Corporate Governance, ESG, and Stock Returns around the World

- Mozzafar Kahn

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Figuring out exactly how to score companies on social issues isn’t as simple as tossing around a universal “ESG Ratio” that works for all. Instead, we have to dig into the details and find the nuanced answer to discover which companies are performing and delivering on social issues. This paper takes on the challenge of discovering methods that may work in deciphering ESG performance.

- Describe the basis of materiality as the perspective utilized for a new ESG measure applied in a global framework?

- What are the elements of materiality necessary to address the global universe for ESG investing?

- Is the newly constructed measure related to future returns?

What are the Academic Insights?

- “Materiality” as a framework is rapidly being incorporated into the dictionary of ESG investing. With respect to scoring ESG, materiality defines ESG “value” at the juncture of shareholder value and the interests of other stakeholders. ESG issues are considered “material” if they also affect shareholder value via a company’s financial performance. An ESG factor may be material for one company or industry, but not another. Materiality is best exemplified with an example taken from the article: “fuel efficiency and management is probably a material ESG issue for a health-care distributor but not for a health-care provider. The distributor, because of its business model, is a heavy consumer of fuel, so managing fuel efficiency is likely to be favorable not only for the environment but also for shareholders in the company. In contrast, the health-care provider probably has relatively limited fuel consumption and is more likely to overinvest in fuel management if it undertakes such management initiatives at the urging of stakeholder groups. Under the materiality framework, a healthcare distributor’s score on a material ESG issue such as fuel management would contribute to its overall ESG score. In contrast, a health-care provider’s score on an immaterial issue such as fuel management would be disregarded in calculating its overall ESG score.” In this manner, “materiality” and the materiality framework is increasingly being applied by a number of investment managers and corporations.

- THREE ELEMENTS CAPTURE THE GLOBAL NATURE OF MATERIALITY: the author cites three reasons that explain the variability of the strength of corporate governance across countries:

- Dispersion of ownership: In contrast to other countries, where ownership concentration is high, in the US, it is much more dispersed. This is an important distinction as it clarifies just where the conflicts of interest intersect. For the US, conflicts of interest occur between managers and shareholders, whereas in other countries it resides between minority and controlling shareholders (private enrichment, capital misallocation). Dispersion is represented by free-float standardized by shares outstanding.

- Shareholder orientation: An orientation that demotes shareholders relative to other stakeholders may make business priorities difficult to define and retard efficiency in capital allocation, ultimately harming long-run business sustainability. Orientation is proxied by a country’s legal tradition—common law (coded as 1.0), Scandinavian/German code law (coded as .90), French code law (coded as .80), or socialist law (coded as .70). The assumption was made that a country’s legal tradition is correlated with shareholder protection and as such a reasonable proxy for shareholder orientation.

- Institutional strength is measured at the country level using a Bloomberg political risk score.

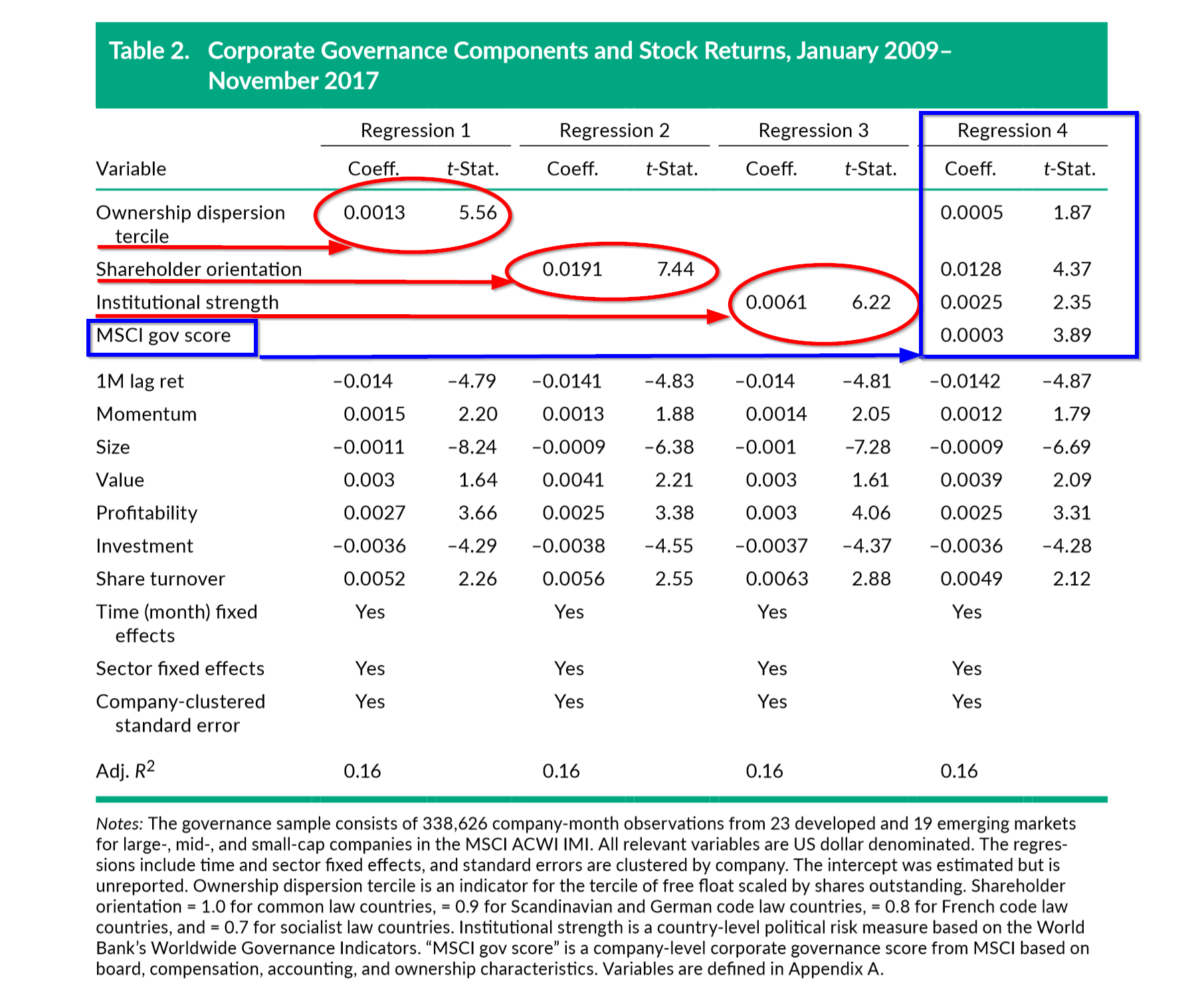

- YES. Refer to Table 2 below and note:

- Regressions presented in Table 2 document that ownership dispersion (regression #1), shareholder orientation (regression #2) and institutional strength (regression #3) are related to future returns. The dispersion was significant with an implied 26 bps spread (equal to the coefficient of .0013 *2) between the top third and bottom third. Orientation was significant with an implied spread of 19.1 bps (0.0191 × 0.1) higher for common law countries than vs. Scandinavian/German code law countries; 19.1 bps between Scandinavian/German countries vs. French code countries, and so on. Given the quartile spreads in institutional strength scores were .50, the regression results imply a return spread of 30 bps (coefficient of .0061*.5) between the top and bottom range of institutional strength.

- A composite governance score was constructed from the 3 new governance scores in combination with MSCI governance scores. MSCI rates companies on board characteristics, executive compensation, and shareholder voting rights. In Regression #4, control variables were added (for style, time, and sector differences) along with the composite governance score. All four measures exhibited significance. The results indicate that ESG performance including the strength of corporate governance are related to future stock returns and therefore confirm the premise of this research.

- The authors also reported backtested results of a monthly return spread of 33 bps for the estimated top-quartile– bottom-quartiles. There are however a number of caveats to keep in mind. The strength of the approach used here is also its’ weakness. The results may not be corroborated under a different perspective that defines ESG investing and ESG objectives. Further, the results presented here are not indicative of a live trading strategy and are not robust to trading costs, portfolio construction methods and implementation variants. However, the “materiality” twist on creating ESB scores appears to me to be a large step forward.

Why does it matter?

A fundamental issue for ESG investing is deciding what the objective is, defining the appropriate perspective to frame that objective, and then measuring it. The perspective defined in this article is based on the proposition that building a sustainable business is only possible if the business is able to provide an appropriate return to investors over the long run. The major contribution here is the idea that materiality may be a necessary condition for the successful measurement of ESG factors in predicting future return performance. As professional money managers also act as fiduciaries this concept aligns with the objective of finding value (if not alpha) in the ESG style. The ESG measures grounded in this perspective provide evidence that return predictability is possible.

The most important chart from the paper

Abstract

Nonfinancial performance measures, such as environmental, social and governance (ESG) measures are potentially leading indicators of companies’ financial performance. In the study reported here, I drew on prior academic literature and the concept of ESG materiality to develop new corporate governance and ESG metrics. The new metrics predicted stock returns in a global investable universe over the tested period, which suggests potential investment value in the ESG signals.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.