly changing the mechanism through which information is assembled and delivered. It is plausible to expect that prices should incorporate all publicly available information both from traditional and non-traditional sources (such as tweets). However, would such a study pass the Harvey et al. (2016) “smell test” of robust research?

The most important chart of the paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Elisabetta Basilico, Ph.D., CFA, (@ebasilico) is an independent investment consultant. With co-author Tommi Johnsen, PhD, she is writing an upcoming book on research backed investing. You can learn more at http://academicinsightsoninvesting.com/

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.