This paper explores several key aspects related to household consumption behavior during the Great Financial Crisis of 2008-2009, with a focus on the impact of salient adverse macroeconomic announcements.

Spending Less After (Seemingly) Bad News

- Garmaise, Levi and Lustig

- Journal of Finance, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The research questions are as follows:

- What are the primary factors contributing to the steep and persistent decline in U.S. consumption growth during the Great Financial Crisis of 2008-2009?

- How does the salience of adverse macroeconomic announcements affect household consumption behavior?

What are the Academic Insights?

The data cover 9,664,860 unique consumers drawn from all 50 U.S. states and the District of Columbia over the period Jan. 1, 2012- Dec. 18, 2018. By analyzing data on the spending of U.S. consumers drawn from information on credit card and bank account transactions compiled by an online account aggregator, the authors find:

- There are four factors. 1) Binding Financial Constraints. Many households faced tighter credit conditions and reduced access to borrowing, which limited their ability to smooth consumption over time. As credit markets froze and lending standards tightened, consumers were unable to finance their spending through debt, leading to a significant drop in consumption. 2) Wealth Effects. The sharp decline in asset values, particularly housing and stock market wealth, reduced household wealth and, consequently, their spending. The decrease in house prices and the resultant loss of home equity particularly affected households’ consumption as they felt poorer and more constrained financially. 3) Downward Revisions of Expected Future Income Growth. As the economic outlook worsened, households revised their expectations about future income growth downward. This pessimistic view about future earnings led to a reduction in current consumption as households anticipated tougher economic conditions ahead. 4) Increased Uncertainty. The crisis brought about significant economic uncertainty, including uncertainty about job security and future income. According to standard economic theory, an increase in uncertainty leads to precautionary saving, where households cut back on current spending to build a financial buffer against potential future income shocks.

- The salience of adverse macroeconomic announcements affects household consumption behavior with

- An Immediate Reduction in Discretionary Spending:

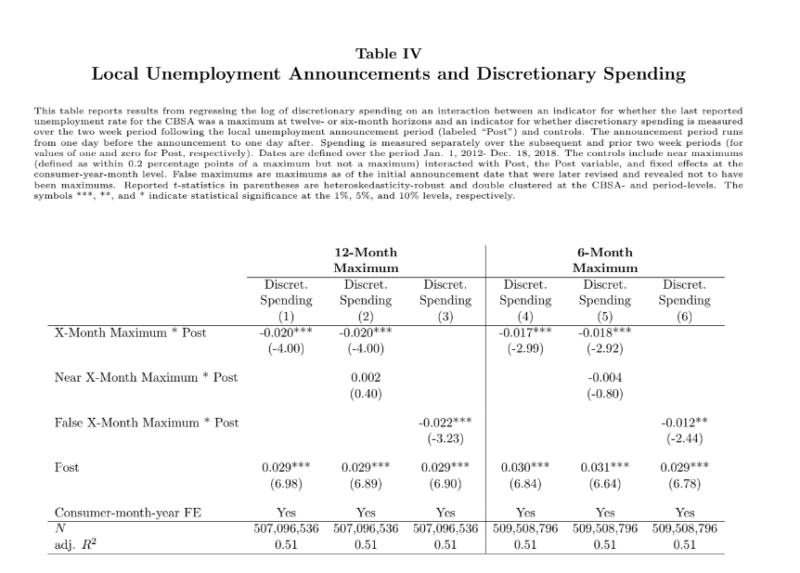

- Households tend to cut back on discretionary spending in response to salient negative economic news. For example, an announcement of a new local maximum unemployment rate leads to a measurable drop in discretionary spending within the affected area. The study mentioned finds a 2% reduction in discretionary spending in the two weeks following such an announcement.

- A Behavioral Response Irrespective of Actual Economic Fundamentals:

- The response to salient news occurs even if the news does not reflect changes in local economic fundamentals. This suggests that the perceived economic environment, influenced by salient announcements, can drive consumption behavior independently of the actual economic conditions.

- Persistent Consumption Decline:

- The reduction in spending is not just immediate but can also be persistent. Areas experiencing repeated maximum unemployment announcements see a cumulative effect on consumption, with spending declines persisting for months after the initial announcement. A single maximum announcement can lower future discretionary spending for up to four months, and areas with a sequence of such announcements face even more significant declines.

- Impact on Financial Behavior:

- Salient negative announcements also affect financial behaviors. For instance, households reduce their credit card repayments by 3.6% following a maximum unemployment announcement. This behavior indicates that households are drawing down their existing credit lines and are less likely to take on new loans, reflecting an increase in perceived financial constraints.

- An Immediate Reduction in Discretionary Spending:

Why does this study matter?

This study is important because it provides evidence that household consumption behavior deviates from the predictions of standard intertemporal optimization models, such as the permanent income hypothesis and the complete markets model. These models assume that households smooth consumption over time based on their expected lifetime income, but the observed excess sensitivity to salient news challenges this assumption. Understanding these deviations is crucial for improving economic models and theories. Additionally, the findings highlight the significant role of consumer sentiment and behavioral responses to salient news in driving consumption patterns. This insight is vital for economists and policymakers to understand how psychological and emotional factors influence economic decisions, beyond purely rational calculations based on fundamentals.

The Most Important Chart from the Paper:

Abstract

We show that household consumption displays excess sensitivity to salient macro-economic news, even when the news is not real. When the announced local unemployment rate reaches a 12-month maximum, local consumers in that area reduce discretionary spending by 2% relative to consumers in areas with the same macro-economic fundamentals. The consumption of low-income households displays greater excess sensitivity to salience. The decrease in spending is not reversed in subsequent months; instead, negative news persistently reduces future spending for two to four months. Announcements of 12-month unemployment maximums also lead consumers to reduce their credit card repayments by 3.6%. Households in treated areas act as if they are more financially constrained than those in untreated areas with the same fundamentals.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.