- Title: MITIGATING ESTIMATION RISK IN ASSET ALLOCATION: DIAGONAL MODELS VERSUS 1/N DIVERSIFICATION

- Authors: CHRIS STIVERS, LICHENG SUN

- Publication: THE FINANCIAL REVIEW, 2016 (version here)

What are the research questions?

In spite of several efforts by researchers to overcome the estimation-risk problem (the use of estimate inputs based on sample information as if they were representative of the true population) which produces the so-called “wacky weights”, DeMiguel, Garlappi and Uppal (2009) present striking evidence that favors a simple 1/N naıve portfolio strategy.

The authors challenge the results by DeMiguel et al. (2009) by studying the following research question:

- Are asset allocation models that use “diagonal” elements of the inverse covariance matrix superior to those using the “full” matrix, in addressing the “wacky weights” problem?

- Do “diagonal” models outperform the naive 1/N strategy?

What are the Academic Insights?

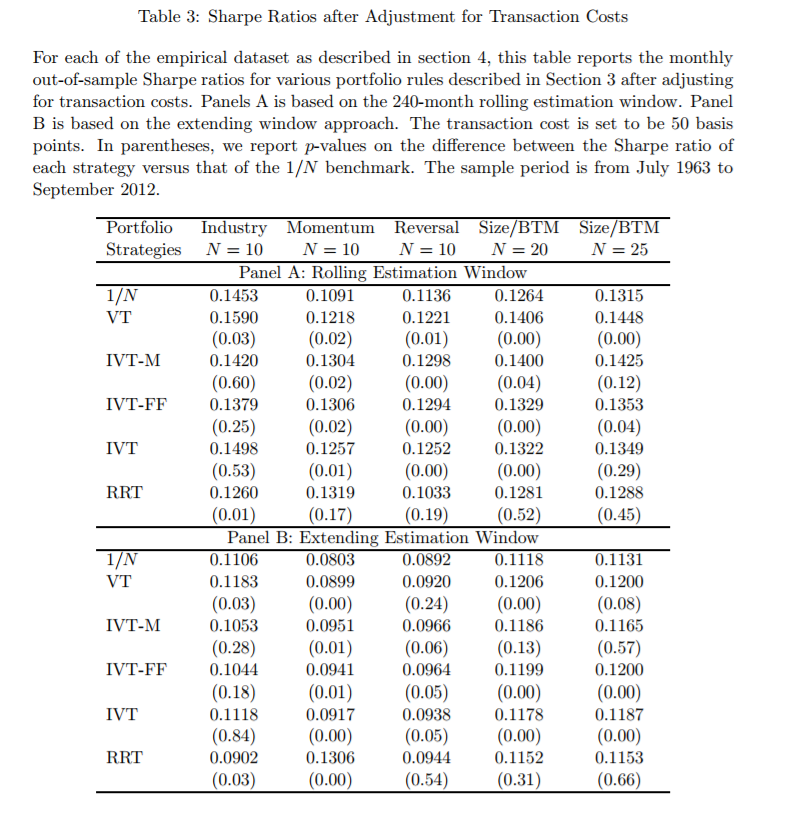

By using five different empirical datasets of disaggregate portfolio returns, simulated data, out of sample testing and the introduction of transaction costs, the authors find that:

- YES- Diagonal strategies naturally avoid short-sale positions and substantially mitigate the so-called “wacky weights” problem

- YES-Simple diagonal strategies based solely on estimates of total volatility, generally outperform the 1/N strategy. The differences in the performance metrics are statistically significant in most cases

Why does it matter?

This study adds to prior literature focused on comparing “full-matrix” strategies to 1/N. In fact, it studies “diagonal only” solutions that consider limited information such as volatility or idiosyncratic volatility. It shows that they avoid short sale positions and limit the “wacky weights” issue. Additionally, they generally outperform 1/N. Asset allocation and its research development is not dead yet!

The Most Important Chart from the Paper

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.