Hedge Funds and Stock Price Formation

- Charles Cao, Yong Chen, William N. Goetzmann, and Bing Liang

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

- Do hedge funds exploit stock mispricing? Specifically, do hedge funds tend to hold undervalued stocks that exhibit positive alphas?

- Do hedge funds profit from these holdings in undervalued stocks?

- Does the trading in these stock reduce mispricing?

What are the Academic Insights?

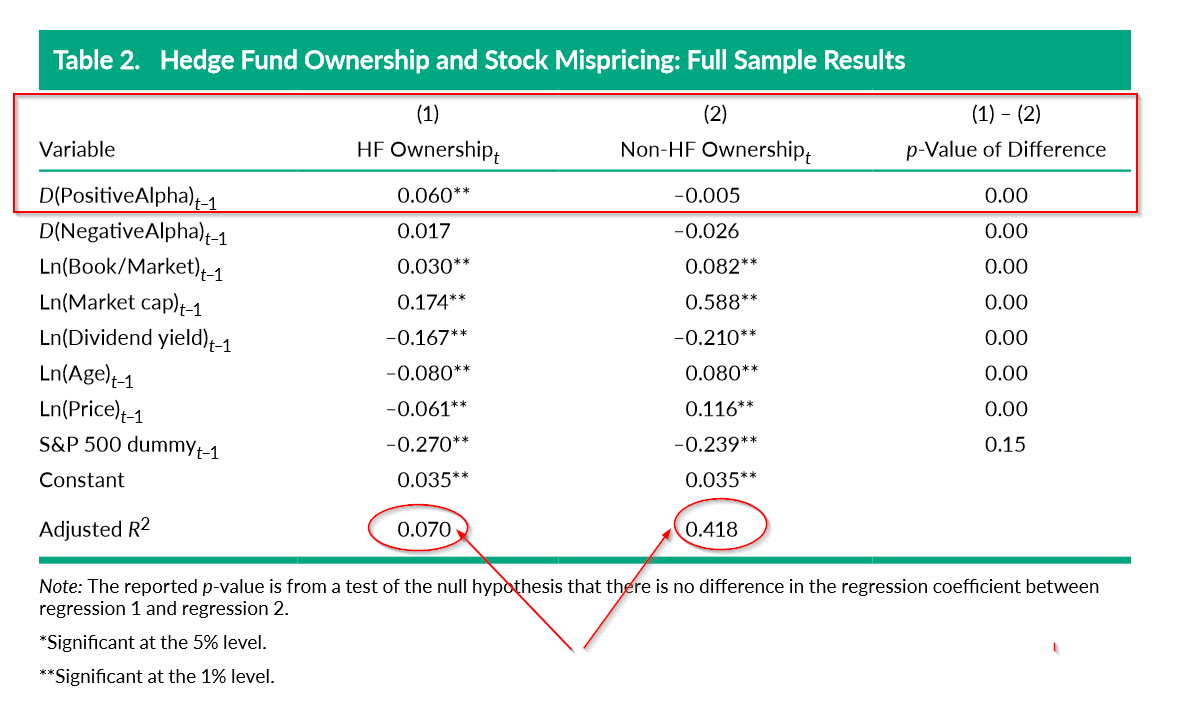

- YES. The results of the four-factor Fama-French-Carhart (1997) model are presented in Table 2 below. Note that the coefficient on “D(PositiveAlpha) at t-1” is positive and significant at 1% for hedge funds. A nonsignificant, negative coefficient is found for non-hedge funds. This is evidence that undervalued stocks are associated with higher hedge fund ownership. The coefficient on “D(NegativeAlpha) at t-1” was not significant, indicating no relationship between hedge fund ownership and negative alpha stocks. Hedge funds also tend to hold smaller, growth-oriented, younger, low-priced stocks and those not listed in the S&P 500. This is consistent with the lower R-square estimated for hedge funds relative to non-hedge funds and suggests that the active risk for hedge funds varies significantly (is higher) than non-hedge fund investors.

- YES. For the positive alpha stocks, the spread between the highest and lowest hedge fund portfolio is .42% per month (the high ownership portfolio returned 1.53% vs. 1.11% for the low ownership portfolio). The high ownership portfolio also exhibits a higher return to risk profile with higher Sharpe and Information ratios, although it also has a higher return volatility. The outperformance exhibited by the high ownership portfolio continued for the two consecutive quarterly periods.

- YES. The authors present evidence that the presence of hedge fund ownership and associated trades were statistically significant and were positively related to the dissipation of positive alpha in the following quarter. Non-hedge fund ownership exhibited no such relationship.

Why does it matter?

The authors have created and studied a comprehensive dataset consisting of 1,517 hedge funds, essentially all major hedge funds that invest in US stocks, covering the period 1981-2015. The study focuses on stocks with long positions held by hedge funds in order to analyze the impact hedge funds have on the stock price formation process. The research presented in this article is interesting in that it supports the contention that trading by hedge funds improves market efficiency. Moreover, the authors are able to identify differences in pricing impacts of trading by hedge funds and that of institutional investors including banks, insurance firms, and mutual funds.

The authors discuss an important CAVEAT to their research:

“We wish to point out an important caveat about our analysis. We examined the aggregate holdings of all hedge funds for a given stock, so the information is stock specific rather than hedge fund specific. We used this approach because of the nature of 13F data, which are reported at the firm level rather than the fund level. As a result, we were unable to perform analyses on the basis of specific hedge fund strategies.”

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Using comprehensive quarterly data on hedge fund stock holdings, we study the role of hedge funds in the process of stock price formation. We find that hedge funds tend to hold undervalued stocks and that both hedge fund ownership and trading by hedge funds are positively related to the degree of stock mispricing. A portfolio of undervalued stocks with high hedge fund ownership generated a risk-adjusted return of 0.40% per month (4.8% annually), and the profit remained even after transaction costs. Hedge fund ownership and trades also precede the dissipation of stock mispricing. These patterns are either nonexistent or much weaker for other institutional investors. Our results suggest that hedge funds exploit and help correct mispricing but the process is not instantaneous.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.