Momentum in prices is the tendency of assets that have performed well recently (such as over the prior year) to outperform assets in the same asset class that have performed poorly over the prior year. For a more thorough review of momentum check out this post by Wes Gray. This phenomenon has been found to exist not only in stocks all around the globe, but in bonds, commodities, and currencies as well. Additionally, momentum has historically generated large, though highly volatile, returns, and it’s also subject to crashes.

The persistence and pervasiveness of the momentum anomaly in stocks led Nobel Prize-winner Professor Gene Fama to call momentum the greatest challenge to the efficient markets theory—it’s hard to construct a risk-based explanation (other than it is subject to crashes). With that said, as my co-author Andrew Berkin and I explain in our book “Your Complete Guide to Factor-Based Investing” the academic research has provided evidence of some possible risk-based explanations: momentum is stronger among stocks with large growth opportunities and risky cash flows and liquidity risk can explain at least part of the momentum phenomenon.

In his February 2015 NBER paper, “Fundamentally, Momentum is Fundamental Momentum,” Professor Robert Novy-Marx presented the evidence demonstrating that momentum in stock prices isn’t an independent anomaly. Instead, it’s driven by fundamental momentum—it’s “a weak expression of earnings momentum, reflecting the tendency of stocks that have recently announced strong earnings to outperform, going forward, stocks that have recently announced weak earnings.”(1) Novy-Marx also found that earnings momentum subsumes volatility managed momentum strategies. His findings are consistent with those of Shuoyuan He and Gans Narayanamoorthy, authors of the September 2017 study “Earnings Acceleration and Stock Returns.” They found that earnings acceleration is a significant predictor of future stock returns.

Is Fundamental Momentum Pervasive Across Asset Classes?

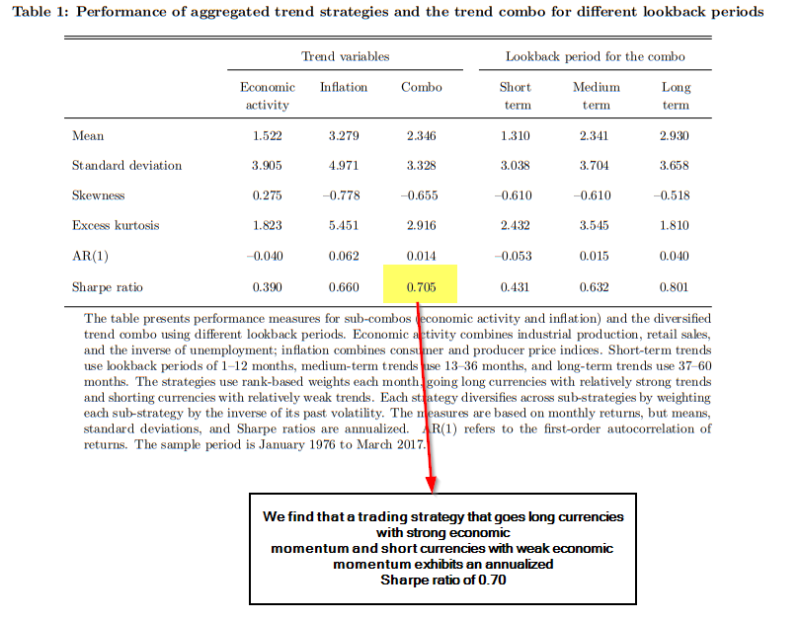

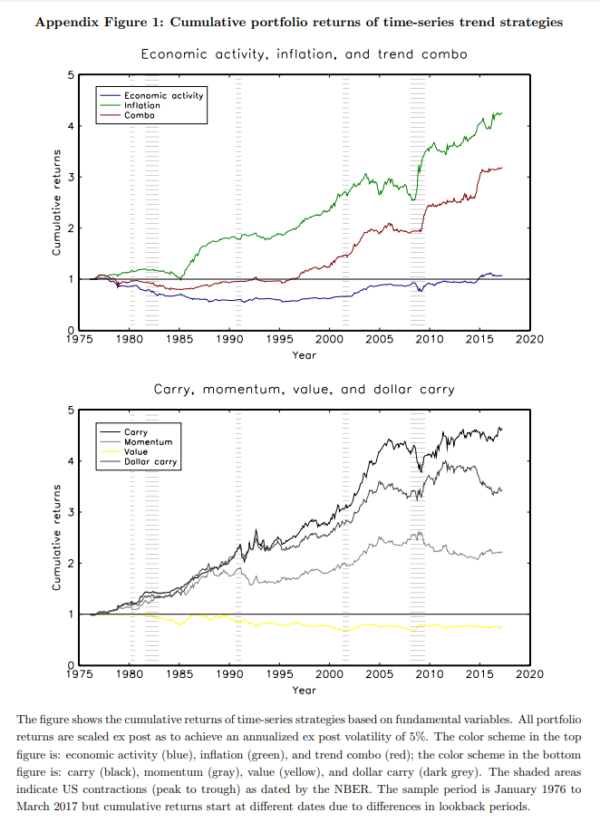

An interesting question is as follows: Do we have evidence of fundamental momentum in other asset classes? Magnus Dahlquist and Henrik Hasseltoft sought the answer to that question in their study “Economic Momentum and Currency Returns” which appears in the April 2020 issue of the Journal of Financial Economics. Their data sample covers the period January 1976 to March 2017, 21 developed markets, and a set of emerging markets. They used five fundamental variables: industrial production, retail sales, unemployment, consumer prices, and producer prices.

Following is a summary of their findings:

- Past trends in fundamentals linked to economic activity and inflation predict currency returns— countries that have experienced relatively strong (weak) economic trends in the past, their currencies are associated with high (low) expected returns.

- A trading strategy that goes long currencies with strong economic momentum and short currencies with weak economic momentum exhibits an annualized Sharpe ratio of 0.70 and yields a significant alpha when controlling for standard carry, momentum, and value (negative of the change in real exchange rates) strategies.

- Less than half of the average return to the economic momentum strategy is explained by common currency strategies (carry, momentum, and value).

- The economic momentum strategy subsumes the alpha of carry trades (the reverse is not true), suggesting that differences in past economic trends capture cross-country differences in carry—cross-country differences in interest rate differentials are captured by differences in past economic trends, where countries that rank high (low) in terms of carry are countries that experienced high (low) economic activity and inflation in the past.

- The cross-section of past economic trends significantly predicts excess returns up to a horizon of 12 months. While past trends in fundamentals all contain complementary information about expected returns, the strongest contribution to performance comes from long-term trends over the past three to five years. Long-term trends in fundamentals also most strongly capture the carry-trade alpha.

- The economic momentum strategy and the carry trade display different dynamics. For example, the portfolio weights for the economic momentum strategy and the carry trade have different signs 38% of the time, measured across currencies. Compared to the portfolio weights of the momentum and value strategies, the portfolio weights of the economic momentum strategy have different signs approximately 50% of the time. Hence, investing according to past trends in fundamentals seems to represent an additional source of returns to traditional momentum, carry and value strategies—there is a diversification benefit. When building a portfolio diversified across all four strategies, economic momentum carries the highest weight (45%).

- Traditional momentum strategies (based on the exchange rate) cannot explain the returns of the economic momentum strategy—price and economic momentum strategies are distinct.

- Past inflation predicts currency returns positively—likely caused by monetary policy responses.

- The data is robust to various subsets of countries, lookback periods, and methods of portfolio construction. In addition, at least for the developed market currencies, trading costs would have a limited impact on returns as the markets are highly liquid.

Conclusion

As research has shown with several financial instruments Dahlquist and Hasseltoft concluded: “Fundamentals do matter for exchange rates.” They suggested their findings result from changes to monetary policy. The process works as follows: Strong economic conditions and inflation in the past induce a tightening of monetary policy. Thus, countries with currently high (low) carry likely experienced positive (negative) past trends in economic fundamentals. “Cross-sectional carry can therefore be captured by relative trends in fundamentals, which explains why the alpha from carry trades is subsumed by the economic momentum strategy.”

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.