We are fundamentals-based value investors, just like Warren and Charlie, but have chosen to pursue the art of value investing in a slightly different way than they do — we use quantitative tools. Perhaps we are heretics who have lost our way. We accept this possibility. However, both Wes and I tried to emulate Warren and Charlie for many years, but after some big successes and a lot of failures we decided to simplify the decision-making process when it came to value investing. And as fundamental investors first, the team decided to pay respects to our humble hero Warren Buffett.

Here is a picture of some members from the Alpha Architect team who attended the Berkshire Hathaway Annual Shareholders’ Meeting:

From Left to Right: Pat Cleary (AA), David Foulke (AA), Mike Jennings, Dave Babulak (AA), Xin Song (AA), Shukang Xue , Yang Xu (AA)

The meeting was held during a rainy day, but the auditorium was packed with perhaps 40,000 people. They could have had a collegiate basketball game instead and you wouldn’t have known the difference. The sheer scale of the event was stunning.

We watched a short video and then were treated to a multi-hour question and answer session with possibly the two greatest value investors of all time. For the first time, the event was live streamed (a link is here), which is how we created the transcript below.

Topics ranged across the world of business, investing and finance, and even turned intimate at times. Incredibly, they were not informed ahead of time as to what the questions would be, but instead answered them extemporaneously, on the fly. Amazing.

Below we outline some discussion points between Warren and the audience and how they relate to our approach to value investing.

Perhaps all value investors are created equal–buy cheap, buy quality, have horizon

Here is a question posed to Buffett and his response:

—

Question: The magic of long term, concentrated value investing is real, yet…the rest of the world doesn’t believe we exist. How should [children] look at stocks when every day in the media they see companies that have never made a dime in their life, go IPO. They’re dilutive, they see a lot of very short term spin. The cycle is getting shorter and shorter. How should they view stocks, and what’s your message for [children]?

Warren Buffett: …You don’t have to really to worry about…what’s going on in IPOs, or people making money. People win lotteries every day, but there’s no reason to have that effect at all. You shouldn’t be jealous about it…if they want to do mathematically unsound things and one of them occasionally gets lucky, and they put the one person on television, and the million that contributed to the winnings with a big slice taken out for the state…don’t get on there, it’s nothing to worry about…all you have to do is figure out what makes sense…and when you buy a stock you get yourself in the mental frame of mind that you’re buying a business. And if you don’t look at a quote on it for five years, that’s fine. You don’t get a quote on your farm every day or every week or every month. You don’t get it on your apartment house if you own one. If you own a McDonald’s franchise, you don’t get a quote every day. You want to look at your stocks as businesses and think about their performance as businesses. Think about what you pay for them, as you would think about buying a business. And let the rest of the world go its own way. You don’t want to get into a stupid game just because it’s available.

—

Buffett is essentially describing value investing: Understand and value a business; pay a cheap price. Buffett describes 3 key features of value investing, which we have tried to reproduce via a systematic process:

- Quality–“Think about their performance as businesses.” Buffett’s comment here relates to the quality of the business. Buffett approach is forward-looking. Our approach seeks to avoid firms at risk of financial distress, and show signs of financial strength in fundamentals, such as leverage, liquidity, operating efficiency, and operating trends. These metrics are all backward looking

- Price–“Think about what you pay.” Our algorithm uses enterprise yields, which compares operating earnings flowing to an acquirer post-acquisition, and thus controls for the mix of debt and equity in the capital structure by considering the cost to acquire the entire enterprise.

- Long Horizon–“You don’t get a quote on your farm every day.” As Buffett mentions, don’t get caught in day-to-day portfolio assessments. Value strategies can work over the long haul, but in the short run they can be volatile.

As it turns out, Buffett, although he may not admit it, has been quantitatively determined to buy cheap stocks with indications of quality.

Assets under management destroy opportunity

Scale is the enemy of performance. Another Buffett conversation at the meeting:

—

Question: …In your 1987 Letter to Shareholders, you commented on the kind of companies Berkshire would like to buy: those that required only small amounts of capital. You said, quote, “Because so little capital is required to run these businesses, they can grow while concurrently making all their earnings available for deployment in new opportunities.” Today the company has changed its strategy. It now invests in companies that need tons of capital expenditures, are over-regulated, and earn lower returns on equity capital. Why did this happen?

Warren Buffett…It’s one of the problems of prosperity. The ideal business is one that takes no capital, but yet grows, and there are a few businesses like that. And we own some…We’d love to find one that we can buy for $10 or $20 or $30 billion that was not capital intensive, and we may, but it’s harder. And that does hurt us, in terms of compounding earnings growth. Because obviously if you have a business that grows, and gives you a lot of money every year…[that] isn’t required in its growth, you get a double-barreled effect from the earnings growth that occurs internally without the use of capital and then you get the capital it produces to go and buy other businesses…[our] increasing capital [base] acts as an anchor on returns in many ways. And one of the ways is that it drives us into, just in terms of availability…into businesses that are much more capital intensive.

—

Pat has a great post on alpha or assets, which highlights that asset managers face a conflict: on one hand they want to maximize the expected performance of their portfolio, but on the other hand, they want to maximize their assets under management. And because the market is competitive, as one builds a portfolio for scalability, one simultaneously takes a hit on expected performance. We have a post outlining this problem, which has been discussed by Jonathan Berk in great detail.

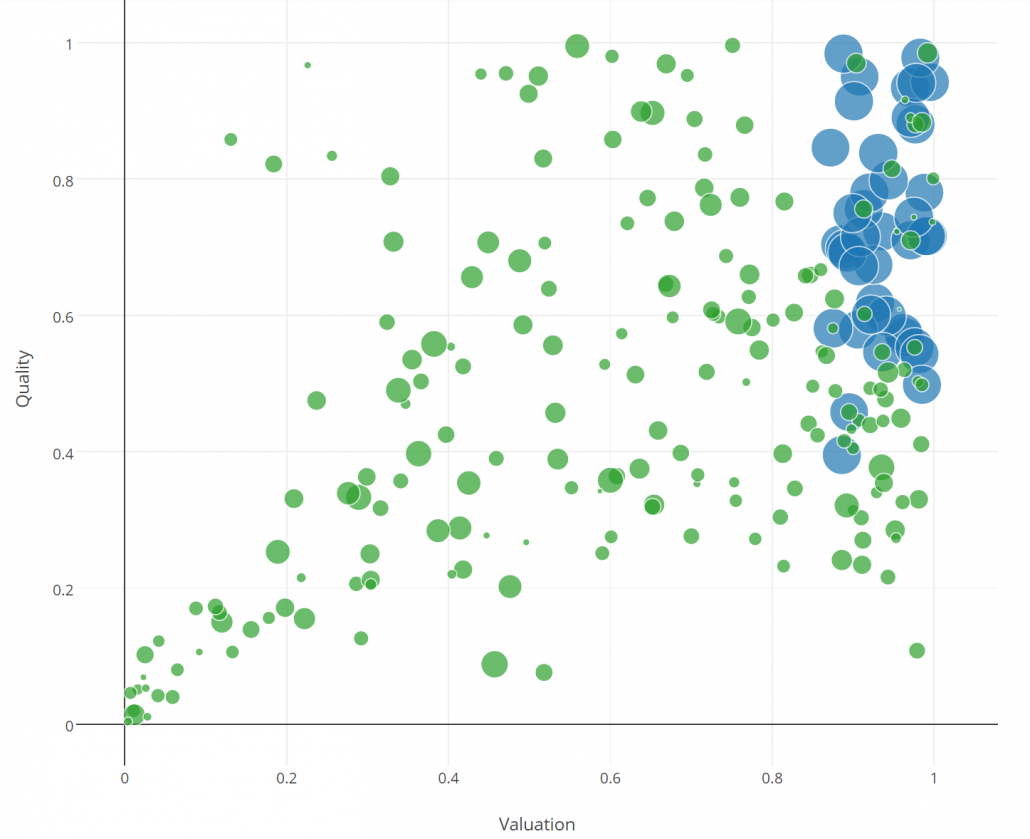

Here is an example of how portfolios can be constructed for scale or expected performance.

- The x-axis represents “valuation” based on the percentile rank of EBIT/TEV across the universe of all stocks (1 = cheap, 0 = expensive).

- The y-axis represents “quality” based on the percentile rank of ROE across the universe of all stocks (1 = quality, 0 = junk).

- The dots reflect the percentage weight in the respective index.

- Purple = Quantitative Value Index

- Green = CRSP US Mid Cap Value Index

Historically, the portfolio characteristics of value investing that drive expected performance are associated predominantly with cheapness (x-axis). Only as a secondary condition should we consider quality (this is the key takeaway from Wes’ book Quantitative Value.) The CRSP index, which is highly scalable due to a market-cap weighting scheme and a large basket of securities, only partially reflects the characteristics that a value investor wants (i.e., green is all over the cheapness and quality map). Meanwhile, our Quantitative Value Index is squarely focused on cheapness with a secondary focus on quality. The QV index is also equal-weighted and concentrated on less than 50 stocks. This portfolio construction is way less scalable than the CRSP index. The CRSP index can handle $50 billion + in capacity, while the QV index would need to adjust the portfolio construction once it got past a few billion.

Buffett is amazing

In the end, the Berkshire event was a fantastic experience. If you ever want to hear an incisive discussion across a range of US businesses, you should head to Omaha one of these years. While Warren and Charlie have opinions on a broad range of topics, they have stayed true to their roots as value investors. Buy quality; buy cheap; have horizon. Those ideas seem to underlie a lot of what they have achieved in business. We hope to emulate that consistency and discipline, and we hope other value investors can too.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.