- Title: FURTHER EVIDENCE ON THE STRATEGIC TIMING OF EARNINGS NEWS: JOINT ANALYSIS OF WEEKDAYS AND TIMES OF DAY

- Authors: RONI MICHAEY, AMIR RUBIN, ALEXANDER VEDRASHKO

- Publication: JOURNAL OF ACCOUNTING AND ECONOMICS, 2016 (version here)

What are the research questions?

- Do managers act to strategically time negative earnings announcements?

- Is there a strategic weekday (Monday through Friday) and/or time of day (either before trading hours, during trading hours or after trading hours) that is optimal for the release of negative earnings news?

What are the Academic Insights?

- YES- There is evidence that firms have an incentive to time “bad news” and the effort to strategically time the release of negative news about earnings is effective in reducing the immediate market impact on the firm’s share price.

- YES- The worst news about earnings is announced on Friday evenings and occurs later in the evening than other days and times, including Fridays and other evenings. These late Friday announcements are also followed by the highest possible negative drifts as the market fails to fully incorporate the news immediately into prices.

- Associated with and following the Friday evening announcements these behaviors and firm characteristics are observed: (1) Firms have a lower frequency of holding conference calls; (2) a higher frequency of major restructuring events occur; (3) more insider trading: (4) more delisting or merger events; (5) smaller size and higher book/market ratios; (6) lower institutional ownership; and (7) a smaller analyst following.

Why does it matter?

The size and significance of the post-earnings announcement drift, suggest that managers utilize Friday evening announcements to avoid market and investor scrutiny.

The differences in firm characteristics noted for Friday announcers suggest that these firms have a relatively low presence of corporate governance and more information asymmetry.

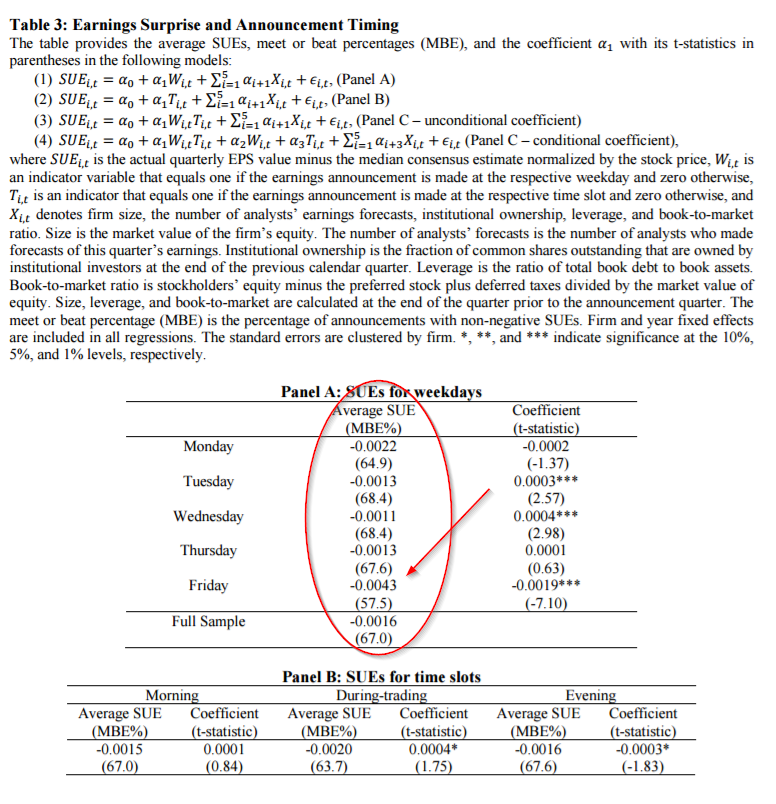

The Most Important Chart From the Paper:

Tommi Johnsen, Ph.D., (@TommiJohnsen) is an independent investment consultant. With co-author Elisabetta Basilico, PhD, CFA she is writing an upcoming book on research backed investing. You can learn more at http://academicinsightsoninvesting.com/

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.