Buyback Derangement Syndrome

- Clifford Asness, Todd Hazelkorn, And Scott Richardson

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

The authors present 4 MYTHs regarding stock buybacks popular in the financial press.

- MYTH 1: Companies are self-liquidating using share repurchases at a historically high rate.

- MYTH 2: Share repurchases have come at the expense of profitable investment.

- MYTH 3: The recent run-up in prices is the result of share repurchases.

- MYTH 4: Companies that repurchase shares do so only to increase EPS and thereby “Price”.

What are the Academic Insights?

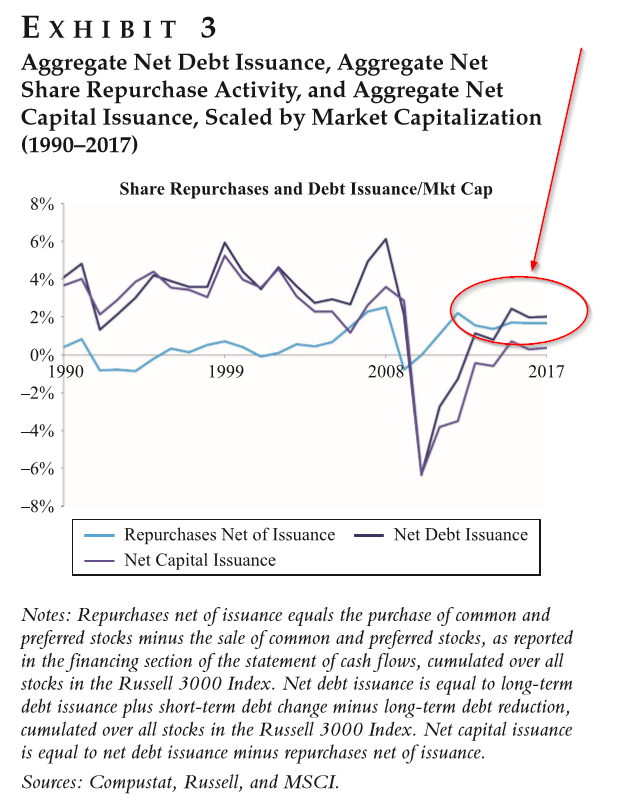

- DEBUNKED. Data presented in Exhibit 3 debunks this myth. Total repurchases of common and preferred stocks is currently high, measured in dollars. However, repurchases have been financed by the issuance of debt. The source of funds financing repurchases is key to understanding repurchases in the aggregate.

- DEBUNKED. See Exhibit 4 for data that debunks this myth. Total investment has increased over the last 27 years, with the exception of the financial crisis. Although it is lower currently than it was in the 1990s, it has trended upward since the crisis. However, when compared to share repurchase activity, there is no apparent systematic relationship, although both have increased since 2008. Further the relationship, according to financial theory, is actually in the opposite direction. Companies pay back capital when no viable investment opportunities are available, and raise capital when there are positive NPV projects available.

- DEBUNKED. Evidence from academic studies suggests share repurchases contribute 1%-2% to equity returns. The authors calculate an approximate return of 15% for the Russell 3000 between 2009 and 2013. The 1-2% is a far cry from this return. In fact, the percentage contributed by repurchases is likely overstated as not all companies have repurchase activity in any one year.

- DEBUNKED. The authors comment on this myth with alternating explanations of it’s merit. However, when it comes down to basics, it is very hard to believe that markets are so easily duped by such an obviously bogus strategy. The idea that EPS and share price could be artificially boosted by manipulating shares outstanding is silly. Enough said.

Why does it matter?

The article is an interesting read, because it debunks some of the conventional wisdom by using relevant data to counterbalance a number of the myths surrounding stock buybacks.

Best stated by the authors:

The popular press is replete with commentary seeking to damn the behavior of corporate managers in handing free cash flow back into the hands of shareholders. Investment professionals have even been heard to comment on the profligate use of free cash flow when it is used to buy back common shares. These criticisms are often, even regularly, without merit (at least merit that can be demonstrated), sometimes glaringly so.

The most important chart from the paper

Abstract

The popular press is replete with commentary seeking to damn the behavior of corporate managers in handing free cash flow back into the hands of shareholders. These criticisms are often, even regularly, without merit (at least merit that can be demonstrated), sometimes glaringly so. Aggregate share repurchase activity has not been at historical highs when measured properly, and when netted against debt issuance is almost a non-event, does not mechanically create earnings (EPS) growth, does not stifle aggregate investment activity, and has not been the primary cause for recent stock market strength. These myths should be discarded.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.