I’ve noticed something profound the past few years: depending on your audience, the definition of active investing and passive investing is different.

To a financial journalist, active means “human stock-picker,” and passive means “computer stock-picker.” In addition, financial journalists often consider that index and passive mean the same thing, because both strategies rely on a “computer stock picker.”

An example of this interpretation of the terms active and passive was highlighted recently in a Barron’s article, which describes our firm’s recent switch from operating our ETFs under an active relief, to operating our ETFs under index relief:

Well if you can’t beat ‘em, join ‘em. That’s what Alpha Architect is doing with four of its actively managed ETFs flipping the switch and going passive.

Further in the article, the writer highlights the interpretation that active = human stock-picker and passive = index = computer stock-picker:

…the funds…weren’t all that active to begin with. The firm uses quantitative strategies based on academic research, so a manager wasn’t making portfolio changes on a whim every morning.

Now, to be clear, there is nothing inherently wrong with the press’s use of the terms “active,” “passive,” and “index.” These are just words and nobody could — or should — get to serve as the Speech Police. However, in this piece I would like to highlight that how the press uses the terms active/passive is completely different than how the finance profession uses the same terms: a financial professional’s interpretation of the terms active and passive are very different and the term index is ambiguous because an index can be highly active or passive.

In fact, when it comes to understanding the words active and passive it’s almost as if some people see the duck in the image below, but others see the rabbit:

Finance professionals and the financial press are looking at the same picture, but they are interpreting the information in completely different ways. The problem with this communication logjam is that it can cause immense confusion among the investing public (we’ll explain why later in this post).(1)

The Financial Definition of Active and Passive Investing

For anybody who has ever studied finance, the definitions for active and passive are well-established (a shortened version of Bill Sharpe’s definition from the Arithmetic of Active Management is below:(2)

- Passive = Value-weighted index of all assets in a given market (e.g., the US stock market, often proxied by the S&P 500, or even more accurately proxied via the Wilshire 5000).(3)

- Active = Not passive.

- On one extreme, an active portfolio might hold a single position in stock ABC. On the other extreme, an active fund might hold 490 out of ~500 stocks from the S&P 500. Both portfolios are active to varying degrees(4), but one thing is clear: they aren’t passive.

- Alpha Architect believes active can be useful if investors are sustainable.

We should also highlight the two investment approaches a fund manager can utilize to “pick their stocks:”

- Systematic or Index-Based or Computer Stock-Picker = Stock picking with a model or system.

- There is typically minimal human decision-making involved once the process is established (e.g., “quants”, “smart beta”, “high-frequency-trading”, and so forth).

- Alpha Architect believes in this approach and this approach is driving the ETF industry.

- Discretionary or Human Stock-Picker = Stock picking based on human intuition, analysis, and synthesis (e.g., Warren Buffett, Peter Lynch, Julian Robertson, my dad, etc.).

- Some firms believe in this approach, and it is often associated with famous investors such as Bill Ackman, Dan Loeb, Leon Cooperman, and David Einhorn.

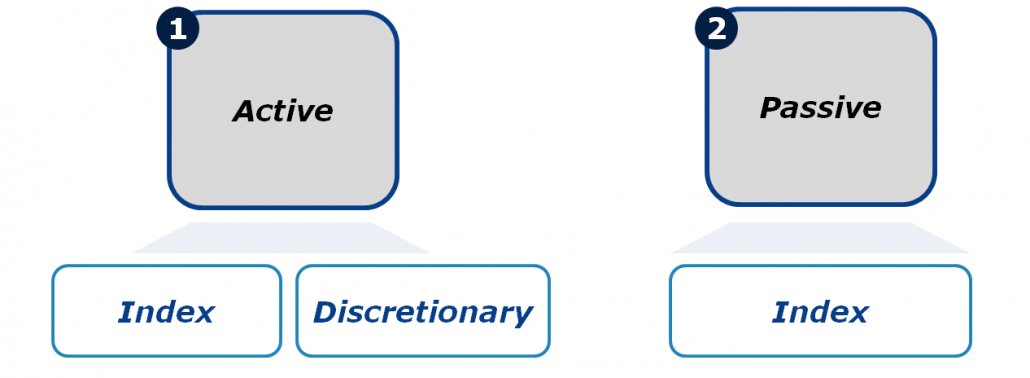

With these definitions in hand, we can categorize most investment approaches into the following taxonomy:(5)

- Active Index — computer-driven stock-picking that deviates from the passive approach.

- Active Discretionary — human-driven stock-picking that deviates from a passive approach.

- Passive Index — passive portfolios that, by construction, are systematic and computer-driven.(6)

Please note that the terms active and passive have nothing to do with who implements the strategy (i.e., a computer or a human being), but have everything to do with the construction of the portfolio (i.e., deviates from market-cap weighting of all assets in a market or does not).

Interchangeably using the terms “passive” and “index” is ambiguous and confusing, unless one describes the term “index” as either a “passive index” or an “active index.”

This is finance 101 stuff and I’m sure regular blog readers are all bored out of our minds at this point…

What are the Alternative Definitions of Active and Passive?

As was alluded to earlier, for the non-finance jargon crowd (e.g., financial press, lawyers, etc.), active and passive mean something very different:

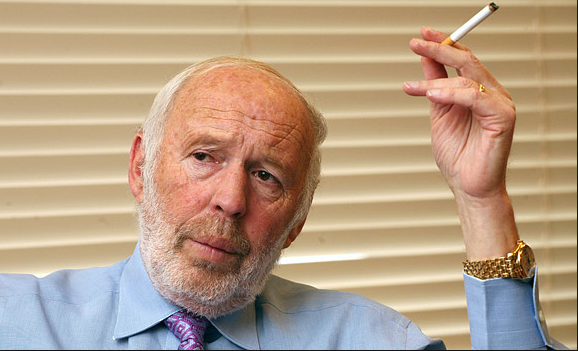

- Passive_nonfinance = Systematic or Index-Based or Computer Stock-Picker (e.g., quants smoking cigarettes with their computers like Jim Simons).

- Unlike the finance definition of passive, passive_nonfinance means a computer “passively” selects securities.

- Example: Jim Simons, the uber-quant hedge fund manager, would be deemed a passive investor to a non-finance person. However, to a finance-jargon person, Jim Simons is clearly an active systematic/index/model investor.

Jim Simons, former head of RenTech: “Passive” according to the press and lawyers because his stock selection is based on a systematic process driven by computers.

- Active_nonfinance = Discretionary or human stock-picker.

- The active_nonfinance term has nothing to do with the underlying portfolio construction.

- Example: A closet indexing fund that considers discretionary input in the stock selection process, but which essentially mirrors the weights of a passive index portfolio to avoid career risk, would be deemed active. However, to a finance person, this portfolio construction would, for all intents and purposes, be considered passive.

How Did this Confusion Start: Was it the Advent of ETFs?

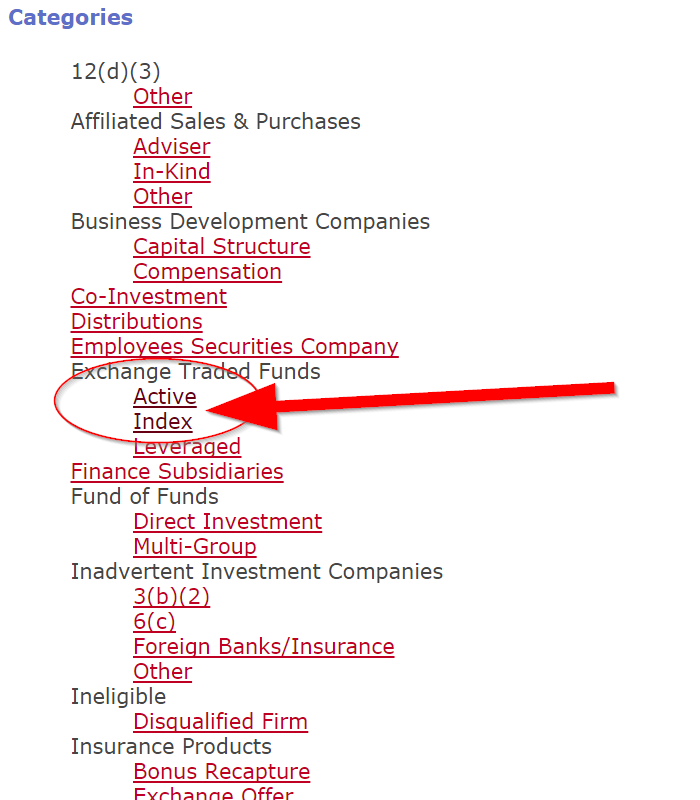

First, some background: ETF sponsors must file an exemptive application to the SEC. Why? In order to operate an ETF, a fund sponsor needs to do things that are not allowed based on the Investment Company Act of 1940, so they seek relief from these regulations from the SEC.

There are two primary types of relief:

- Index relief — granted to those fund sponsors that systematically follow a process, or index.

- Active relief — granted to those fund sponsors that can choose to follow an index and/or invest based on their discretion.

A Solution: Add Active or Passive to better describe an Index

The confusion probably started because index relief is now often termed passive relief. In fact, I’d argue the term passive ETF is now more ubiquitous in the financial press than index ETF, despite the fact “index ETF” is the official wording for any ETF that operates under index exemptive relief granted by the SEC.

Of course, as mentioned earlier, by using the word passive to label index exemptive relief ETFs, we enter the twilight zone of confusion. This is the place where rabbits seem to be mistaken for ducks and ducks for rabbits.

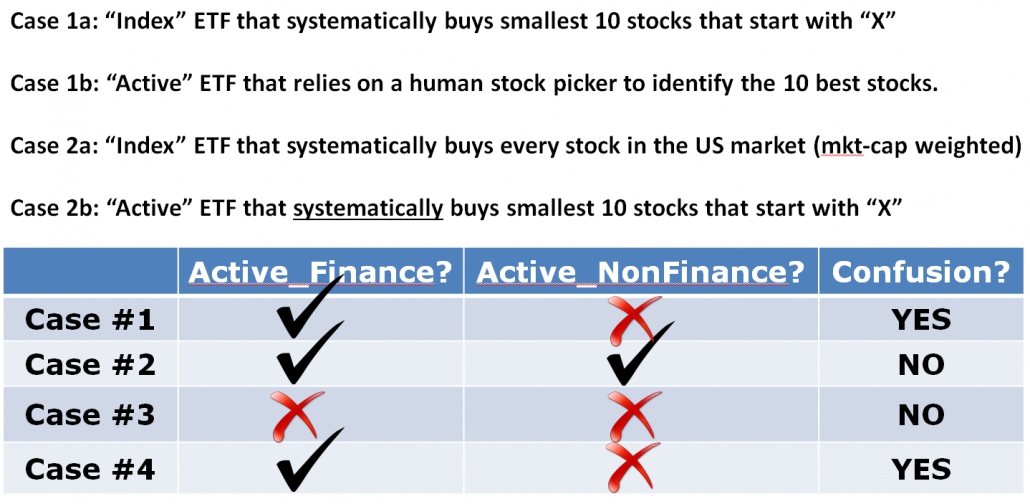

Some examples to highlight the point:

- An index relief fund (called “passive” by the financial press) that systematically holds the 10 smallest stocks that start with the letter “X.”

- Major problem. Clearly, this index ETF strategy is incredibly “active,” but labeling it “passive” creates immense confusion for investors.

- An active relief fund that relies on a portfolio manager’s discretion to pick its 10 best stocks.

- No issue here. This active relief fund would be called “active” by the financial press and would in all respects be actively managed.

- An index relief fund (called “passive” by the financial press) that systematically buys the largest 500 stocks in the US stock market and owns them in accordance with their market cap weights (i.e., ~ the Vanguard S&P 500 fund).

- No issue here. The press will label this index ETF passive because a computer runs the decision-making and this matches the financial definition of passive.

- An active relief fund that systematically holds the 10 smallest stocks that start with the letter “X.”

- Lot’s of confusion. The active relief fund would be deemed passive by the press because a computer is making the investment decisions, but the financial definition of this strategy is definitely active.

Here is a summary of the options and the potential for confusion:

The confusion is created by the generic use of the term “index.” Simply using the terms active index and passive index would eliminate most of the confusion when discussing various funds and strategies with the investing public.

Hopefully the financial media will help lower confusion when they discuss “index ETFs” going forward. A good example is the term smart beta, which isn’t necessarily “smart” and may not even reflect “beta.” Ben Johnson at Morningstar suggests the term strategic beta, but perhaps the term “active index” would be even more appropriate?(7)

Just a thought…

References[+]

| ↑1 | The Cliff Asness approach of being true to the original finance definition is probably the cleanest and most transparent for the investing public. In fact, it made his famous “Top 10 peeves” at #6. |

|---|---|

| ↑2 | Here is the full version of Sharpe’s definition from the Arithmetic of Active Management.

|

| ↑3 | academics argue over the granular detail on what determines the truly passive portfolio, or what geeks label the “market portfolio.” See the famous Roll critique as an example of this banter. |

| ↑4 | active share is a technique to identify the “level” of activeness |

| ↑5 | note: some investors might blend index/discretionary to become “quantamental” |

| ↑6 | Passive Discretionary? — Not really plausible since a classic passive portfolio reflects a systematic design. |

| ↑7 | Of course, one can additionally classify an active index fund as highly active or not-very active (i.e., closet-indexer), but that discussion is beyond the scope of this short essay (we have discussed this here and here, and are building tools to help RIAs differentiate better understand what they are buying). Active share is one technique to identify the “level” of activeness |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.