Trading out of sight: An analysis of cross-trading in mutual fund families

- Alexander Eisele, Tamara Nefedova, Gianpaolo Parise, Kim Peijnenburg,

- Journal of Financial Economics

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

As equity trading moves to less regulated markets and off of exchanges across the world, mutual fund families have increasingly taken advantage of this opportunity to reallocate trades. Fund families are able to offset opposite trades of their affiliated funds within an internal market referred to as “cross-trading” (CT). In theory, because we don’t observe it directly, cross-trades have the effect of reallocating performance between and among various funds. How does this reallocation occur? When coordinated at the fund family level, for example, funds can avoid liquidations at firesale prices—selling at full price internally; and through the discretionary ability to set a price beneficial to one “trader” at the expense of another—for example pricing a cross-trade at the highest bid price instead of the average bid/ask. There is little direct empirical evidence in the current literature because the data is not detailed in regulatory filings. As a result, research is handicapped by the fact that funds disclose their holdings at the end of the quarter without disclosing activity that occurs throughout the quarter. This research uses the ANcerno(1) database which includes 12 years of trade-level equity transactions from a large number of US mutual funds. It is the first study to identify and define cross-trades directly. The authors define a cross-trade as a mirror transaction that occurs within the same fund family; occurring in the same stock and in the same quantity; at the same minute of the same day at the same price, but traded in the opposite direction.

- Are cross-trades by mutual funds opportunistically priced?

- Can those cross-trades be mitigated by increased regulation and monitoring?

What are the Academic Insights?

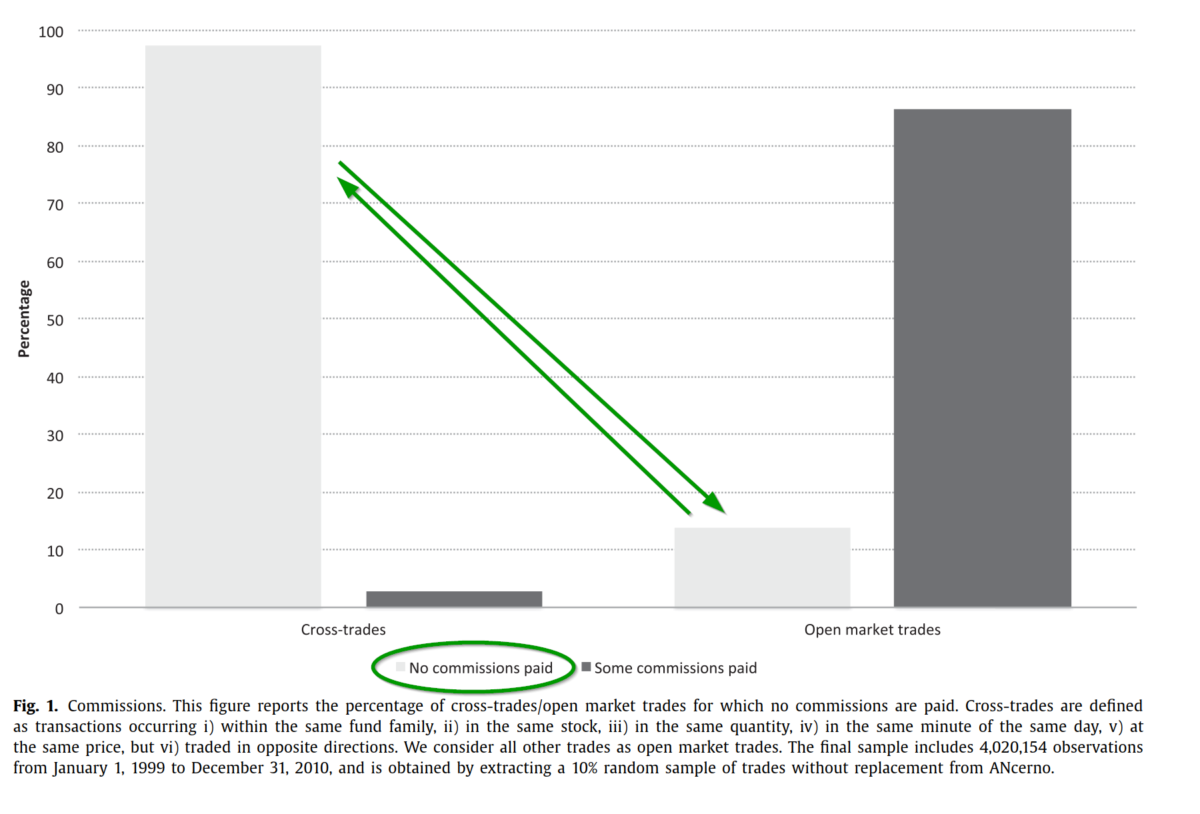

- YES. Figure 1 presented below, is descriptive of the potential for the strategic or opportunistic pricing of cross-trades. Stricter empirical tests confirm the hypothesis that if CTs are used to price opportunistically, then we should see higher effective spreads when compared to similar open exchange markets. The authors report that under conditions of minimal monitoring, CTs exhibited a 42 basis point spread higher than that of matching open market trades. Apparently, the execution prices of CTs deviate more from the mid-price than comparable transactions in public markets. In addition, the authors report that CTs are retroactively priced, set either to the highest or lowest price of the day. This type of backdating process permits the largest performance reallocation among the trading funds or other trading counterparties. The effect is 4 times more likely to be executed at the exact high or low daily price when compared to open exchanges, indicative of backdating to the point in time when the price move was at it’s most extreme. The authors report CTs are more likely to occur between funds with higher fees, funds with liquidity shortfalls, and with younger funds. The losing counterparties tend to be funds suffering persistent outflows. All in all, it seems that CTs do indeed reflect discretionary pricing that acts to reallocate performance from distressed funds to funds that are valuable in one way or another, or in need of liquidity relief.

- YES. When compliance and monitoring efforts are enhanced then the 42 bp spread drops to 3bps. It seems that fund families utilize CTs when monitoring is weak, while discretionary pricing effectively disappears with stronger monitoring policies.

Why does it matter?

This research provides insights into the regulatory debate on the implications of off exchange trading venues for investors. Asset managers argue that internal crossing reduces transaction costs, fire-sale impacts and liquidity constraints, thus a beneficial feature of off-exchange trading options. Regulators, while recognizing the dampening effect on costs of transactions and fire-sales, CTs that are not adequately monitored impose unfair penalties on some investors.

The most important chart from the paper

Abstract

This paper explores how mutual fund groups set the price of in-house transactions among affiliated funds. We collect a data set of four million equity transactions and compare the pricing of trades crossed internally (cross-trades) with that of twin trades executed with external counterparties. While cross-trades should reduce transaction costs for both trading parties, we find that the price of cross-trades is set strategically to reallocate performance among sibling funds. Furthermore, we provide evidence that a large number of cross-trades are backdated. We discuss the implications for the literature on fund performance and the current regulatory debate.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.