The Causal Mechanism of Financial Education: Evidence from Mediation Analysis

- Fenella Carpena and Bilal Zia

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

Worldwide there are billions of people who have little to no knowledge of even the most basic of financial concepts. This lack of basic financial literacy creates a glass ceiling that keeps many members of the worldwide population in poverty or unprepared for future financial commitments. Though significant work has been done to educate this population few have explained the mechanisms through which financial education operate.

The researchers seek to answer the following questions:

- What are the mechanisms through which financial education can materially impact financial behavior?

- How do educational practices improve financial knowledge in terms of numeracy, awareness, and attitudes?

- How do different dimensions of financial knowledge mediate the impact of financial education programs?

What are the Academic Insights?

This study utilized a population of 959 urban poor Indian’s living in Ahmebadad. The group was broken up into 3rds with 1/3 being a control group that received health care education, and the remaining 2/3rds received financial education. The financial education group was then further broken down to having a random sub-population which had individualized concrete goal setting, and another population had individualized financial counseling, and a final group received financial education as well as goal setting and counseling.

The specific outcomes were measured to analyze the financial behavior of the subjects after the treatment were as follows:

- Making a budget.

- Opening a savings account.

- Opening a loan for a productive reason.

- Purchasing life insurance.

Participants financial knowledge was also measured after treatment in 3 specific areas:

- Financial Numeracy (the ability to do simple financial calculations).

- Financial Awareness (simply being aware of financial concepts such as household budgeting, deposit insurance, and loan fees).

- Financial Attitudes (which encompass individuals’ perspectives on the benefits of financial services).

It was then determined which of the three pathways were impacting the behavior of the participants. Surprisingly, the financial education alone (a fairly rigorous 10-15 hours of cumulative video training) has no significant impact on savings, borrowing, or insurance. The video training alone only materially improved budgeting outcomes, but when complemented with in-home goal setting and/or in-home counseling the results in substantial positive effects in most categories. For example, when financial education is complemented with counseling it resulted in a 40.2% rise in the propensity of making a budget, 16.7% in of having a savings account, 16.7% greater chance of using borrowing for productive means, and 4.5% improvement in the likelihood of purchasing life insurance.

- It was found that none of the treatments improved subjects financial knowledge in terms of numeracy. However, all four treatment combinations have statistically significant impacts on awareness and attitudes. Financial awareness improves by as much as 15.1% over the control group, and financial attitudes improve up to 14.5%.

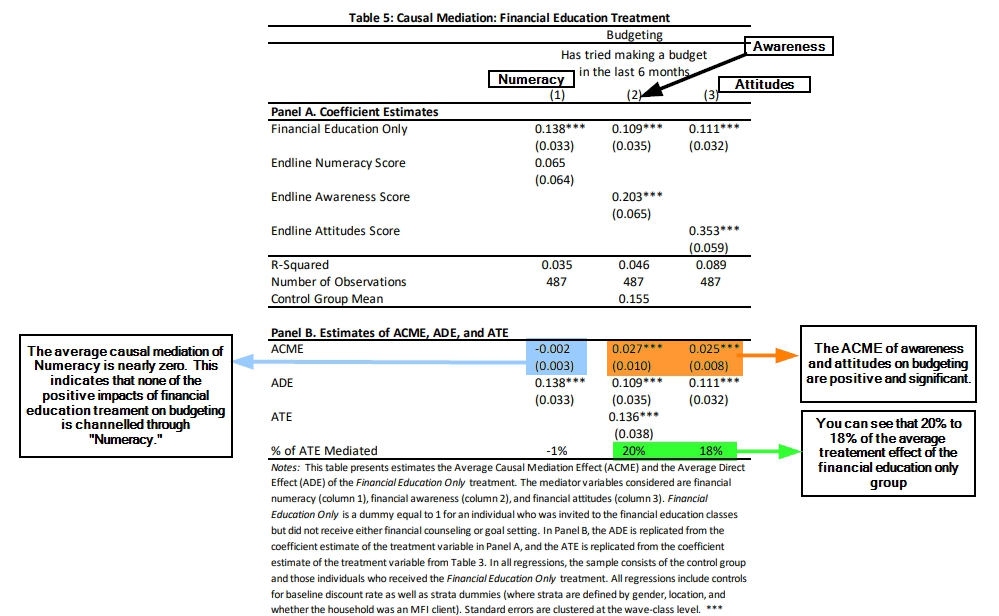

- There were four notable patterns that shed light on the role of numeracy, awareness, and attitudes as mechanisms between financial education and financial outcomes. First, it was found that numeracy does not serve as a mediator for financial education in anyway. Secondly, it was observed that both attitudes and awareness significantly and positively impacted budgeting outcomes. Third, it was found that attitude alone mediates the impact of financial education on savings outcomes. Finally, it was found that although the most intensive treatments (i.e. financial education with counseling) have significant positive effects on borrowing and insurance outcomes, these results were not due to numeracy, awareness, or attitudes.

Why does it matter?

The authors said it best when they said,

Understanding how financial knowledge acts as a mechanism is critical not only to fill the gap in the academic literature, but also to inform public policies on designing more effective financial education initiatives.

When coupled with my last post, which describes how the beliefs of advisors are directly contributing to client allocations, it is becoming clear that effective financial education should focus not just on a mechanical understanding of financial products, but on managing human beliefs, attitudes, and awareness of financial products. This research seems to support the hypothesis that normal people (i.e., non-finance geeks who never read this blog) probably benefit when they have a financial advisor. The advisor can educate the client about financial concepts, but can also help the client form goals and consult the client along the way.

What are the most important charts from the paper?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Abstract

This paper uses a field experiment in India with multiple financial education treatments to investigate the causal mechanisms between financial education and financial behavior. Focusing on the mediating role of financial literacy, we propose a broader definition of financial knowledge that includes three dimensions: numeracy skills, financial awareness, and attitudes towards personal finance. We then employ causal mediation analysis to investigate the proportion of the treatment effect that can be attributed to these three channels. Strikingly, we find that numeracy does not mediate any effects of financial education on household outcomes. For simple financial actions such as budgeting, both awareness and attitudes serve as critical pathways, while for more complex financial activities such as opening a savings account, attitudes play a more prominent role. These findings underscore the importance of changing perceptions about financial products and services as a vital mechanism for the success of financial education. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3244634

About the Author: Rich Shaner, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.