What is Smart Beta?

Nobody really knows these days. Heck, even the godfather of smart beta, Rob Arnott, is no longer certain.

Here’s his original definition (from a great piece attempting to bring sanity to the debate in 2014):

A category of valuation-indifferent strategies that consciously and deliberately break the link between the price of an asset and its weight in the portfolio, seeking to earn excess returns over the cap-weighted benchmark by no longer weighting assets proportional to their popularity, while retaining most of the positive attributes of passive indexing.

And recently on Barry Ritholtz’s podcast, Masters in Business, Rob and Barry had this exchange (emphasis my own);

RITHOLTZ: Here’s the Bill Miller push back, most active managers are as you’ve described with a very low active share and essentially they are closet indexers so why on earth should anybody pay a high fee when you can pay a low fee and get 95% of the same portfolio? Fair criticism.

ARNOTT: It’s a fair criticism, there’s a lot of active managers hiding in the bushes near the benchmark, most active managers are constantly looking over their shoulder at the benchmark and worrying about beating [it and] the beauty of the fundamental index and of smart beta, as it was originally defined, smart beta originally meant strategies that break the link with price that don’t pay any attention to market capitalization or price in setting the weight of a stock. This term has been stretched to the point of meaninglessness.

For some additional current perspective, I slid into the DM’s and asked the question among fintwit philosophers: “What is smart beta?”(1).

Group 1: Smart beta is a marketing term:

From Eric Balchunas @EricBalchunas:

Smart-beta is active management served in better packaging.

From Phil Huber @bpsandpieces:

Smart Beta is a trendy investment cocktail made by mixing three parts beta, one part factor investing, and a splash of soda to water it down. Garnish with seductive marketing.

From Justin Castelli @jus10castelli:

Smart beta is just a fancy way of marketing factor investing. At a high level, smart beta is an investment strategy utilizing a rules-based approach to tilt away from a market cap weighted portfolio.

Group 2: Serious attempts at defining the term:

From Lawrence Hamtil @LHamtil:

The theory that the market can be beat not by picking some stocks and excluding others, but by capitalizing on quantifiable inefficiencies

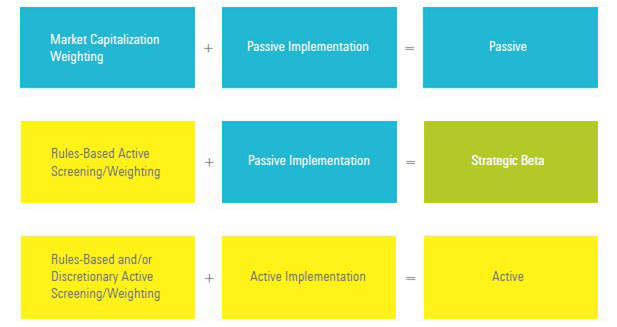

From Ben Johnson @MstarETFUS (who even gave us a chart to bring clarity through visuals):

Strategic beta, or so-called smart beta, is a new form of active management. Strategic-beta exchange-traded funds and mutual funds are linked to indexes that make one or more bets, of varying degrees of magnitude, against the broad market-cap-weighted benchmarks that are their starting point—more purely passive “market” exposures. These wagers are embedded in the funds’ index methodologies, which are their active playbook. But unlike conventional active managers, strategic-beta funds cannot make adjustments. With respect to the ongoing implementation of the strategies built into their benchmarks, they are strictly passive.

And there’s the comical definition from @ROIChristie:

We call it smart beta, but I petitioned hard to try to frame it to clients as dumb alpha…

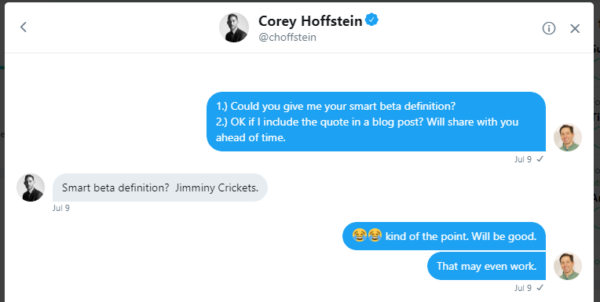

I also spoke with Corey Hoffstein @choffstein. Corey holds a Master of Science in Computational Finance from Carnegie Mellon University and a Bachelor of Science in Computer Science, cum laude, from Cornell University. He’s about as qualified to answer a financial question as anyone out there…

Here’s his answer when I asked him “What is smart beta?”:

Okay, I’m Still Confused: What is Smart Beta?

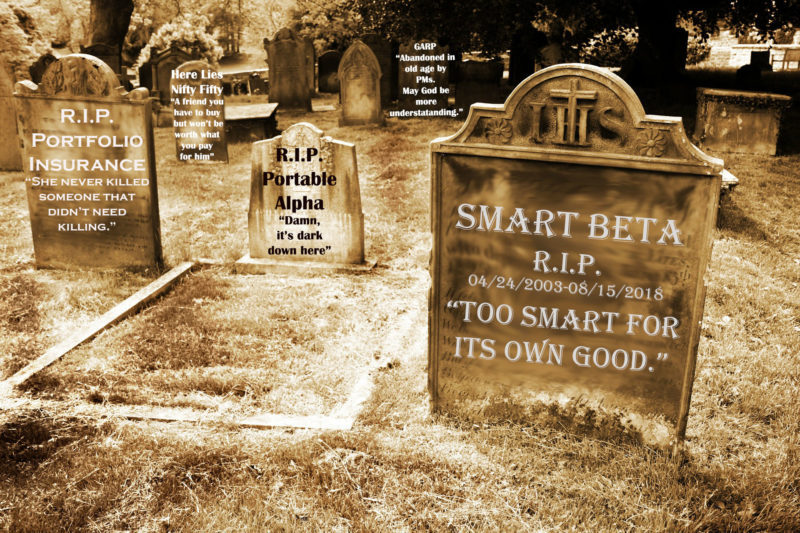

Smart beta is — and always has been — a marketing term. No argument there.

Also, from an investment process standpoint, smart beta is — and always has been — active investing with an algorithm.(2)

“Active investing with an algorithm” isn’t that interesting and has been around forever. But the history of smart beta as a marketing term is interesting, and possibly underappreciated, because I think the term played a huge role in helping the ETF industry go from a niche backwater to a mainstream player.

Let me explain…

My Smart Beta Story

From 2009-2013 I worked in the New York Stock Exchange’s ETF group. Our job was to get ETF companies to list their ETFs with us. Fortunately, we were the only game in town and 99% of all ETF listings were on the NYSE. We saw everything that came into the ETF industry and not once did I hear the term “smart beta.” It certainly was in use at this time, but it was nowhere near a hot buzzword…yet.

Very soon after my time at the NYSE the term exploded onto the scene.

In 2013, I moved to a firm called RevenueShares ETFs where they weighted the S&P 500 index by revenue. Weighting the S&P 500 by the revenue each company produced, instead of by market cap, was something different at the time (at least in the ETF space). Lucky for me, it was around this time that the term used to mark this differentiation, “smart beta,” became the buzzword of the asset management industry. And the firms that had products deemed to be “smart beta” exploded in growth. These strategies represented the “cutting edge.”

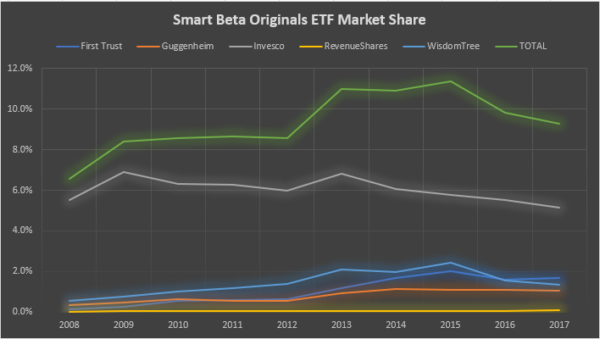

The five firms that were the first to launch products that were primarily (or totally) built on the smart beta concept were Invesco PowerShares, Guggenheim, First Trust, WisdomTree, and RevenueShares.

Here’s these firms’ combined ETF market share from 2008-2017:

Percent Market Share of Smart Beta ETF Companies 2008-2017

Source: Morningstar

You’ll notice a sharp spike in AUM around 2012. Moving market share from 8.6% to almost 11% market share in three years time is pretty good, right? But the growth of these firms was even better than it appears on market share alone. The ETF industry was not (and is not) a stagnant growth industry.

By riding the rapid growth of the ETF industry as a whole, plus gaining significant market share, these firms went from managing a combined $85 billion in AUM on 12/31/2011 (right before that jump you see in the chart above) to $218 billion in AUM on 12/31/2015. That’s a 156% increase is assets in four years time.(3) The products were a hit. It was during this time that these “smart beta” firms really figured out how to concisely explain their subtle differences and benefits to investors and a large swath of investors began to appreciate the difference these firms were offering.

The Term “Smart Beta” Drove Firm Growth

Believe it or not, the original purpose of the term smart beta was to add clarity for financial advisors and investors. If you spoke with a financial advisor from 1993 until about 2014, and you said “ETFs,” what they heard you say was, “low cost, market cap weighted, product.” The terms were one in the same. At RevenueShares (and I imagine the other original smart beta firms as well), we realized we needed a simple way to quickly and painlessly differentiate ourselves from the market cap-weighted ETFs. The term smart beta did just that for us.

With the “smart beta” term in hand, the meetings with financial advisors would now go something like this:

Me: Hi, I’m from RevenueShares. We make ETFs. Do you use them?

Advisor: Yes. We’re big fans of low cost, tax efficient, and market cap weighted. What index do you track?

Me: Our ETFs fall into a new type of ETF called smart beta. We track the S&P 500, but we weight ourselves differently than a market cap weighted index.Advisor: You’re an ETF company that doesn’t use market cap to weight your stocks? What’s smart beta?

Me: Smart beta is non-market cap weighted, passive, investments.Advisor: Really? Like some of these mutual funds I own that cost 1%+ and have terrible tax efficiency? Tell me more.

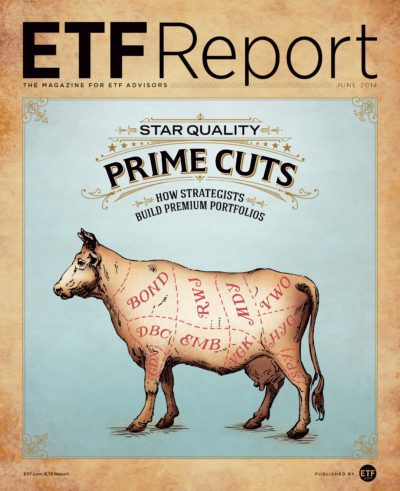

And off the conversation went to explain how these “new” ETFs didn’t simply market cap weight the index and the pros/cons of the difference. Equity ETFs, once synonymous with “passive index fund,” were no longer living in a one size fits all world. Both types had their benefits and disadvantages over the others, but the term smart beta enabled the smart beta firms a simple way to break the standard industry mindset that ETFs = market cap weighted. It was during this time that one of our products, our small-cap fund RWJ, became particularly popular and was featured alongside some of the ETF heavyweights on this iconic cover of the June 2014 ETF Report:

Thanks to Dave Nadig of ETF.com for allowing us to republish this image!

We at RevenueShares had made it to the big time — the cover of the ETF magazine! However, with increasing fame comes increasing competition. The success of these smart beta firms meant the competition had to react. For the big asset managers at the top, who were losing market share, this meant rolling out similar products and adopting the term “smart beta.” Every ETF company was rolling out their own “smart beta” product suite to compete with the originators. Many of the larger firms created (and still have) a full page on their website exclusively dedicated to their “smart beta” ETFs. This was (is) a way to differentiate their smart beta ETFs from their existing product suites and catch some of the asset flows.

And it worked. You can see the breakdown in the smart beta firms market share beginning shortly after this in the market share chart above.

If you go to any of the original smart beta firms websites (those left, at least) none of them has a smart beta landing page broken out for specific ETFs. It’s like being one of the originals of any lesser known “cool” group that suddenly became popular. The originals knew who the originals were. You didn’t have to go out of your way to say you were smart beta because you had the confidence you were.

Or its similar to Bane explaining to Batman, “You merely adopted the dark. I was born in it. Molded by it.”(4)

The original smart beta firms were born in smart beta so they deeply understood the history and why they used the term — to help their sales teams quickly explain to advisors that ETFs were no longer passive market-cap-weighted index funds. The term was needed to break that. But these new firms, who never struggled in the world where advisors didn’t understand that ETFs could be unique and differentiated from market-cap indexes, simply latched on to the term as a way to grow assets. And of course, advisors, being savvy to blatant marketing attempts, were no longer impressed with the term “smart beta.” The more we attempt to create a solid definition for it, the more meaningless the term has become as advisors no longer need the term. You only need to say what your fund actually does.

Here’s to You, Smart Beta, You Lived an Inspired Life and Helped the ETF Industry Grow!

References[+]

| ↑1 | (that’s where it all goes down after all) |

|---|---|

| ↑2 | If you are still confused on what “active investing” is, here is a piece to end that confusion. |

| ↑3 | and if you look at the chart, it’s actually really mid-2012 to mid-2013 that these firms ate up ~3% market share. |

| ↑4 | did I force this reference in there? Maybe. But I was scared this would be my best shot at ever jamming this scene into a blog, and I love this scene, so here you go people. |

About the Author: Ryan Kirlin

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.