The verdict is still out on the impact of legislation regarding firm disclosure rules on the gender pay gap (GPG). First, results from recently published research are mixed. Second, estimates of the impact of legislation aimed at closing the GPG have produced a wide range: no impact in Austria, 2% reduction in Denmark, and a reduction of 20% to 40% in Canadian universities. Is there a better approach?

Can gender Pay-Gap disclosures make a difference?

- Menachem Abudy, David Y. Aharon, Efrat Shust

- Finance Research Letters

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

The authors of this piece of research examine the effectiveness of the GPG disclosure rule in the UK. The UK Equality Act requires UK firms with 250 or more employees to disclose information about the GPG. This dataset produces a more accurate estimate because the UK law requires reporting the percentage of males vs. females within each pay quartile. This is a feature not included in the legislation passed in other countries. Results for the UK data are detailed below.

What are the Academic Insights?

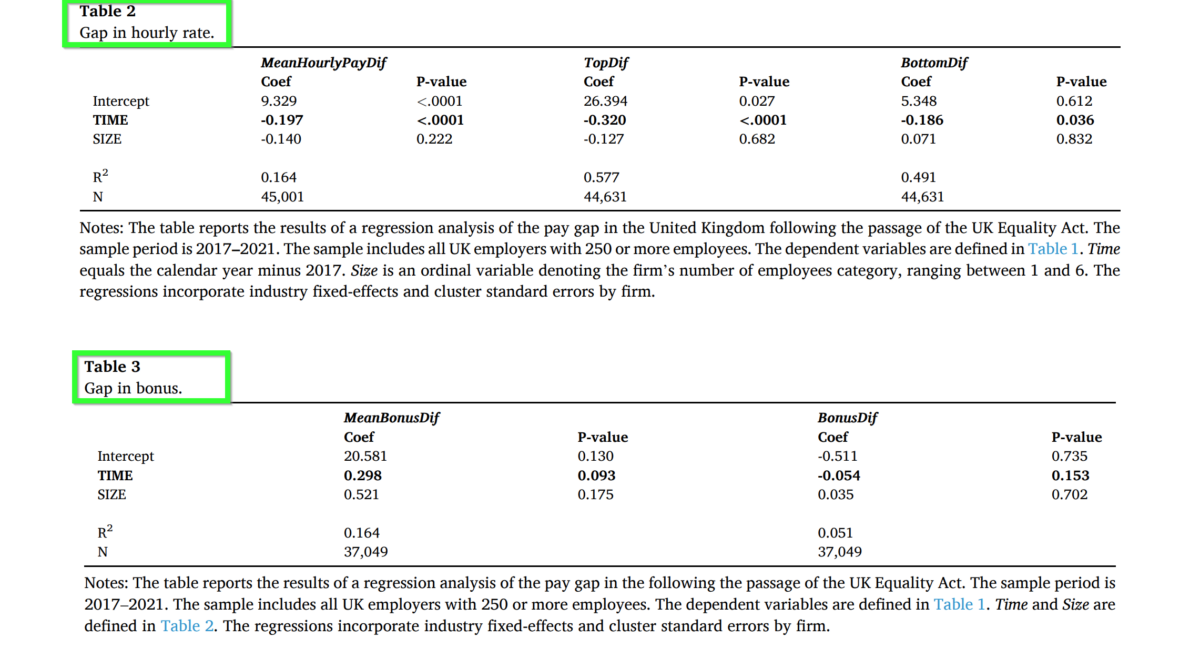

Generally, the GPG in the hourly pay rate appeared to decline after the required GPG disclosures were adopted in the UK. However, the results of the bonus pay gap were disappointing. The results for the average gap in bonuses and the percentage gap between males and females receiving bonuses are presented in Table 3.

- The average hourly GPG declined over time. See Table 2, where the TIME variable is negative and significant.

- The SIZE variable was not significant. The GPG is unrelated to the number of employees in the firm.

- For the top quartile, TIME was also negative and significant, indicating that the GPG declined over time.

- The pattern for the bottom quartile was different. Females were the majority percentage in the lowest paid employees. In this case, the negative coefficient on TIME reflected an increase in the GPG, although the size of the coefficient was smaller than in the top quartile.

- There was little to no evidence of an impact on bonuses. The TIME variable was positive and barely significant. Unlike the observed decline in the gap in hourly pay, the gap in bonuses was persistent and exhibited little change overall.

- A similar result was observed in the percentage gap between gender in terms of bonus recipients, with no change. The SIZE variable was not significant.

Why does it matter?

The research presented here suggests that policymakers and firms should focus on the components of compensation when constructing legislation focused on the elimination of the whole of the gender pay gap. For the UK, the requirement that firms disclose not only the hourly GPG but the bonus gap and the extension to specific pay quartiles provided quite a bit of clarity. In addition, the legislation dictated specific measures for the GPG to increase the transparency of the remuneration discrepancy between genders. Overall, the specifications embedded in the UK Act guide efforts to reduce the pay gap across countries.

The most important chart from the paper

Abstract

The United Kingdom passed the UK-Equality-Act-2010 in 2017, mandating public and private firms to disclose their gender pay gap (GPG). To evaluate the effectiveness of this regulation, we examine whether the effect of the disclosure rule led to any change in male and female pay differences. Our analysis reveals that the GPG disclosure has reduced the pay gap over time since the Equality Act was introduced. The results hold for different regression specifications and after controlling for industry-fixed effects. The findings may suggest a possible channel through which policymakers can reduce gender disparities and improve corporations’ social responsibility conduct.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.