This blog discusses the academic research about after-tax alpha by exploring how taxable asset management has evolved over time, and the predictors of tax-efficient asset management.

Is Your Alpha Big Enough to Cover Its Taxes? A Quarter-Century Retrospective

- Rob Arnott, Vitali Kalesnik and Trevor Schuesler

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions about after-tax alpha?

- Has taxable asset management changed over the last 25 years? What has not changed?

- Where should investors look to obtain after-tax alpha?

- Are ETFs and smart beta vehicles similar to actively managed funds in terms of their ability to generate after-tax alpha?

What are the Academic Insights?

- YES. Various tax-advantaged and tax aware strategies have grown and have taken their place in asset and fund management practices with an emphasis on measuring after-tax performance. Investors, advisors and other investment professionals are now tax aware and tax consequences of any strategy are always a consideration. The emergence of ETFs, ETNs and “smart beta” products are powerful vehicles offering tax efficiency for long term investors. The list of investing practices that have developed over the last quarter century include but are not limited to: deferral of capital gains; loss harvesting; lot selection; wash-sale management; dividend avoidance; holding-period management; and yield management. What hasn’t changed: The ability for asset managers to produce alpha remains elusive. Far worse, active investors of all types, relative to cap-weighted indexing, continue to underperform not only on a pre-tax but also on a post-tax basis.

- YES. Funds with relatively higher turnover and dividend yield, and larger fund size are correlated with higher tax burdens. Fund outflows that occur over long periods of time, an orientation towards a smaller fund size and an orientation towards value/growth styles are not significantly correlated with higher tax burdens. Caveat: the 10 year period where growth outperformed value by over 3% annually, may explain the latter result.

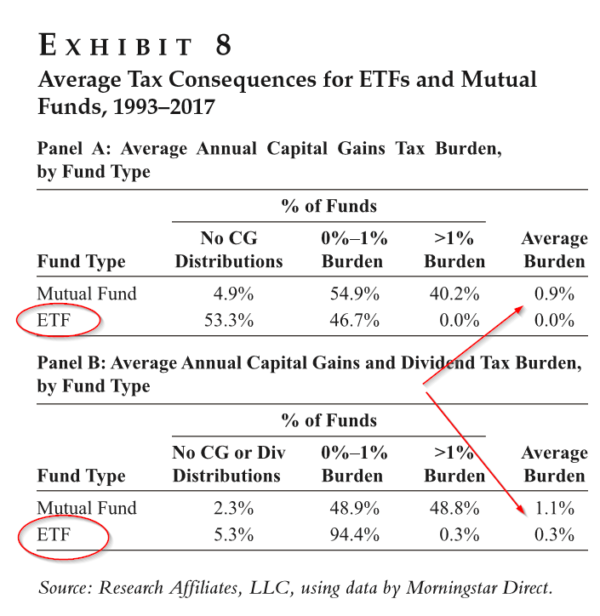

- NO. Smart beta and ETFs exhibit superior tax efficiency which is mainly achieved by deferring taxes (here is a piece on why ETFs are more tax efficient). Smart beta funds underperform the benchmark by 1% after taxes and fees. Passive funds underperform by 1.3% and active funds underperform by 1.9%. The tax liability occurs when shares of the fund are old by the investor and the underlying stocks are consequently liquidated. Direct comparisons between ETFs and mutual funds are shown in Exhibit 8 below. ETFs provide an advantage of 0.9% over mutual funds in terms of the average annual capital gains tax burden. When dividends are added to capital gains the ETF advantage drops to 0.8%. Note the results reported in this summary include only the S&P500 Index as the benchmark. The authors also present results using Fama-French risk adjustments.

Why does after-tax alpha matter?

The analysis indicates lower turnover and lower dividend yields are significant predictors of the tax-efficient active manager. Given a lower standard of significance, it’s possible that tax-efficiency is also related to fund size and the lack of fund outflows.

A warning from the authors:

We should be cautious about the low yield component. History suggests that low-yield stocks underperform both high-yield and zero-yield stocks. These stocks are more likely to be expensive growth stocks. If investors are not careful, a lighter tax burden may be paired with a lower pretax return, and the benefit may cancel out, which can to some degree be mitigated by avoiding managers who invested in the most extravagantly priced growth stocks. If we want growth, a reliance on zero-yield stocks, and funds that favor them, may be a better choice.

In any case, it’s entirely possible that the emergence and popularity of ETFs and smart beta vehicles will challenge the idea that alpha on an after-tax basis can be achieved. The evidence is clear: mutual funds trade more and have higher fees—net of fees and taxes they underperformed their benchmark by -3.4% over the period studied. ETFs underperformed by -1.1% and passive funds by -1.7%. Smart beta produced an underperformance of -0.9% and fundamental indexers outperformed by +.5%.

Hmm.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This article revisits the findings (published in this journal) of Jeffrey and Arnott, who reported that over 95% of active managers underperformed a capitalization-weighted index fund on an after-tax basis. The authors posit that much has changed in the quarter century since the publishing of that article, including increased tax awareness on the part of investors and advancements in the tax efficiency of some investment funds and vehicles; thus, investors may now have a better opportunity to generate alpha that is big enough to cover its taxes. The authors measure the degree to which fund characteristics affect a fund’s tax burden and compare the tax efficiency of investing in exchange-traded funds and mutual funds. The authors calculate the after-tax returns of funds and examine whether new categories of funds (e.g., smart beta) are better at generating after-tax alpha than their active and passive fund peers.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.