Employee Stock Ownership Plans (“ESOP”) create unique opportunities for business owners and their employee-participants to build wealth through their companies. To foster broader adoption of ESOPs, Congress instituted a number of attractive tax advantages benefitting ESOP companies and the business owners who form them. Among these is the opportunity for sellers to defer capital gains taxes on the sale of their stock through a 1042 exchange – potentially forever. To do so, a seller rolls the proceeds from the stock sale into Qualified Replacement Property (QRP).

But what happens if cash proceeds are insufficient to complete the entire 1042 QRP rollover? In this

Two distinct approaches exist to financing the purchase of 1042 QRP when cash sale proceeds fall short of the sale price due to seller financing:

- A conventional long-term strategy that relies on specially designed ESOP bonds called floating rate notes; and

- An innovative short-term strategy that supports the purchase of blue-chip equities as the QRP asset.

The above strategies have stark differences between them in terms of their relative costs and risks to investors. By educating business owners and their trusted advisors about these differences, we seek to empower them to make the best possible decisions for their 1042 QRP investments.

Introduction

We intend that this article serve as a reference for business owners seeking to grasp the implications for their 1042 exchanges of receiving non-cash proceeds for the sale of their company stock to an ESOP. We wrote this article as a deeper dive into this complicated topic, in response to many client questions we have received during the past few years.

If you are just starting out on the path to understanding the benefits offered under IRC §1042, then we suggest you first read our overview of 1042 qualified replacement property rollover strategies. That detailed article will provide a fundamental grounding in prerequisite concepts.

Why Finance a 1042 QRP Rollover?

For 1042 QRP investors, the challenge typically arises when the ESOP company does not have enough cash on hand at closing to cover the entire purchase of the seller’s company stock. In such instances the seller typically takes back a seller (or promissory) note from the Company to cover the cash shortfall.

The U.S. Treasury offers some relief(1) in such circumstances by extending the seller 12 months during which to complete the purchase of their 1042 QRP rollover after the stock sale. However, this purchase period is often inadequate to address meaningful cash shortfalls, unless the seller has independent sources of liquidity. Don’t despair! Financing the purchase of 1042 qualified replacement property when holding a seller note is very common. Do not let the task dissuade you from enjoying your tax benefits for the entire sale amount!

Two Approaches to Financing 1042 QRP

There are two distinct approaches to financing the purchase of 1042 qualified replacement property prevalent in the marketplace.

The first, and more onerous approach from our perspective,(2) is a longstanding strategy offered by brokerage firms in conjunction with special ESOP bonds known as floating rate notes. Although largely unattractive from the standpoint of their investment prospects, floating rate notes have the virtue themselves of being QRP-compliant and of being marginable. Like buying a house with only a down-payment, the investor uses the collateral value of the floating rate note itself to backstop a margin loan to purchase the entire required face value of the bond. Rarely is this loan ever repaid, for reasons discussed below.

The other, newer approach to financing the purchase of 1042 QRP employs a temporary loan that counter-balances the seller note that the investor holds on their balance sheet. The ability to borrow is effectively divorced from the risk and return attributes of the QRP asset. As fiduciary advisors, we favor this approach for the obvious reason that the loan—and thus the ongoing costs and risks of leverage—remains in place only for so long as the seller note is outstanding. More importantly, the investor is free to purchase qualified replacement property with inherently more attractive long-term investment prospects, such as carefully selected large cap equities, in this case.

This latter approach gives investors the option to better align the QRP asset itself with the 1042 investor’s typically long-term holding period. We believe it is also significantly more cost effective and tax efficient. (You can read about such a 1042 QRP rollover strategy here.)

Costs (and Risks) of Each Strategy

To understand the respective costs and risks of these financing strategies, a little history is in order. In the past, business owners seeking to finance their 1042 QRP portfolios were largely limited to purchasing floating rate notes to meet IRS requirements. In exchange for the convenience of being able to borrow against them, 1042 QRP investors had to make the best of the bonds’ relative shortcomings in that strategy. These include low or negative long term investment returns, pricing opacity in the secondary market and added complexity, among others. (For deeper insights into why we view floating rate notes as an intrinsically unattractive investment asset class, please refer to our article Between a Rock and a Hard Place.)

Despite these challenges, the implementation of floating rate note monetization strategies, as they are known, has remained largely unchanged for more than 30 years. We believe this reticence to innovate on the part of brokerage firms is rooted in the layered fees associated with the strategy. A business owner who purchases floating rate notes is liable to become a long-term borrower, encumbered by a potentially permanent margin loan structure.

How does this happen? The answer lies in the typical 1042 QRP investor’s three likely objectives, as follows:

- Roll sale proceeds into an investment security that meets QRP requirements;

- Complete the purchase often with limited cash proceeds from the stock sale; and

- Compound low-cost, tax-deferred wealth over time, potentially indefinitely.

Floating rate notes tend to meet the first two objectives well but fall flat, in our view, at accomplishing the third. Their attributes are helpful for investors seeking to purchase their 1042 QRP with only a 10-25% down payment. However, a floating rate note monetization strategy de-prioritizes most investors’ long term objective of low-cost, tax-deferred wealth creation.

The FRN Dilemma

This often leads to an investor dilemma. Floating rate notes pay a yield rate that is lower than the borrowing rate charged on the margin loans that they collateralize. But paying off that margin loan only traps investor wealth in that asset. In the low interest rate environment of today (and during the past two decades), there are very few exceptions(3) when it would have made economic sense to repay the outstanding margin loan and simply hold the floating rate note for its intrinsic yield.(4)

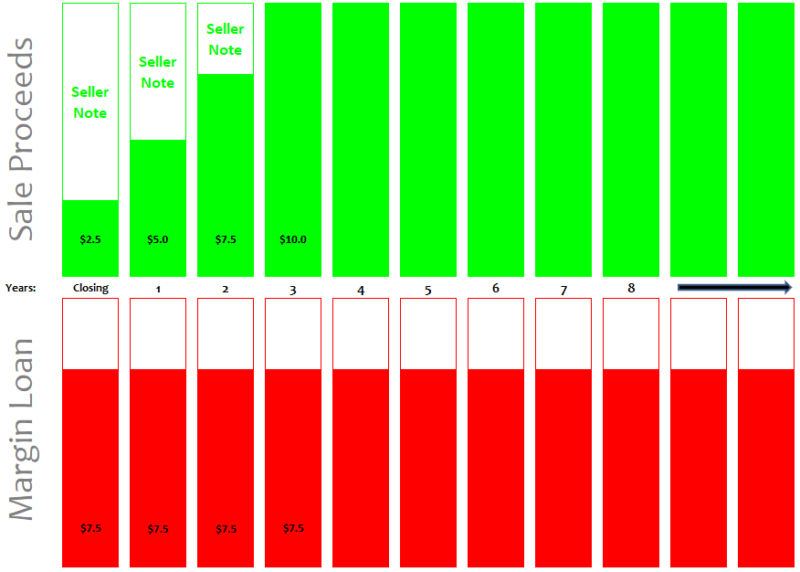

Instead, in order to build wealth, floating rate note investors typically feel compelled to reinvest the cash from their seller note repayments in more attractive investment assets. By borrowing against the floating rate notes, the QRP investor might eke out an incremental return on their wealth from the sale of the business. The margin loan thus remains outstanding. The loan that initially financed the purchase of the QRP itself consequently gets baked into the investor’s permanent balance sheet. The following graph depicts an example of margin loan exposure when a hypothetical investor opts for this extended leverage strategy.

Illustrative Margin Loan Exposure of QRP Floating Rate Note Investor

For illustrative purposes only. Depicts margin loan exposure on personal balance sheet of $10mm QRP investor who receives $2.5 mm cash and $7.5mm seller note at closing. Assumes seller note repaid in equal $2.5mm installments over three years. Not necessarily drawn to scale.

We can appreciate how the interest expense from servicing the outstanding margin loan could be a source of frustration for floating rate note investors. How much is that annual interest drag on the portfolio? Monetization loans typically impose a net interest charge that exceeds the floating rate note’s coupon by about 1.0%, although this can fluctuate. This is known as negative carry, because the financial burden of maintaining the paired floating rate note / margin loan combination on the investor’s balance sheet typically results in a net cost to the investor. Negative carry is a perpetual financial cost that remains in effect for as long as the investor might seek to access the wealth that is otherwise “trapped” in the low-yielding floating rate note.

Permanent Negative Carry: Not a Great Outcome

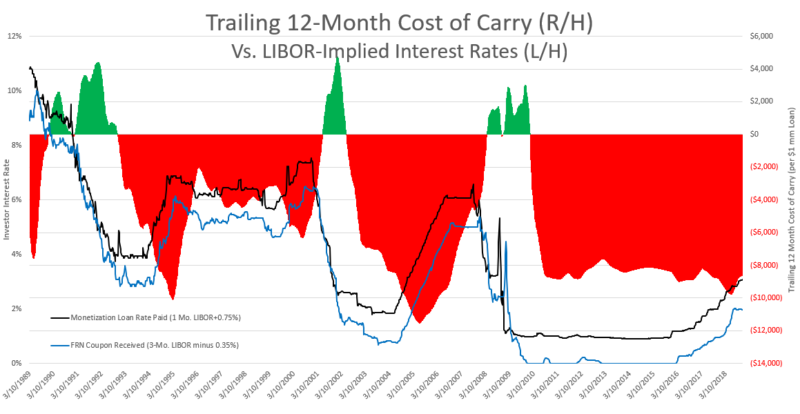

One can quantify and visualize that cost over time in the graph, below, which depicts the historical interest rate received by typical investors in floating rate notes (blue line), the interest rate charged for the margin loan the investor borrows against the floating rate notes (black line) during the same period, and the resulting net implied amount, or spread, that must be paid to carry that paired position during the trailing twelve-month period, per $1 million borrowed (red shading).

Depicts historical trailing 12-month imputed cost of carry of floating rate note monetization strategy (assuming 90% LTV) per $1 million of borrowing versus LIBOR-implied interest rates. Assumes FRN coupon of 3 Mo. LIBOR minus 0.35% and FRN monetization loan rate charged of 1 Mo. LIBOR plus 0.75%. Market data source: Bloomberg.

Readers will note that the implied cost of carry per million dollars borrowed, shaded in red in the graph above, has on occasion turned slightly positive (green shading). Brokers who sell floating rate notes often highlight this fact. They suggest that while current capital market conditions might imply a negative cost of carry, it is not an absolute feature of the strategy. However, readers should be forewarned that periods of positive carry typically coincide with capital market distress, when credit risks for the bonds themselves have likely increased.

Note in the above graph that the carrying costs implied for this strategy turned positive during the recessions associated with the following three downturns:

- The 1990-1993 Savings and Loan Crisis;

- The 2001-2002 Dot-Com Bubble; and

- The 2008-2009 Great Financial Crisis

During such periods of credit market distress, the collateral value of floating rate notes that collateralize investors loans is liable to suffer markdowns by the investment banks that lend against them. The banks do this in order to make timely investor margin calls. In addition, these banks might tighten lending standards on monetization loans. Several lenders did this during the 2008 financial crisis, decreasing the loan-to-value limits of QRP borrowers.

As fiduciary advisors, we view the ongoing risk of a margin call to be one of the principal drawbacks of floating rate note monetization strategies. When combined with the fee drag associated with floating rate notes’ negative cost of carry, the strategy strikes us as especially onerous. In order to overcome the hurdle of negative carry and build wealth over time, a floating rate note investor likely must reinvest a significant proportion of their seller note repayments in equity assets. We think investors are better off simply purchasing those equities directly as their qualified replacement property, which leads us to the next section of this article.

Using Blue-Chip QRP Equities to Finance a Seller Note

In a floating rate note strategy, an investor borrows against the ESOP bonds themselves to finance their purchase. By binding the financing mechanism of the strategy to the QRP asset, the growth attributes of the QRP itself are constrained. We urge investors to consider an arguably more attractive alternative for financing the cash shortfall of their sale proceeds.

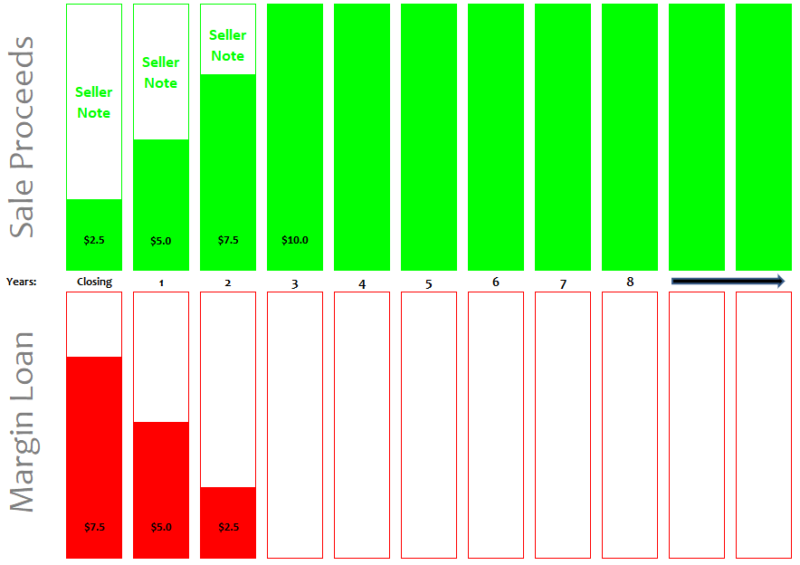

Consider your seller note as a sort of bridge financing to a QRP growth asset. With blue-chip equities, an investor borrows only what is required to purchase the qualified replacement property portfolio until such time as the seller note is paid off by the ESOP company. In other words, there is symmetry between the amount of the seller note received by the seller from the ESOP company and the amount borrowed by the investor to purchase the 1042 QRP portfolio. It is not an indefinite loan, as contrasted in the image below, and the extended costs and risks of long term leverage can be curtailed.

Illustrative Margin Loan Exposure of Blue-chip QRP Equities Investor

For illustrative purposes only. Depicts margin loan exposure on personal balance sheet through Blue-chip Equity financing strategy for $10mm QRP investor who receives $2.5 mm cash and $7.5mm seller note at closing. Assumes seller note repaid in equal $2.5mm installments over three years. Not necessarily drawn to scale.

Advantages of Financing 1042 QRP Equities

Investors who finance their seller notes through blue-chip QRP equities can achieve three key objectives, including the following:

- The investor can purchase qualified replacement property that may be more appropriately aligned with the typically long term nature of the seller’s holding period. We favor large-cap equities, because they have a track record of long term total returns and are very liquid. Equities are perpetual securities and, unlike floating rate notes, have no maturity. While not for everybody, equities can be a more appropriate replacement property to optimize the 1042 tax deferral opportunity.

- Investors who borrow only until their seller note is repaid forego the debt service burden of perpetual margin loans. We frequently receive inquiries from floating rate notes investors who underestimated the long-term burden negative carry loans posed for their finances. Investors in blue-chip equities can eliminate borrowing costs during the extended QRP holding period, upon their seller note’s repayment.

- Investor leverage remains outstanding only for so long as required. It can be paid off at any time with seller note proceeds. Paying off the loan with those proceeds does not strand the investor in a long-term asset of static value. Just as important, the investor is not exposed to the ongoing credit risks of a perpetual margin loan. Investment strategies that maintain high leverage over long periods subject investors to meaningful risks during credit cycle troughs. We feel credit cycles are inevitable aspects of investing.

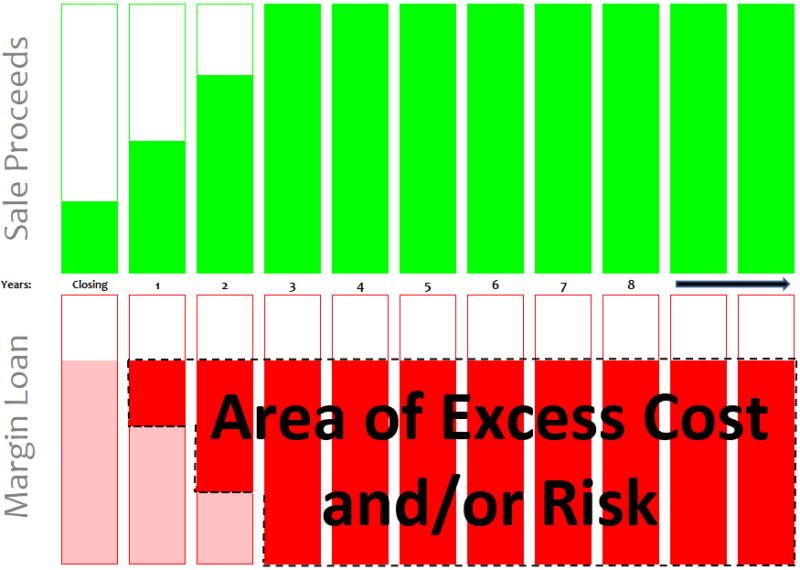

The following image visualizes risks and fees of a permanent floating rate note monetization strategy compared to the more limited leverage of a blue-chip QRP equity financing strategy.

Illustrative Excess Risks and Costs of Long Term Margin Loan Exposure

For illustrative purposes only. Depicts comparative excess risk and costs due to permanent margin loan exposure of floating rate notes, versus large cap equities interim financing strategy, for $10mm QRP investor who receives $2.5 mm cash and $7.5mm seller note at closing. Assumes seller note repaid in equal $2.5mm installments over three years. Not necessarily drawn to scale.

In summary, business owners who have received seller notes through the sale of their companies to ESOPs have attractive alternatives to floating rate notes. Although not for everyone, blue chip equities represent a relatively attractive long term QRP asset. Just as important, equities can be financed with a low-cost loan that matches the repayment terms of the investor’s seller note. We believe business owners and their fiduciary advisors grappling with the challenge of how to finance a seller note should consider this alternative approach to purchasing their 1042 QRP.

Reach Out

Feel free to contact us for more details (ask for Doug). We are happy to collaborate to build a win/win solution. For all the good business owners do for their employees and communities by setting up an ESOP, they deserve to keep their tax benefits for themselves!

References[+]

| ↑1 | See § 1.1042–1T discussion in which “the term replacement period means the period which begins 3 months before the date on which the sale of qualified securities occurs and which ends 12 months after the date of such sale.” |

|---|---|

| ↑2 | As fiduciary advisors, we urge investors to bear in mind the FACTS (Fees, Access, Complexity, Taxes and Search) when making an investment decision. Our experience suggests that the vast majority of taxable family offices and high net worth individuals should focus on strategies with low costs, high liquidity, simple investment processes, high tax-efficiency, and limited due diligence requirements. |

| ↑3 | Such as for very elderly or infirm investors who merely want to retain the tax deferral on the sale of their stock. |

| ↑4 | The floating feature of the bonds’ coupon means that there is no prospect of capital appreciation over the life of the bond, which is purchased at par. This is compounded by their very low yields relative to long-maturity bonds. For example, our review of seven floating rate note prospectuses found online from issuers such as 3M, General Electric, Colgate Palmolive and UPS, revealed coupons at spreads under LIBOR of approximately minus 35 bps, on average. One bond issued in 2017 by JP Morgan paid interest during an initial period at a rate of LIBOR multiplied by 0.66 minus 40 basis points! |

About the Author: Doug Pugliese

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.