- Harvey, Zeid, Draaisma, Luk, Neville, Rzym, Hemert

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

With a capitalization of $1.3 trillion, cryptocurrencies are now (2022) roughly 50% of the value of US dollars and coins. What was once a fad, has now become prominent and increasingly diverse from an investor’s point of view. In response, this article discusses five key features and concepts critical to the understanding of the cryptocurrency space from the investor’s perspective.

What are the Academic Insights?

- The diversity of the investible universe. The cryptocurrency area includes quite a few layers or subcategories to recognize in addition to layer 1 coins such as bitcoin, Ether, Litecoin, and so on. Although this article deals mainly with bitcoin due to its widespread popularity, at least 19 other vehicles provide exposure to the crypto-space. including DeFi (Uniswap, Compound, Maker Dao, dYdX); Nonfungible tokens (OpenSea, LooksRare); Gaming (Sky Mavis); Metavere (Decentraland, Sandbox); Layer 2 (Starware, Optimism); Privacy (Keep, Aztec); Institutional services (Coinbase Pro, Fireblocks); Financial services (Blockfi, MoonPay, Bitgo, Circle); Infrastructure (Blockstream, Chainlink, Consensys); Trading and exchange (FTX, Coinbase, Binance); Data and analytics (Chainalysis, Dune Analytics, Messari); Mining includes mining companies (TeraWulf, Hive), hardware (Bitmain, Bitfury) and lending (Genesis, NYDIG); Web3 (Skynet, Helium, Protocol Labs); Social networks (DeSo); R&D (OpenZeppelin, Shard Labs), Browser/wallets (Argent, Opera); Security (Gauntlet, Forta); Identity (Spruce); Cross-chain bridges (Wormhole).

- How cryptocurrencies have been valued. There are at least four approaches that hold some validity.

- First, as an economic mechanism, the best argument is that the cryptocurrency network can and does produce value through its ability to implement fast, secure, and/or cheap transactions. The worst economic explanation is that bitcoin is popular because investors simply believe its’ price will continue to rise, obviously an unsustainable assumption. Traders in this space often shrug off losses with the explanation that they are long-term investors and expect a rebound.

- Second up is Metcalfe’s “Law”, whereby value (market capitalization) is related to the number of participants in the network. It makes sense that the value of the crypto network will increase as it grows in size. Empirical tests of this hypotheses suggest that any significant results are strictly a function of including bitcoin and ether in the sample.

- Third, Bitcoin is digital gold. Gold (and possibly cryptocurrencies) have value due to its durability, divisibility, transportability, homogeneity, and rarity. A plausible argument that will take more time to develop the necessary conditions to establish the conditions for crypto.

- The fourth approach is to value crypto as a multiple of its’ individual cost of mining. That cost can be compared to other commodities or assets that are also subject to an extraction process (gold, silver, copper, oil).

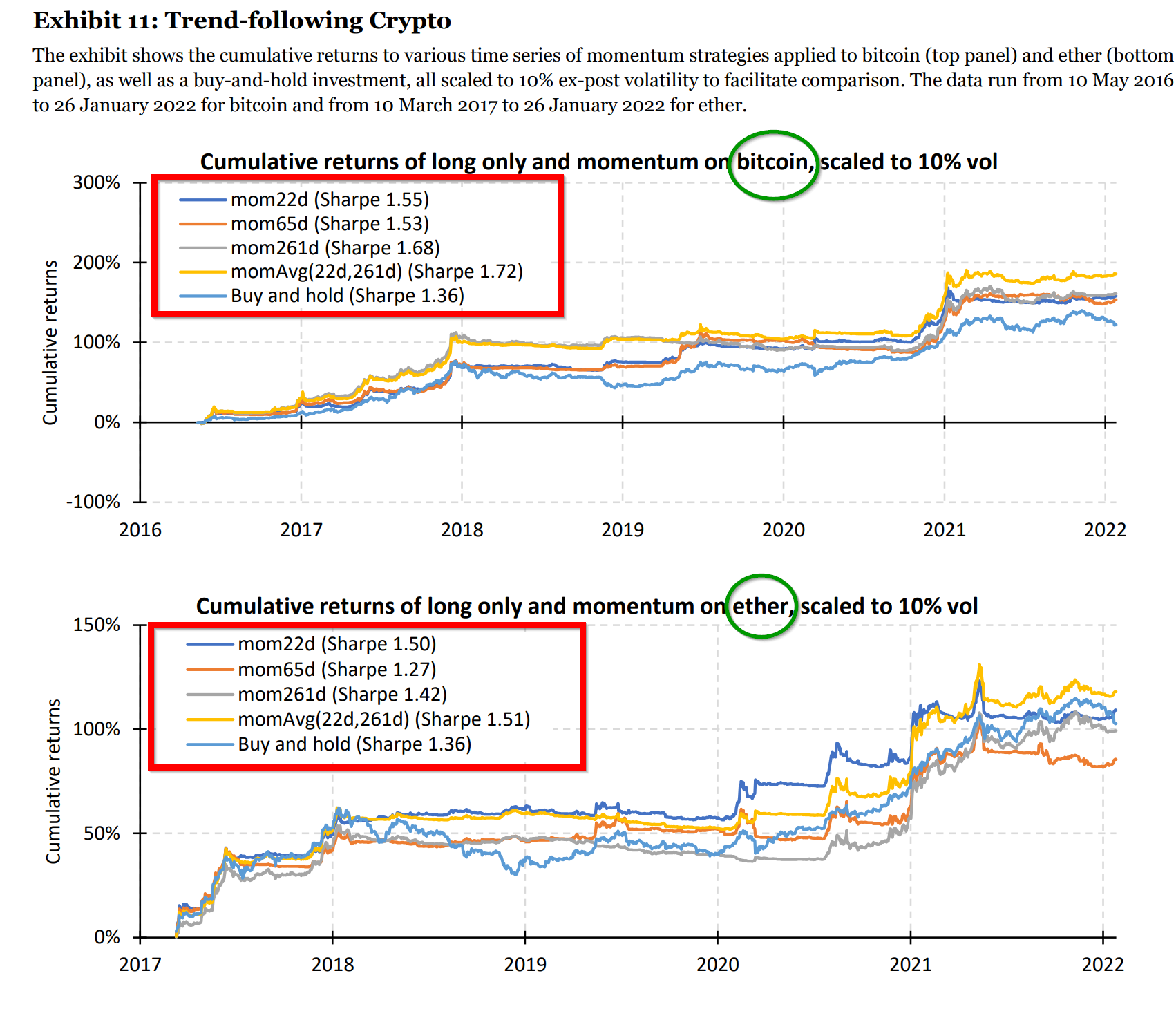

- The risk and return properties of cryptocurrencies and their role in a broad-based portfolio. The authors report the daily returns of bitcoin at +/-10% with a standard deviation of 4.9%, 80% on an annual basis. Results for the S&P 500 were much different, with a daily return vol of 1.2%, 19% on an annual basis. Between 2017-2022, bitcoin investors experienced fewer tail events when compared to the S&P 500. Results for Ether were similar. The currencies themselves exhibited a pair-wise correlation of .4 to .8 suggesting a modest potential for diversification among currencies. The news on diversification with other asset classes is not good. The pair-wise correlation with commodities, equity, L/S value, high yield, US bonds, and L/S quality was .02 when equities were not in decline but did rise to .55 when equities were in a 20% or more drawdown situation. The arguments that crypto could have a diversifying effect are probably overstated. Investors allocating to crypto should be aware that the diversification benefit is considerable, but only when equity markets are relatively calm. However, a bit of “active” management appears to add value. Results of trend-following strategies using bitcoin and Ether were encouraging over the admittedly short period. Taking mostly long positions over the 5 years, the coins outperformed the buy and hold. See Exhibit 11 below for Sharpe ratios for 1, 3 and 12-month trend strategies.

Why Does it Matter?

Given the relatively good news about the development of crypto as an accepted asset class, how might its’ future unfold? A number of scenarios are likely. Crypto could expand on its’ journey towards the mainstream. The participation of institutional investors may increase as the diversification properties of crypto and the availability of digital art and entertainment become more attractive. That type of participation may reduce the amount of volatility to more traditional levels. The issues of buying and holding cryptocurrencies can be challenging to the average investor. Unlike other asset classes, custody is less manageable and hopefully can ultimately be handled with third-party solutions.

The Most Important Chart from the Paper

Abstract

We provide practical insights for investors seeking exposure to the growing cryptocurrency space. Today,

crypto is much more than just bitcoin, which historically dominated the space but accounted for just a 21% share of total crypto trading volume in 2021. We discuss a wide variety of tokens, highlighting both their functionality and their investment properties. We critically compare popular valuation methods. We contrast buy-and-hold investing with more active styles. We only deem return data from 2017 representative, but the use of intraday data boosts statistical power. Underlying crypto performance has been notoriously volatile, but volatility-targeting methods are effective at controlling risk, and trend-following strategies have performed well. Crypto assets display a low correlation with traditional risky assets in normal times, but the correlation also rises in the left tail of these risky assets. Finally, we detail important custody and regulatory considerations for institutional investors.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.