- Title: THE VALUE OF CROWDSOURCED EARNINGS FORECASTS

- Authors: RUSSELL JAME, RICK JOHNSTON, STANIMIR MARKOV, AND MICHAEL C. WOLFE

- Publication: JOURNAL OF ACCOUNTING RESEARCH, SEPTEMBER 2016 (version here)

What are the research questions?

- Are crowdsourced earnings forecasts from a source such as Estimize, useful in the capital markets by capturing new information about future earnings?

- Does a site such as Estimize add incremental accuracy when combined with the conventional, sell-side earnings forecasts such as the IBES consensus as well as a statistical model of forecasts? Is the crowdsourced consensus more or less related to earnings surprise announcement returns?

- Is the crowdsourced consensus more or less related to earnings surprise announcement returns?

What are the Academic Insights?

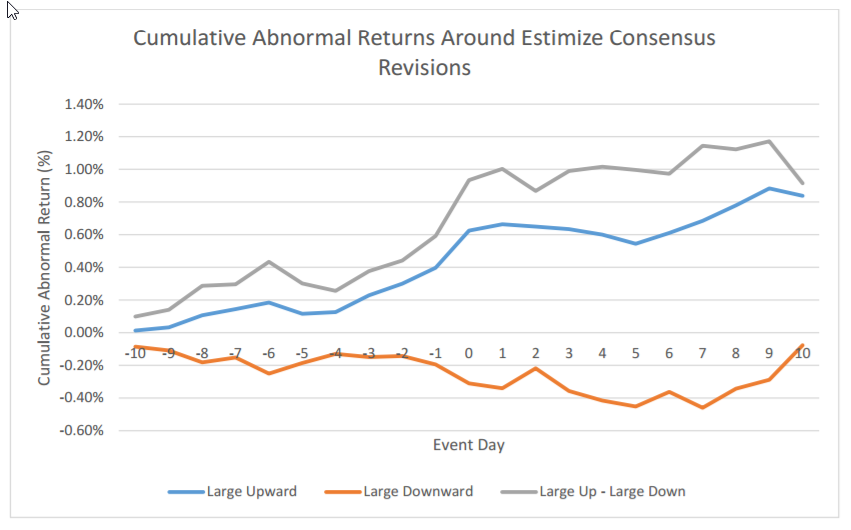

- YES- Significant two-day excess returns (0.41%) surrounding large upward/downward EPS revisions were documented. Notably, this excess return was not reversed over the following two weeks and was unrelated to confounding corporate events.

- YES- Including the Estimize forecast with either a statistical model or using the IBES consensus resulted in significant improvements in the accuracy of forecasting actual EPS. The accuracy improvements extended to all forecast horizons. Accuracy of the Estimize contribution increased with the number of Estimize contributors.

- YES- The Estimize consensus added incremental explanatory power to the three day earnings surprise announcement returns, controlling for the IBES consensus forecast. With five or more contributors, the Estimize forecast dominated the IBES consensus in explaining the three day announcement returns.

Why does it matter?

This paper is interesting because it is the first to examine the value of this alternative source of earnings forecasts. A crowdsourcing site such as Estimize versus other whisper sites, attracts and utilizes a wider variety of capable forecasters including analysts, portfolio managers, independent investors, corporate finance professionals and students.

The results indicate that capable external forecasters, using their own content, are able to provide and distribute less biased, more relevant and incrementally useful information about future EPS.

One caveat, Estimize contributors are potentially able to capitalize on sell-side estimates given those are timelier and widely available. The benefit in forecasting accuracy from such an advantage is inherently compromising.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Tommi Johnsen, Ph.D., (@TommiJohnsen) is an independent investment consultant. With co-author Elisabetta Basilico, PhD, CFA she is writing an upcoming book on research backed investing. You can learn more at http://academicinsightsoninvesting.com/

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.