Tax-Managed Factor Strategies

- Lisa R. Goldberg , Pete Hand , and Taotao Cai

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

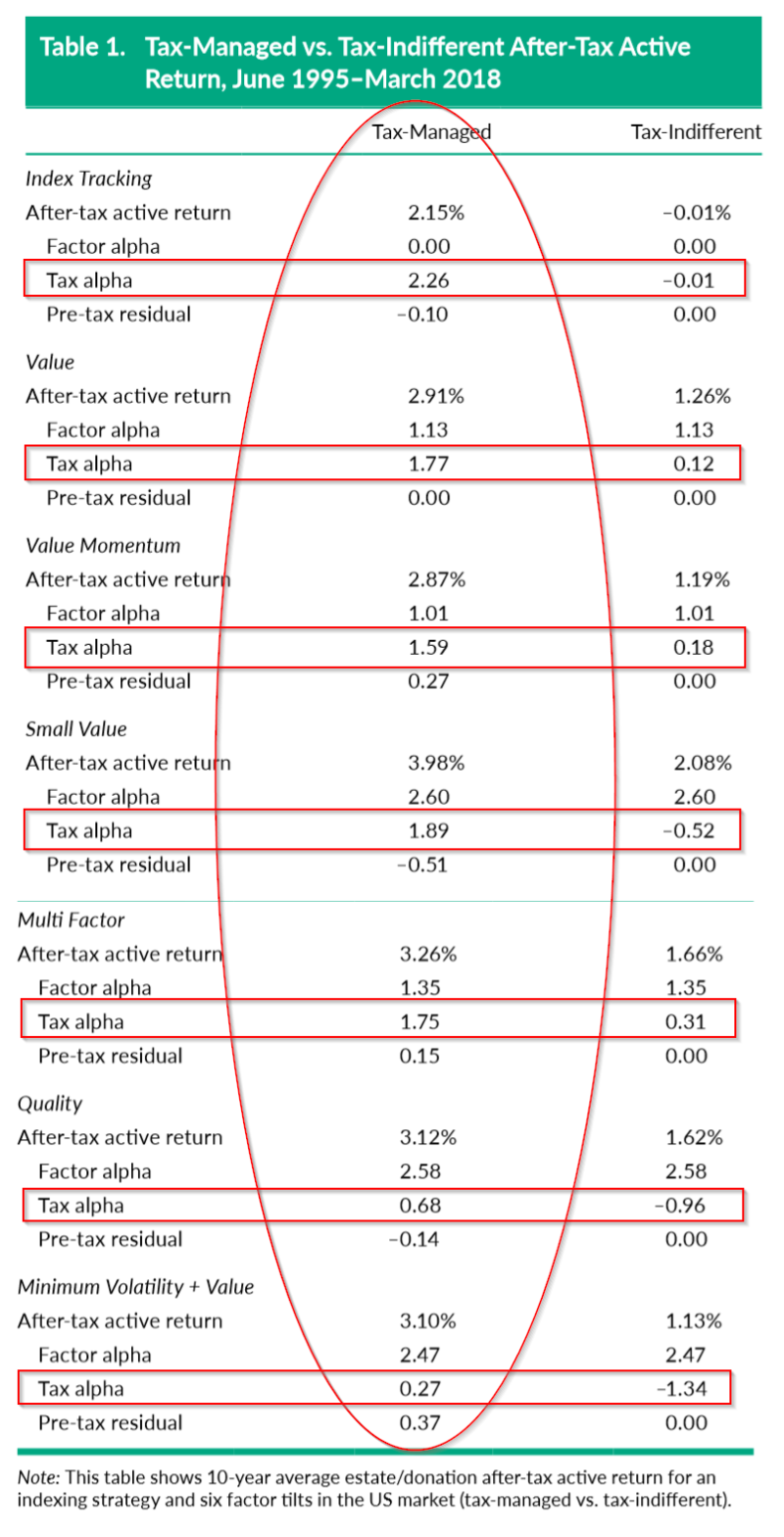

The authors decompose strategy returns into factor alpha, tax alpha, and residual return for 6 tax-managed versus and 6 tax-indifferent factor strategies and for one indexing strategy. In contrast to other studies, where the impact of starting date dependence is eliminated, this research generates a range of outcomes by initiating each strategy at regular intervals over a 10 year investment horizon. In this study, tax management refers to the combination of disciplined loss harvesting with a standard investment objective such as indexing or factor tilts.

- Does the typical loss harvesting approach increase after-tax active returns for the strategies considered?

- Is there value in tax loss harvesting relative to the incremental risk that it produces?

What are the Academic Insights?

- YES. The after-tax excess returns are presented in Table 1 below. For all strategies evaluated, the active returns were higher for the Tax-Managed strategies vs. the Tax-Indifferent strategies: Indexing higher by 2.16%, Value tilt higher by 1.65%, Value + Momentum tilt higher by 1.68%, Small-cap Value higher by 1.90%, Multifactor higher by 1.6%, Quality tilt higher by 1.5%, Min Volatility + Value tilt higher by 1.97%

- YES. Quite a bit. Additional Tracking Error (TE) for Value tilt was 18bps, additional TE for Value + Momentum tilt was 19bps, additional TE for Small Value tilt was 11bps, additional TE for Multifactor was 30 bps, additional TE for Quality tilt was 61bps, and 31bps for Min Volatility + Value tilt. The increases in alpha per unit of TE ranged from 2x to 17x depending on the strategy.

Why does it matter?

The predominant topic of research in the area of taxes and investing is concerned with tax-exempt investing while the objective of managers and wealth advisors remains the delivery of strong pre-tax returns. When the two are combined, investors are left with a dearth of attention paid to tax-management (loss harvesting) both in theory and in practice. This study advances the literature considerably on the value to be gained by adding tax loss harvesting to typical investment objectives such as indexing or factor tilting.

One caveat: The results of this study are directly supported by the assumptions inherent in the analysis: the value of tax loss harvesting is diminished by fees, liquidation and longer investment horizons; the value is enhanced with the existence of state taxes; and that the supply of short-term and long-term capital gains to be offset are adequate.

For different takes on tax loss harvesting, here is a piece by Maneesh Shanbhag and here is a piece by Larry Swedroe.

The most important chart from the paper

Abstract

We examine the tax efficiency of an indexing strategy and six factor tilts. Between June 1995 and March 2018, average value added by tax management exceeded 1.50% per year at a 10-year horizon for all the strategies we considered. Tax-managed factor tilts that are beta 1 to the market generated average tax alpha between 1.59% and 1.89% per year, while average tax alpha for the tax-managed indexing strategy was 2.26% per year. These remarkable results depend on the availability of short-term capital gains to offset. To a great extent, they can be attributed to loss harvesting and the tax rate differential.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.