Craftsmanship Alpha: An Application to Style Investing

- Ronen Israel, Sarah Jiang, and Adrienne Ross

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

This is an important article for practitioners because it brings specific investing decisions that are often treated as afterthoughts, to the forefront in style-based investing. The authors propose that decisions made beyond the initial decision to invest in a style, such as value or momentum, are alpha-generating. The authors label this, “Craftsmanship Alpha.”

Although the same style labels are applied to a number of portfolios, those portfolios can and do differ significantly across a number of dimensions. For example, the specific definition of style may be applied in a long only versus a long/short strategy, or the style may be defined by a single variable or multiple definitions may be combined into one.

This recognition is a powerful insight for practitioners. Using simulated data in backtests from 1990 to 2015, the authors examine the value added (or lost) from differences in implementation decisions. In addition to discussing the complexities of integrating different style in a multi-style portfolio, and the pros and cons of tactical timing versus the maintenance of strategic allocations, the authors consider the following:

- Does the definition of the signal (single versus multiple measures combined) matter?(1)

- Does the type of weighting scheme add value?

- Does controlling the extent of unintended risk exposures matter?

- Can the trading cost of rebalancing frequency detract from performance?

The questions of interest were examined using traditional value and momentum styles, although the results and implications can be extrapolated to other styles and factors.

What are the Academic Insights?

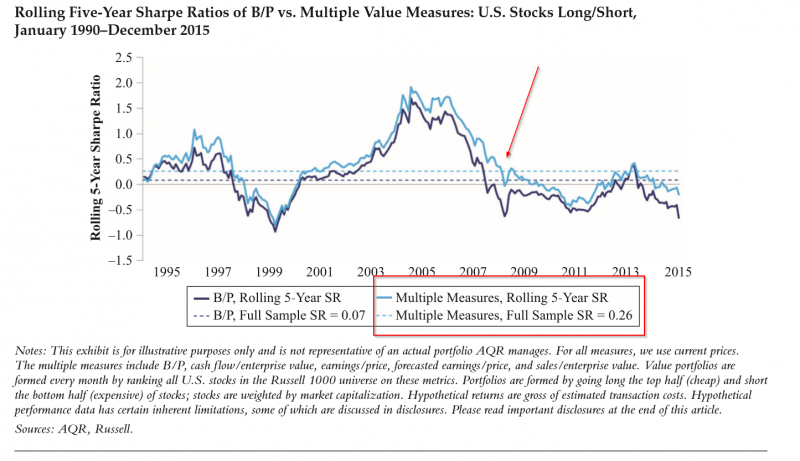

- YES. The use of multiple measures of a factor or style is advantageous because it mitigates the noise associated with a single measure and may separate the “true” measure of the factor by identifying the common component across several definitions. A comparison of Book/Price and a combined measure of 5 value indicators produced positive excess returns (.07 for B/P and .26 for the combination) while maintaining a strong positive correlation between the two measures. Datamining issues aside the combination measure is argued as a more robust representation of the style desired.

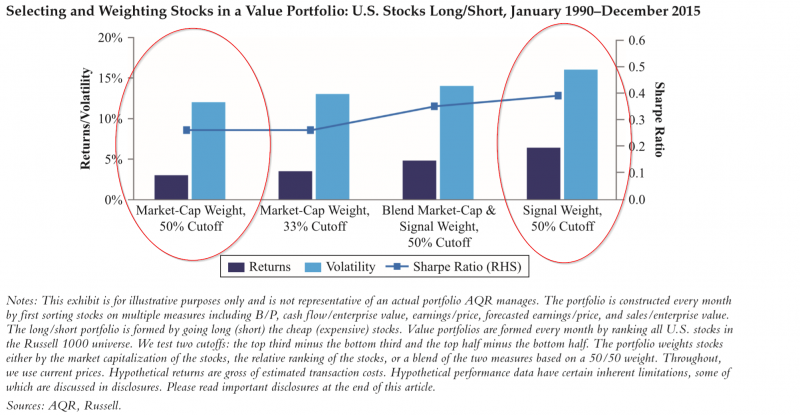

- YES. The cutoff point for including stocks and the ultimate weighting scheme utilized for a factor based portfolio had a large impact for the value portfolio tested. For example, the simulated Sharpe Ratio increased from slightly under .3 for the market cap weighted portfolio to approximately .4 for the factor weighted portfolio.

- YES. The excess returns and Sharpe Ratios for a “pure play” value portfolio exceeded that of a simple B/P portfolio that contains inadvertent market and industry bets. The Sharpe Ratio is .05 for the B/P portfolio and approximately .17 for the risk-controlled portfolio. Portfolio construction methodology that neutralizes industry and market bets usually results in higher Sharpe Ratios via a reduction in volatility with the caveat that turnover is also higher.

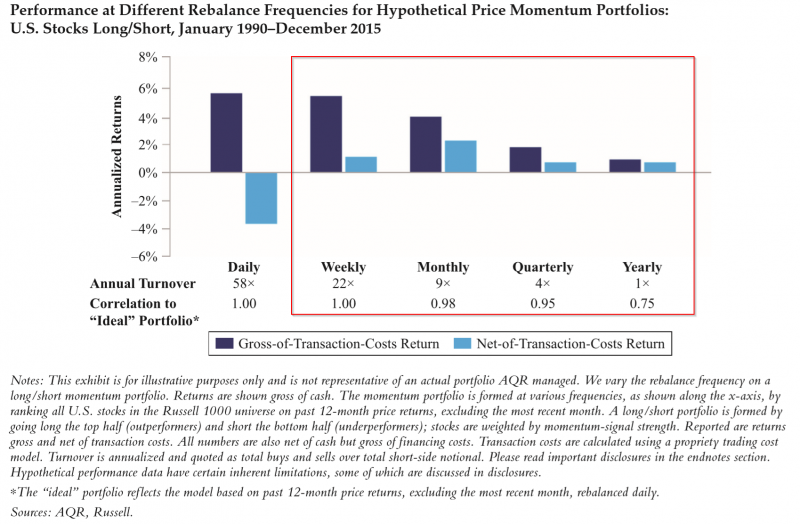

- YES. The tradeoff between trading at a lower frequency against the performance degradation from delaying the rebalance is significant. In a simulated momentum portfolio, the net-of-costs performance is positive for rebalance periods that occur at the weekly, or longer, timeframe and is actually negative when the rebalance period is daily.

Why does it matter?

This article contains very practical information, guidelines, and explanations for practitioners considering style or factor investing. The paper is perhaps one of the best explications of the implementation issues associated with quantitative strategies that I have come across.

A quote from the authors:

Although there may be broad agreement on the major styles that drive asset returns, we have shown that when it comes to style investing, many details matter—from how to transform signals into portfolio weights, to risk control, optimization, and trading….. Ultimately, what may seem like inconsequential decisions can lead to a meaningful edge over time.

The most important charts from the paper

3 charts this time…

Chart 1

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Chart 2

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Chart 3

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Successful investing requires translating sound investment concepts into actual trading strategies. The authors study many implementation details that portfolio managers should pay attention to when constructing multistyle portfolios across asset classes. The article focuses on portfolio implementation choices, including how to transform signals into portfolio weights and how to combine multiple styles, optimization, risk control, and trading. While these kinds of decisions apply to any type of investment strategy, they are particularly important in the context of style investing, where the craftsmanship choices that can impact investment success are ubiquitous. In fact, the skillful targeting and capturing of style premia may constitute a form of alpha on its own—one that the authors refer to as “craftsmanship alpha.”

References[+]

| ↑1 | discussion on the potential perils of multi-measure testing. |

|---|

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.