In this article, we examine the research on whether institutional ownership impacts investee companies’ carbon footprint (in terms of emissions and carbon intensity).

Institutional Investors and Corporate Carbon Footprint – Global Evidence

- Gianfranco Gianfrate, Tim Kievid and Angelo Nunari

- EdHec Risk Institute publication, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Most global institutional investors have now signed the United Nations’ Principle for Responsible Investments (UNPRI), committing to integrate ESG factors, including climate change, in their asset management operations. Disclosure of assets’ exposure to climate risks is emerging as a new practice with the growing diffusion of dedicated reporting frameworks such as the Task Force on Climate-Related Financial Disclosures (TCFD). Financial regulators, including central banks, are looking into ways to embed climatic change risks in their supervision and financial stability mandates.

In this context, the authors attempt to answer this research question:

Can institutional investors actually affect the extent to which investee companies deliver on the Paris Agreement goals?

What are the Academic Insights?

The quick answer is NO. The authors study to what extent institutional investors’ ownership affected corporate carbon emissions in 68 countries for the period of 2007 to 2018*. The sample is panel data of 6,392 firms from 68 countries between 2007 and 2018 on the impact of shareholders on their investees’ carbon-sales intensity.

They find:

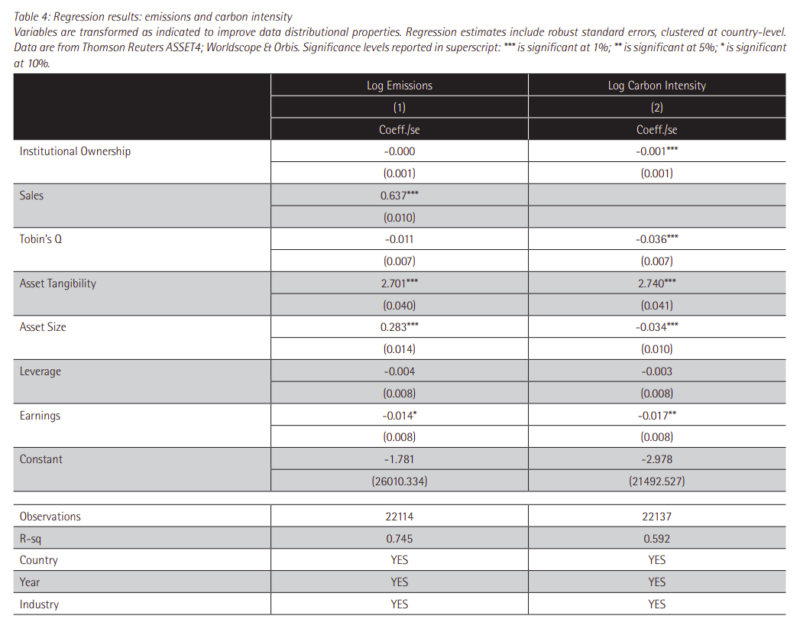

- Institutional investment, on average, does not appear to lead to a carbon footprint reduction. Specifically, the authors observe that the carbon intensity decreases by 0.1% for each 1% increase in ownership by institutional investors.

- However, institutional investors are associated with a limited reduction of carbon footprint for the highest polluters in the sample. Specifically, in the quartile of “heavy polluters”, it is possible to see that the coefficient is negative and significant for both the dependent variables used in this research piece. Concerning the emissions, the coefficient (– 0.006) suggests that for each 1% when carbon intensity is considered, the effect is smaller in magnitude but still statistically significant; an increase of 1% in institutional ownership determines a carbon intensity reduction of 0.4%.

- Thus, responsible investors can help the decarbonization of investors but are unlikely to play a major role in the low-carbon transition unless their active ownership becomes more effective.

*The authors obtain the portion of the 2018 survey to the signatories of the United Nations’ Principle for Responsible Investments (UNPRI) reporting their dealings with climate change risks and opportunities. The survey respondents have accumulated Assets under Management (AuM) of about 71 trillion USD. According to some estimates, the global AUM of such investors is about 79 trillion USD globally, so the survey can be considered fairly representative (about 90% of the world’s total).

Why does it matter?

This study is an important contribution because it helps shed light on investors’ limited impact on climate change.

The Most Important Chart from the Paper:

Abstract

Climate-aware institutional investors are assumed to affect the transition towards a low carbon economy by exercising their prerogatives as owners of global companies. Investors concerned with climate change can influence investee companies’ carbon footprint by voting at shareholder meetings on climate-related issues and by actively engaging with executives and board members. This paper studies to what extent institutional investors’ ownership affected corporate carbon emissions in 68 countries for the period of 2007 to 2018. Results show that institutional investment on average does not appear to lead to a carbon footprint reduction. However, institutional investors are associated with a limited reduction of carbon footprint for the highest polluters in the sample. These results suggest that climate-driven responsible investors can complement but not substitute national and international climate policies.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.