Eric Balchunas had a recent tweet that I found fascinating.

Eric’s tweet merely captures the tip of the iceberg with respect to the current market environment, which certainly feels “bubbly.”(1)

The gist of the tweet is that $META, which is an ETF from our friends over at Roundhill Investments, has gained a substantial level of new assets because investors are confusing the ETF with the name change recently announced by Facebook (they are changing their name to ‘Meta’ apparently).

Two hypotheses as to what is going on:

- META is raising a ton of capital via organic efforts that are independent of the Facebook name change. (congrats to the team, if so!)

- META is raising a ton of capital because investors are being silly.

We will probably never know which hypothesis is causal/correct, however, one cannot eliminate #2 as a valid hypothesis. While it might appear insane that investors would do really stupid things — like buying a ticker because it is randomly associated with a FB name change — we’ve seen this sort of silly behavior before from investors…over 20 years ago!

Enter the Internet Bubble. When I got really started in investing…

“A Rose.com by Any Other Name” is a fascinating paper that documents how firms would add a “.com” to the end of their name and see an immediate increase in their firm value, despite the fact, there were no fundamental changes to their business.

The abstract discusses in more detail:

Abstract

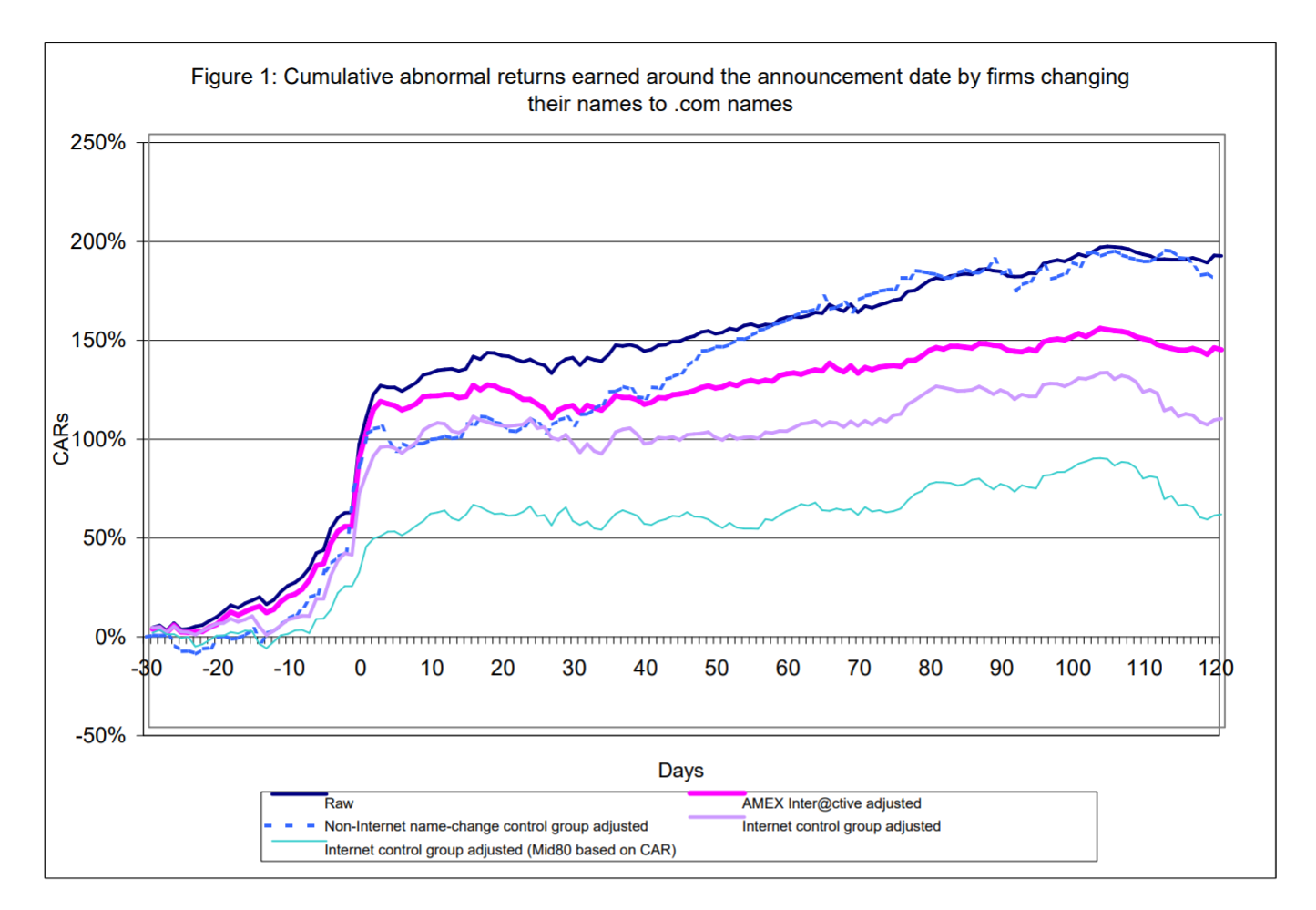

We document a striking positive stock price reaction to the announcement of corporate name changes to Internet related dotcom names. This “dotcom” effect produces cumulative abnormal returns on the order of 74% for the ten days surrounding the announcement day. The effect does not appear to be transitory; there is no evidence of a post announcement negative drift. The announcement day effect is also similar across all firms, regardless of the firm?s level of involvement with the Internet. A mere association with the Internet seems enough to provide a firm with a large and permanent value increase.

Just how wild was the effect? On average, the abnormal returns around the announcement period were 74%!

Here is a figure from the paper with the bottom line:

Degenerate gamblers are common in the stock market and become more common in sentiment-driven markets with plenty of liquidity and strong animal spirits.

Funny enough, here is a quote from the paper, quoting an investor from a yahoo message board:

Just bought 50,000 shares, took 3 transactions to get it done, there r no shares out there, going to run big.

The quote above is a carbon copy of what you see on twitter, reddit, tiktok, and so forth in the current environment.

Same game. Different tools.

I can’t help but think about the research papers that will be written on the current marketplace. There will certainly be differences, at the margin, but it is truly the case that when it comes to human behavior, history repeats itself. Over. And over. Again.

Ok, boomer.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.