The Financial Costs of Sadness

- Lerner JS, Li Y, Weber EU

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

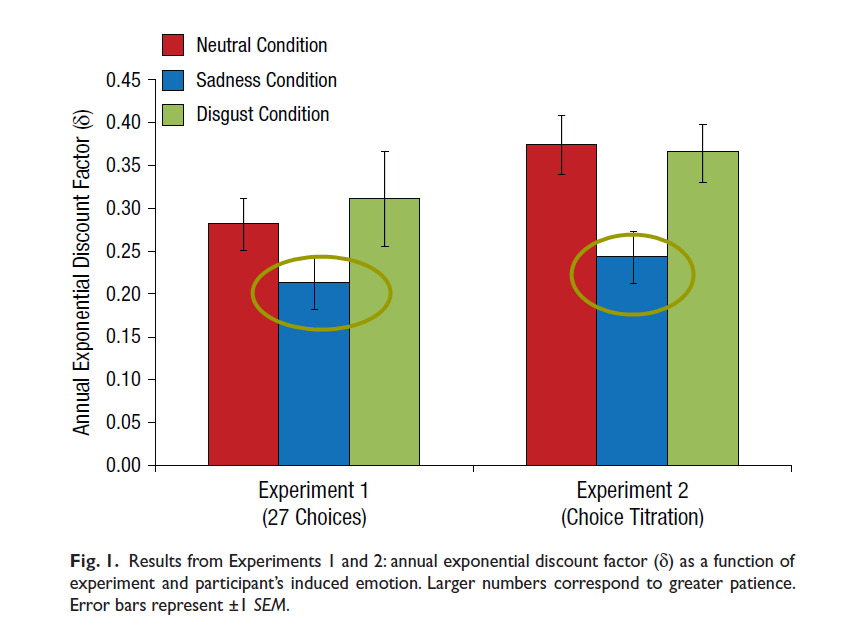

Hundreds of studies have examined the “sadder-but-wiser” hypothesis—that sad people make wiser decisions—and most find support for it. But virtually no tests of the hypothesis examined financial decisions, which are some of the most frequent and consequential decisions people make. To address this gap, the present experiments examined the effects of sadness on intertemporal financial choices of the form $X now versus $(X+Y) later—typical of the choices people make when considering whether to spend now or save to spend more later. Studies of intertemporal choices typically reveal extreme impatience. That is, people choose earlier rewards over significantly larger, later rewards, often leading to regret. Would sadness reverse the typical impatience pattern in choices—by increasing wisdom and decreasing impatience—per the sadder-but-wiser hypothesis? Three experiments tested the hypothesis, inducing sadness in randomly assigned participants and then offering participants an intertemporal financial choice unrelated to the source of sadness. Each experiment found that sadness dramatically increased impatience: Relative to the median neutral-mood participant, the median sad-mood participant was willing to accept 35% to 79% less money today to avoid waiting for a payoff. Sadness increased impatience even though the emotion was normatively irrelevant to the choice. In sum, sadder is not wiser when it comes to making tradeoffs between time and money.

Data Sources:

Experimental data.

Alpha Highlight:

“Exponential Discount Factor” is a measure where a lower value represents more impatience. People in a sad state tend to be more impatient.

Strategy Summary:

- Don’t make financial decisions when you are in a sad mood.

- Sad people tend to desire an immediate benefit at the expense of a larger long term gain.

Commentary:

- Never trade while sad; Drink strong whiskey when you are sad.

Any experience trading sad?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.