While environmental, social, and governance (ESG) investing continues to gain in popularity, economic theory suggests the share prices of “sin” businesses (typically those involved in the gambling, tobacco, alcohol, guns, and defense industries) will become depressed if a large enough proportion of investors choose to avoid them—the “shunned-stock hypothesis.” Such stocks would have a higher cost of capital because they would trade at a lower price-to-earnings (P/E) ratio—providing investors with higher expected returns. Some investors may view those higher expected returns as compensation for the emotional cost of exposure to offensive companies. On the other hand, socially conscious investors may be willing to accept less-than-optimal returns while gaining peace of mind knowing they are not promoting activities they believe are detrimental to society and/or one’s health.(1)

The evidence from research papers such as 2009’s “The Price of Sin: The Effects of Social Norms on Markets,” the 2017 papers “Fewer Reasons to Sin: A Five-Factor Investigation of Vice Stocks” and “Sin Stocks Revisited: Resolving the Sin Stock Anomaly,” and the 2020 study “The Underpricing of Sin Stocks” has found:

- Sin stocks have provided abnormal risk-adjusted returns due to neglect by institutional and retail investors, who lean toward the side of ESG.

- The abnormal return to sin stocks occurred because they are more profitable and less wasteful with investment than the average corporation.

- Sin stocks tend to be low-beta stocks and have highly statistically significant loadings on the betting-against-beta (BAB) factor.

- Sin firm IPOs are more underpriced (22.3%) than non-sin firm IPOs.

Greg Richey contributes to the literature on sin investing with his study “Is It Good to Sin When Times Are Bad? An Investigation of the Defensive Nature of Sin Stocks,” published in the October 2020 issue of The Journal of Investing. Richey analyzed the defensive nature of individual sin industries against the market portfolio. His database covered the period 1980 to 2019 (providing 480 monthly observations) and 106 firms from four sin-related industries—alcohol, tobacco, gambling, and defense. He constructed a sin fund portfolio as well as one portfolio for each industry (a booze fund, a smoke fund, a game fund, and a boom fund).

Following is a summary of his findings:

- Sin stocks have had higher returns and Sharpe ratios than the market portfolio, and sin industry funds’ returns have been less correlated with each other than they have been with the market portfolio.

- The betas of the sin portfolios were less than one, indicating they have less systematic risk than the market portfolio (they are more defensive).

- Bad news events have a lesser impact on sin stock return volatility than do good news events.

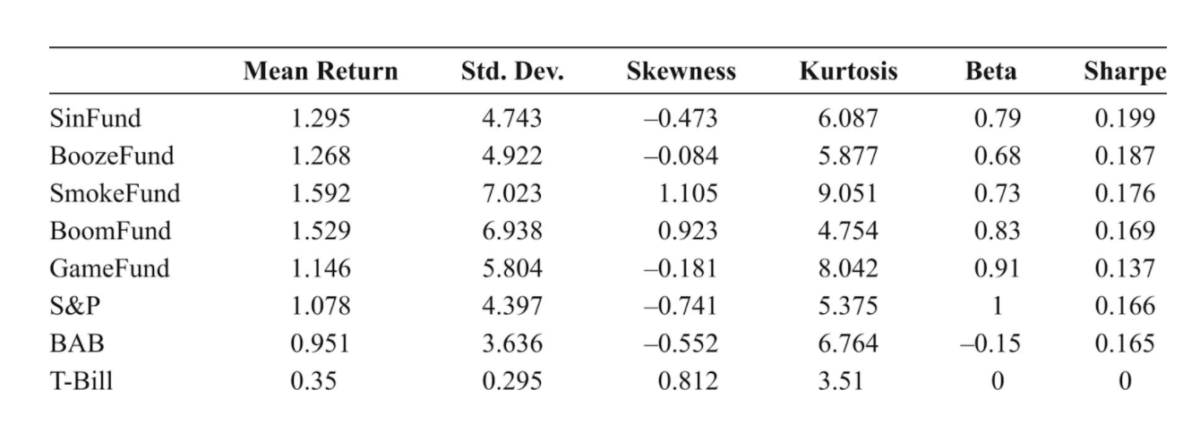

As the following table demonstrates, the returns on the sin portfolios outperformed the market portfolio (S&P 500) over the sample period, both in percentage (mean) return and in risk-adjusted (Sharpe) return. They also outperformed the BAB factor portfolio.

Summary

As the shunned-stock hypothesis suggests, sin stocks have not only provided higher returns than the market portfolio but higher risk-adjusted returns as well. In addition, Richey’s study demonstrates that sin stocks provide the added benefit of being defensive in nature, reducing the tail risk of investing in equities. Risk-averse investors may conclude that, for them, sin investing is a good choice.

Important Disclosure: The information provided in this article is for educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. The analysis herein may be based upon third party information and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Wealth Partners, collectively Buckingham Strategic Wealth® and Buckingham Strategic Partners®. R-20-1511

References[+]

| ↑1 | A good twitter conversation on the topic |

|---|

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.