Everybody’s Doing It: Short Volatility Strategies and Shadow Financial Insurers

- Vineer Bhansali and Larry Harris

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

- Who are the buyers and sellers of volatility-contingent strategies? How extensive is volatility trading and put selling currently?

- Could a volatility “cascade” cause a crash across correlated asset classes?

- Are there mechanisms that might provide stabilization?

What are the Academic Insights?

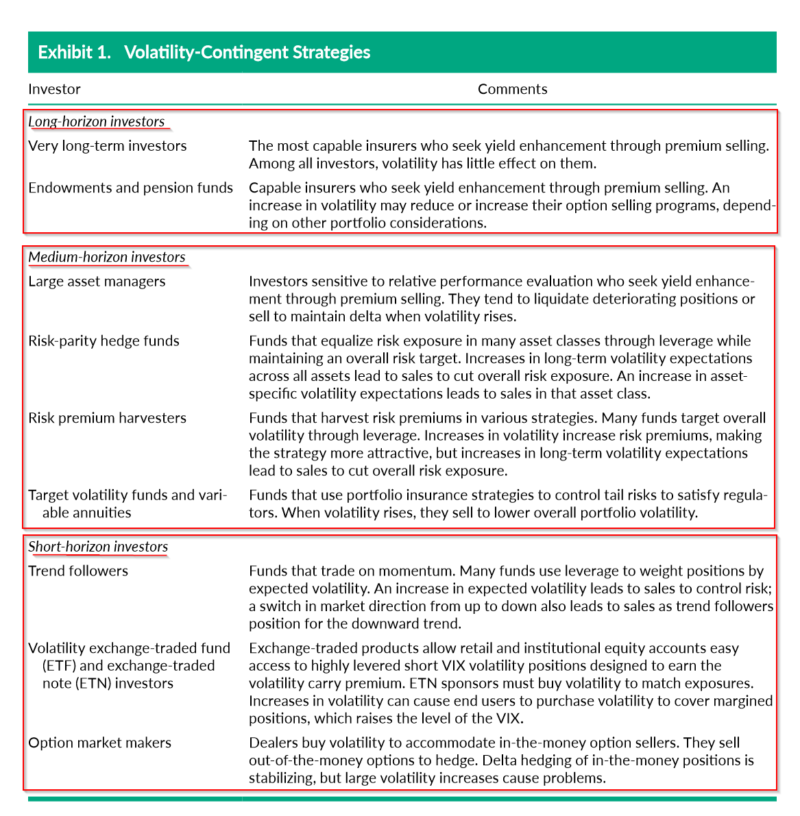

- QUITE EXTENSIVE. Institutional investors such as sovereign wealth funds, larger public pension funds, endowments, and central banks are sellers of insurance and theoretically have the longest time horizon. Central banks, since the financial crisis, implicitly promise to provide a put against rapid market selloffs. Endowments and other funds sell options to enhance yields. Withdrawal of either party from volatility trading could substantially increase volatility and may even destabilize markets. Large asset managers, including risk parity managers, collectors of risk premiums, risk transferors, and those targeting volatility, have a 3-5 year horizon and explicitly, or implicitly, sell Vol to augment returns and increase $AUM. Exchange traded Vol products (VIX futures and options contracts) enable retail and institutional investors with short-term horizons to sell Vol very easily with considerable liquidity and volume. See Exhibit 1 for more details.

- YES. Implied and explicit volatility sellers yield approximately $1.5 trillion and assuming all parties traded in the same direction, this represents a significant risk to stability. The authors do qualify this estimate as imprecise and could be “off by a factor of 2”. In any case, the exposure is huge and investor confidence in selling volatility is growing. The selling of volatility has expanded across asset classes, and the similarity of volatility strategies embeds exposure across time horizons as well. Awareness of the resultant correlations across time and asset class is not widely recognized by investors.

- YES, BUT LIMITED. The authors speculate that short VIX speculators could be a source of stabilization for the index. Be that as it may, the open interest in VIX products is much smaller than the value of assets represented by volatility-related strategies. A large move in the index could completely overwhelm the ability of short VIX speculators to trade in amounts that would be stabilizing.

Why does it matter?

The correlated nature of the volume of trades involving volatility selling conducted by all sorts of market participants with varying time horizons and motivations goes relatively unrecognized, at least on a widespread basis. From the authors:

The risk is greater than most would think because most traders are unaware of the extent to which their trading strategies are correlated with those of others who engage in seemingly different strategies.

UGH.

The most important chart from the paper

Abstract

The extraordinary growth of short volatility strategies creates risks that may trigger a serious market crash. A low-yield, low-volatility environment has drawn various market participants into essentially similar short volatility-contingent strategies with a common nonlinear risk factor. We discuss these strategies, their commonalities, and the generally unrecognized risks that they would pose if everyone were to unwind simultaneously. Volatility-selling investors essentially provide “shadow financial insurance.” Investors and regulators would benefit from preparing for large, self-reinforcing technical unwinds that may occur when/if central banks change policy or macro or political events affect investor confidence. We also discuss potential mechanisms that might provide stabilization against largely adverse financial outcomes.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.