- Title: RETAIL FINANCIAL ADVICE: DOES ONE SIZE FITS ALL?

- Authors: FOERSTER S., LINNAINMAA J.T., MELZER B.T., PREVITERO A.

- Publication: JOURNAL OF FINANCE, V.72, AUGUST 2017 (version here )

What are the research questions?

By studying a unique data set on Canadian households, including transaction-level records on over 5,920 financial advisors and these advisors’ 581,044 clients, along with demographic information on both investors and advisors (i.e. risk tolerance, age, investment horizon, income, occupation, and financial knowledge) from 1999 to 2012, the authors attempt to answer the following:

- Do advisors adjust portfolios in response to such demographic factors?

- Do advisors’ fixed effects modify the explanatory power of the relationship between demographic factors and risky share in portfolios? In other words, do advisors influence portfolio allocations?

- Do advisors add value to their clients in terms of market timing and fund selection?

- Are there any attributes that correlate with clients’ performance? Customization? Average client assets? Number of clients? Advisor demographics?

- Does the high cost of advised portfolios come from costly financial advice or costly mutual fund management?

What are the Academic Insights?

The authors find the following:

- YES — advisors modify portfolios based on client characteristics, with a particular emphasis on clients’ risk tolerance and point in the lifecycle. However, they also find that clients’ observable characteristics jointly explain only 12% of the cross-sectional variation in risky share. That is, although differences in risk tolerance and age translate into significant differences in average risky shares, a remarkable amount of variation in portfolio risk remains unexplained.

- YES — the explanatory power more than doubles ( moving from 12% to 30%)! The authors provide two potential explanations for this finding: a. advisors may have idiosyncratic “personal beliefs or agency conflicts” in portfolio allocation; b. investors may match with advisors that share their beliefs and preferences. Nonetheless, a series of robustness tests show that advisors exert influence on their clients’ portfolios. Additional tests ( on advisors that have personal accounts at their firms) show that, in terms of advisor demographics, the advisor’s own asset allocation is the strongest predictor of the allocations chosen on clients’ behalf.

- NO– the “average” advisor is not able to profit by timing the market or selecting mutual funds both on a gross or net of fees basis. Specifically, net of fees, the average advised dollar earns a net alpha of −2.45% in the CAPM and−3.34% in the six-factor model.

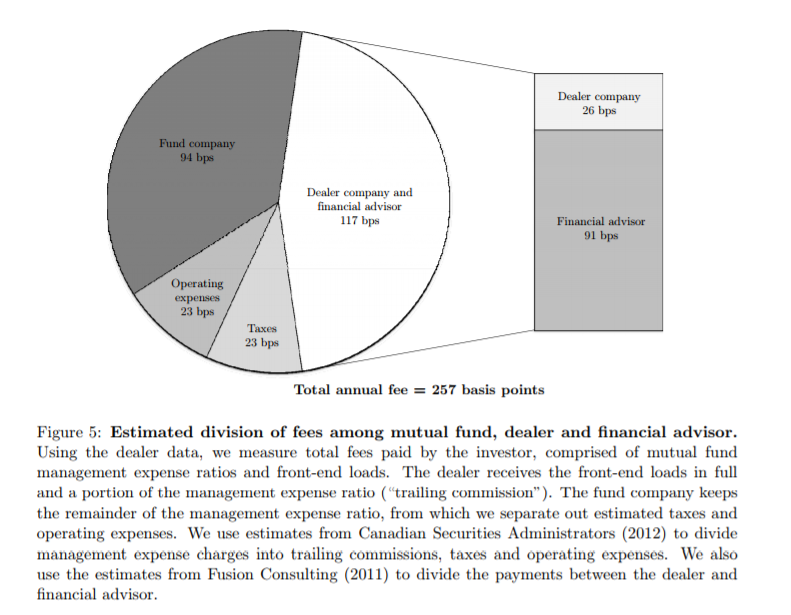

- YES — only customization (higher) and age of the advisor (older) correlate positively with performance. Both expensive mutual funds and financial advice contribute to the cost (a yearly 2.57%) of the advised portfolios. This compares to 1.02% of the Fidelity Clearpath funds—the largest Canadian target-date funds by assets.

Several robustness tests were performed.

Why does it matter?

This paper sheds light on the retail advisors’ influence on their clients’ asset allocation. It finds that clients’risk preferences are not taken much into consideration, customization is low, whereas the strongest predictor of a client asset allocation is the amount of risk that the advisor takes in his personal portfolio.

The puzzle remains as to why, with this “one size fits all” model, advice does not come cheap! But maybe the answer is that while trusting an advisor does cost big money, it lowers stress! In fact, in their 2015 paper, Gennaioli et al. cconclude that consultants (and money managers) compete for investor funds via setting the level of fees, but because of trust, the fees that are set don’t fall to the level of costs.

The Most Important Chart from the Paper:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.