Female Representation in the Academic Finance Profession

- Sherman and Tokes

- Journal of Finance, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

To date, there is no large-sample empirical evidence on gender balance and career outcomes in academic finance. Though we have taken deep dives into and observed “Where are the Women in Finance” and “Women in the C-Suite.” This paper specifically looks to proved insight into the statistics of female representation in the academic arena of finance.

What are the Academic Insights?

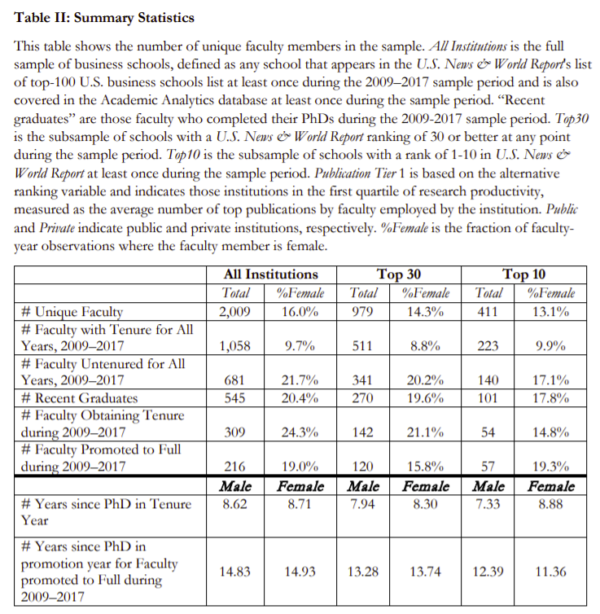

By studying the top 100 US Business Schools from 2009 to 2017, the authors find:

- Only 16% of faculty are women.

- After controlling for research productivity, women hold positions at lower-ranked institutions.

- Women are less likely to have tenure than men, and they are less likely to be full professors.

- There is also some evidence that women are paid less than men during the sample period.

- Using citations as a proxy for quality, we find evidence that the quality of papers written by women is higher than it is for men.

- On average, women tend to have fewer coauthors than their male colleagues.

- But, women in finance tend to have more “female” coauthors than their male colleagues.

There are some positive signs emerging from the research:

- Towards the end of the sample period, the authors find that research productivity (and not gender) explains most of the variation in where a faculty member is employed, whether the faculty member has tenure, or exits the profession.

- While of the faculty who have tenure during the entire 2009–2017 sample period 9.7% are women, of the faculty obtaining tenure during the sample period, 24.3% are women. And 20.4 % of rookie new hires are women.

Why does it matter?

While this paper does not take a stand on the question of what drives gender disparities, it presents basic facts that might motivate additional work to uncover the mechanisms that drive the differences that we observe in the data.

The low representation of women in finance that the authors document could have implications beyond the careers of the faculty members that we study. For example, female faculty serves as role models that impact the career choices of female MBA students (see Meer, 2020 and Carrell et al., 2010). And here is a piece on the potential positive benefits from the positive influence of women.

The Most Important Chart from the Paper:

Abstract

We present new data on female representation in the academic finance profession. In our sample of finance faculty at top-100 U.S. business schools during 2009–2017, only 16.0% are women. The gender imbalance manifests itself in several ways. First, after controlling for research productivity, women hold positions at lower-ranked institutions and are less likely to be full professors. There is also evidence that they are paid less. Second, women publish fewer papers. This gender gap exists in research quantity, not quality. Third, women have more female coauthors, suggesting smaller publication networks. Time-series data suggest shrinking gender gaps in recent years.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.