When individuals try to understand or explain an event, they sometimes employ “frames,” which are interpretive structures or filters that help them make sense of the world around them. The use of frames is a heuristic, or shortcut, that provides an easy way to rapidly process information, and thus may be an evolutionarily adaptive trait since it allows humans to efficiently make judgments and choices while conserving scarce cognitive resources. Similar to a picture frame, which can influence one’s perspective on a painting, a cognitive frame can affect our perceptions in many ways since it introduces parameters and constraints. What has been of particular interest to psychologists and economists is that specific perspectives, or frames, can have a significant impact on the choices we make.

Amos Tversky and Daniel Kahneman famously described a basic framing effect via the presentation of two problems, with different frames.

Problem 1

If Program A is adopted, 200 people will be saved. (72 percent)

If Program B is adopted, there is a 1/3 probability that 600 people will be saved, and a 2/3 probability that no people will be saved. (28 percent)

Problem 2

If Program C is adopted 400 people will die. (22 percent)

If Program D is adopted there is a 1/3 probability that nobody will die, and 2/3 probability that 600 people will die. (78 percent)

In Problem 1, most people (72 percent) prefer the certainty of saving people and are thus averse to taking risk. Even though Programs A and B have identical expected values, the majority of people chose to avoid a chance that no one would be saved. In Problem 2, again with identical expected values, the majority this time is risk seeking, in that most people want to avoid the certainty of 400 people dying. Note that the problems are effectively identical; it was simply the framing of the problems (stated in terms of the certainties of people being saved, or of people dying) that determined whether respondents were risk seeking or risk averse.

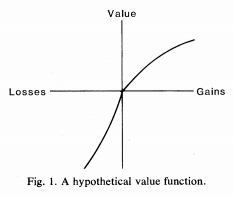

Tversky and Kahneman found that, in general, choices involving gains are risk averse, and choices involving losses are risk seeking. Furthermore, subsequent research indicated that the principle of this asymmetry of subjective values carried over into finance, and that the pain of losing a sum of money is greater than the pleasure of winning the same amount. These ideas formed the basis of “prospect theory,” so named because when individuals attempt to assess the outcome of a prospect, their judgments are shaped not by rational expected utility, but by the value function below:

The implications of this function are profound. It suggests that the way something is framed could cause you to do things that you otherwise would not do. For example, prospect theory has shown that people often rely on a single, “narrow” frame, even when evaluating outcomes with multiple prospects. Relying on one frame is dangerous. You want multiple, “broad” frames so that you get a richer perspective that better represents reality, and insulates you from biases associated with the value function above. It turns out that isolating choices in such narrow frames leads to worse choices.

A common issue involving investing and frames is the act of managing a portfolio. Studies have shown that investors who “broadly” frame investing decisions as portfolio-level decisions, rather than “narrowly” framing them as independent choices about individual stocks, demonstrate trading activity that is clustered around given points. With more clustered trading, investors are making multiple simultaneous integrated portfolio-level decisions, leading to less risky, more diversified portfolios. Moreover, narrow framers who focus on individual stock decisions, often exhibit the “disposition effect,” a well-documented observation that investors are more willing to sell winners in their portfolio, but tend to hold on to losers. The disposition effect imposes substantial costs on investors, who may, for example, pay more capital gains taxes than necessary.

How can you avoid the pernicious effects of narrow framing of your investment choices, including suboptimal diversification and the disposition effect? Simple. Maximize your wealth by relying on Turnkey Analyst, which can reduce your trading activity to a just a few clusters of trades per year.

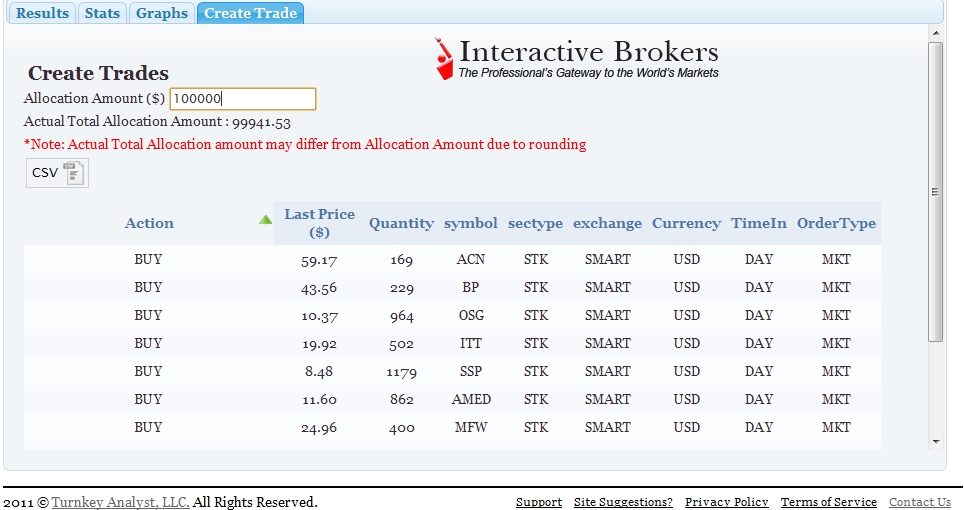

For example, consider the hypothetical $100,000 trade associated with our long term E/P equity screen, created below using the “Create Trade” button:

Note that Turnkey Analyst has done all the analytical work for you. You have price, quantity, and ticker symbol for each stock in your quarterly rebalancing trade. All you have to do is export the trades and execute them in Interactive Brokers or your favorite brokerage account. Rebalance quarterly or annually.

The framing effect is yet another behavioral bias that can trip you up and have significant effects on your portfolio. Turnkey Analyst offers you the tools that enable one to break free from innate human biases, and create superior risk-adjusted portfolios.

All it takes is the will to get started.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.