QE forever certainly makes me think that I should put my entire net worth (all $5 dollars in my piggy bank) into gold bars.

Q: Who would own treasury bonds at 2.7% when the Fed is printing money forever?

A: Japanese investors faced with QE forever.

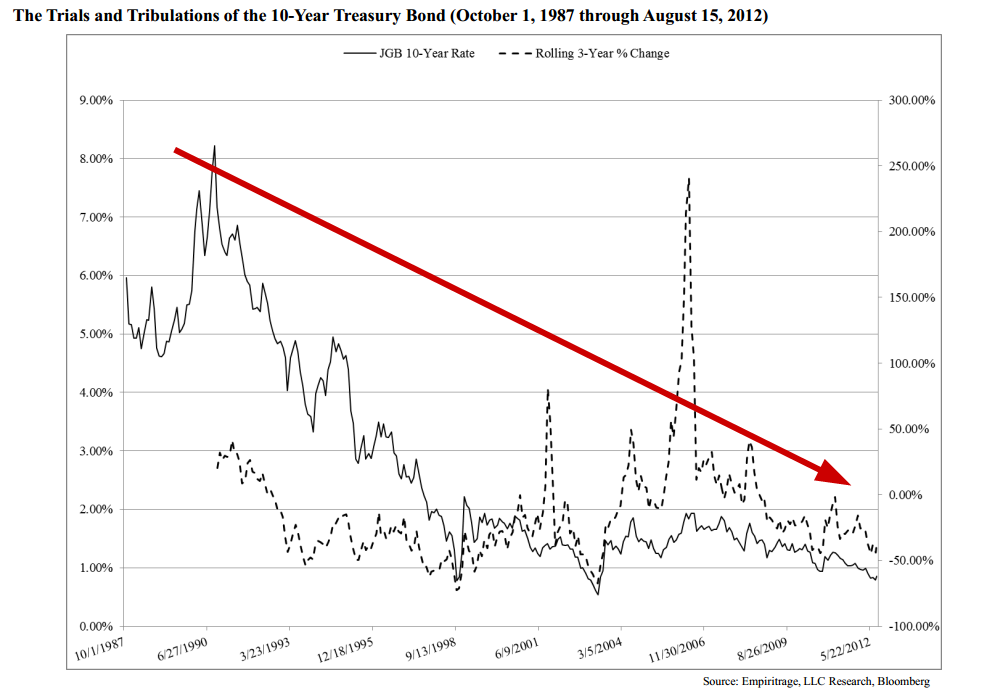

Here’s a chart of the infamous JGB. The graveyard for hedge fund managers who decided that fighting a massive government was sensible.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

But Treasury bonds are a terrible investment, right?

The Japanese Government Bond hit 1.80% in April of 1998. The government was engaging in QE forever, but it was a failed monetary policy, as despite repeated efforts to break the deflationary cycle, consumption and investment remained weak and the economy remained stagnant (sound familiar?).

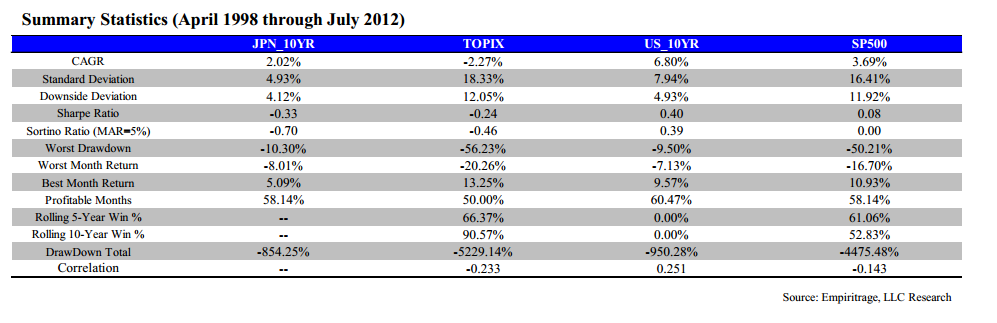

Over the next 14+ years the bond returned a meager 2.02% compound annual growth rate, but with a 10.30% maximum drawdown. Not spectacular.

BUT…

The S&P 500 returned 3.69% CAGR with a 50.2% maximum drawdown; the TOPIX index churned a -2.27% CAGR and 56.23% maximum drawdown. FUGLY!

[click to enlarge] The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Yeah, but this time is different, right?

Possibly, but you simply never know. And the Japanese experience has taught us that “logic”–i.e., how can a government print massive amounts of money and not create insane inflation and run-away bond yields?– doesn’t always equate to knowledge. During the 1990s, Japan’s ZIRP had never before been tried on such a scale, yet in hindsight it was arguably too timid. Additionally, there was debate about whether in a sustained deflationary environment policy rates of zero could even be effective. The intersection of macroeconomics, animal spirits, and deflation/depression economics are impossible to pinpoint in my mind. I will admit ZERO confidence on any prediction in this space.

And what asset can take on trillions when the proverbial sh$% hits the fan?

- Stock markets? Nope, they blew up, who wants to own them?

- Emerging markets? Nope, they blew up and everyone wants USD.

- Gold? Nope, not enough capacity and not enough liquidity.

- The US Treasury? Yep, liquid, massive, and backed by the country that has solid contract law, respects property rights, and sits on massive resources. Yes, we aren’t perfect BY A LONG SHOT, but which country in the world (with trillion$+ size) is even close when you really think about it?

QE forever really strains the brain.

On one hand, it seems inevitable that printing money forever cannot be sustainable and hyper-inflation is right around the corner.

On the other hand, the Japanese experience and the US Great Depression highlight the importance of understanding the counter-intuitive nature of zero-interest rate deflationary macroeconomic situations.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.