Peter Thiel has this quote to open his book Zero to One:

Every moment in business happens only once. The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them. Of course it’s easier to copy a model than to make something new. Doing what we already know how to do takes the world from 1 to n, adding more of something familiar. But every time we create something new, we go from 0 to 1. The act of creation is singular, as is the moment of creation, and the result is something fresh and strange.

The creation of the ETF SPY was the zero to one moment with Nate Most as our Bill Gates. And the result was fresh and strange and very misunderstood for a long time. Only now (26 years after the launch of SPY) is the ETF becoming mainstream and fairly well understood by the large majority of investors. That’s not to say we aren’t still debunking misunderstandings, but those misunderstandings and false statements are squarely driven by the minority now. And as we know with most technological advances, there is a minority that will always insist the old way is better.

With the ETF structure itself being the step change moment, any talk of some new ETF ‘revolutionizing’ investing is nonsense, and most of us are well aware of that. The revolution happened. For the most part, ETFs are doing similar strategies that were done by mutual fund companies or hedge fund managers for decades, but for the first time they are being brought to mass audiences at affordable prices. If you have enough money to buy one share of an ETF (often around $25), you can invest in an ETF strategy. This “no investment minimum”, combined with access for all investors (not large ones

By creating new investment strategies for ETFs we are tweaking from one to n (not zero to one). But what are the revolutionary benefits brought by the ETF structure?

The step change that the ETF structure brought is based on three main benefits:

- Transparency: Relative to previous pooled investment vehicles (hedge funds/mutual funds/ PE funds/ private REITs, etc), ETFs are more transparent. There are a number of ways ETFs and the ETF industry are more transparent. The biggest way is that almost all ETFs have their holdings published on a daily basis on their company’s website. A second major reason ETFs are considered transparent is investors can easily understand the fee. ETF fees are stated clearly and all investors in the fund pay the same fee. Transparency (of both holdings and fees) seems fairly blasé, but this transparency enables investors to know what they own and exactly what they are paying for. (2)

- Lower Costs (to operate): Exchange Traded Funds, in general, have lower operating costs than mutual fund (and therefore lower costs on average for investors. ETFs are the driving force behind savings of approximately $266 billion through 2017).

- Tax Efficiency: The third major change brought by the ETF structure is that ETFs are typically more tax efficient (to an estimated 0.8% per year in tax deferral relative to the average mutual fund). With an ETF, you are much more likely to only pay taxes when you decide to sell (defer your taxes), as opposed to the mutual fund structure where you are often consistently having to pay taxes on capital gain distributions (and this is out of your control). The ability to control your own taxes is a major win for investors and how it should be.

These three benefits freed up hundreds of billions of dollars that are now spread throughout the American economy to continue to create wealth elsewhere. Those three benefits (combined with other smaller benefits) enabled new asset management companies the ability to break in and win against the entrenched and established asset managers at scale. The additional wealth created for investors by passing along the benefits of scale to them is wealth that is now circulated back into the economy and donated to charity, provides for families, or is invested to continue to compound your wealth. That’s a powerful step change.(3)

In a previous post, I explained ETF issuers are no longer competing against mutual funds and hedge funds. That battle was fought already and it is over. In this post, we’ll look at some of the data that can be used to argue in

What Can We Expect in the Future for the Asset Management Industry?

A key question from people in the ETF industry is when will the mutual fund die? Turns out its a bit more complex than many of us in the ETF industry would like to admit.

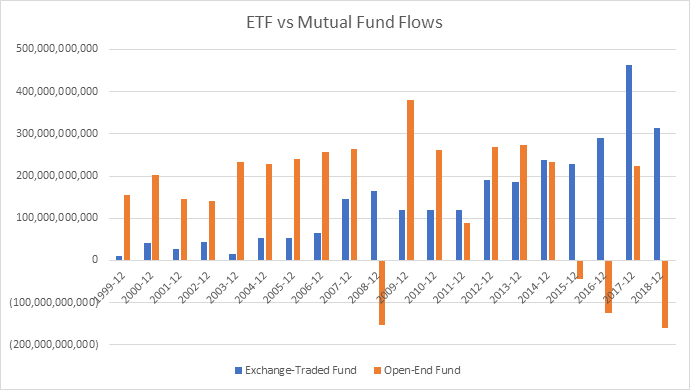

For years the story is that the ETF industry is booming and the mutual fund industry is struggling. While this is directionally correct, looking at some charts may help give us a little more color on the stats behind the story and find the answer may be murkier than we expected.

The chart above shows us mutual funds are in outflows three out of the last four years, whereas Exchange Traded Funds have never experienced outflows for a calendar year.

For the mutual fund industry,

- People are turning mutual fund investments into retirement spending.

- Mutual fund assets are moving into CITs.

- ETFs benefit from substitution effect–used in lieu of single securities and derivatives (4)

No one (that I’ve seen) has a way to measure these three points, but they all sound valid to me.

If you total up the mutual fund industries net flows from the previous four years, it equals “only” $102 billion in outflows from a $13.6 Trillion asset base. That’s not that bad.

On the other hand, ETFs over that same period have had approximately $1.3 Trillion in inflows. That relative difference is where the major pain and angst for mutual fund companies comes from. And that spread is where the excitement is for the future of the ETF industry.

For years, mutual fund companies assets managed to grow even though they had outflows in the funds themselves. The bull market was causing the assets in mutual funds to appreciate faster than the outflows were taking away assets. In 2018 that changed.

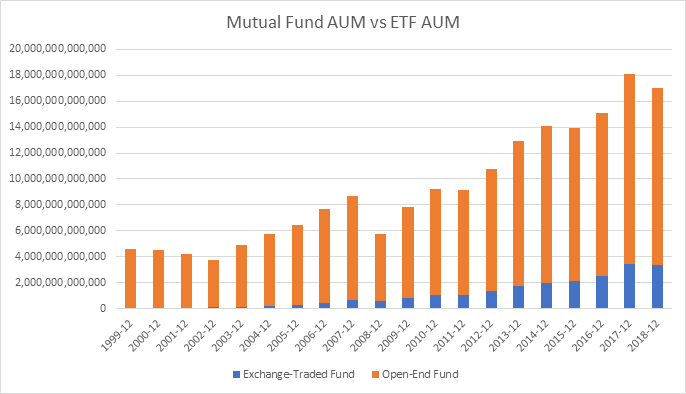

Mutual funds had assets dip from $14.7 Trillion, at the end of 2017, to $13.6 Trillion at the end of 2018. A 7.5% decline in assets. ETFs had assets drop to $3.38 Trillion from $3.41 Trillion. A 1.1% decline in assets. Mutual Fund companies were seemingly hit much harder by the pullback than ETF companies, as Eric Balchunas predicted in this article.

But this chart also highlights another great point: At the end of

For all the hype ETFs get, this is a big difference.

ETFs for the Future

The charts above show you can make a solid case either way. You can look at the flows chart and say its evidence ETFs are throttling the mutual fund industry, or you can say most of the outflows in mutual funds are due to structural reasons of retired owners selling to generate income. You can look at the assets under management chart as being a massive opportunity for ETFs to continue to gather

Me? I say look at what the mutual fund industry does. Not what it says. For Mass Mutual to sell Oppenheimer Funds to the ETF monster Invesco PowerShares, that is major players in the industry showing you what they believe about the future of mutual funds. And it ain’t pretty.

Don’t shoot the messenger.

References[+]

| ↑1 | |

|---|---|

| ↑2 | This wasn’t the case in almost every (every?) pooled investment vehicle before the ETF. Investors would buy a mutual fund or hedge fund and have to just trust the fund manager was going to be doing what they said as holdings are only shown once a quarter. And good luck trying to figure out what you’re actually being charged if you invest in private REITs: hidden fees out the wazooooo! |

| ↑3 | And yes, some of these assets flowed through to index/low cost mutual funds, but the ETF structure was the biggest driver. Without the legacy baggage the mutual fund companies had/have, the ETF industry greatly accelerated change by enabling new asset management companies to start, gain scale, and shake up the investment industry. This rethink of asset management companies is |

| ↑4 | A list within a list?! I’m not sure if this is allowed, but with so many Buzzfeed employees laid off, someone has to step up on the internet superhighway and fill in the gap |

About the Author: Ryan Kirlin

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.