Uncle Sam and affiliates have the greatest fee structure in the world:

- 23.8% to 43.40%+ carried interest, or a “performance” fee on all positive performance:

- Congrats on your market gains…pay up…

- No hurdle rates:

- Inflation of 50% a year?…who cares…pay up…

- Minimal clawback provisions (capital losses are limited against income):

- Congrats on your massive losses. You can shield 3k income, otherwise…pay up…

- An ability to adjust fees on the fly and at the whims of the public (mostly higher):

- We spent too much of other people’s money. We’re raising our fee…pay up…

- No real high water mark:

- I gained $1,000,000 in 1999, paid $500,000 to Uncle Sam. Lost $1,000,000 in 2002–Uncle Sam can I have my $ back? …pay up…

- Uncle Sam can’t get fired:

- Unless there is an act of Congress…literally…pay up…

Most folks are negotiating with their hedge fund providers to lower costs:

“2/20? I’ll pay 1/10. Actually, scratch that…how about 25bps? Your performance has stunk for 5 years…”

The opposite case holds for Uncle Sam–HE IS RAISING HIS PERFORMANCE FEE!!!

“15% performance fee? How about 23.8%? Scratch that. How about 50%+? That works better for me.”

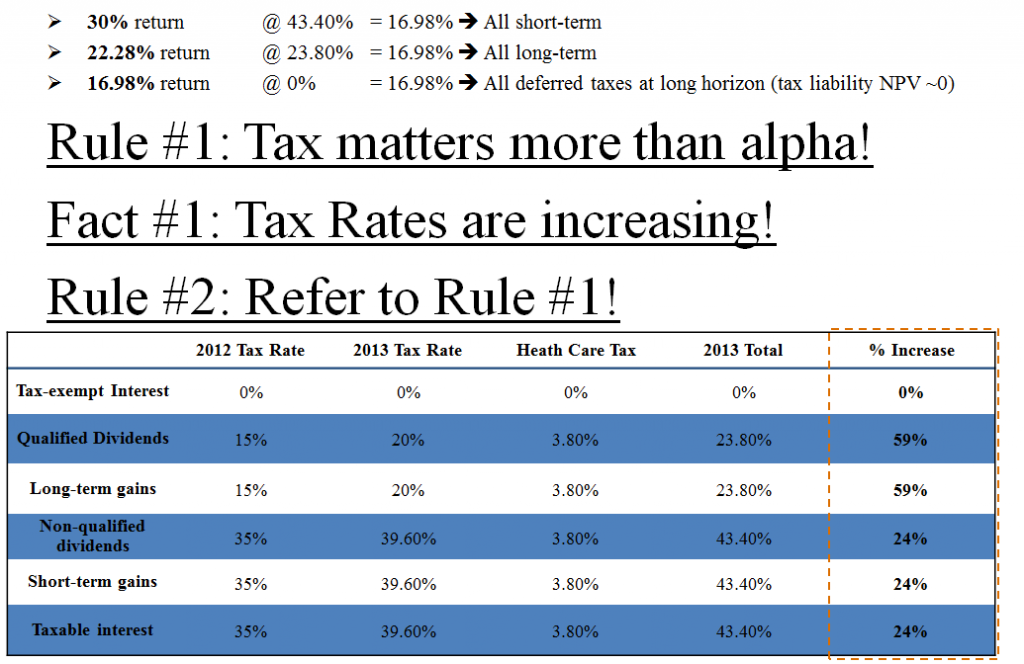

See the graphic below, which highlights why taxes matter and how tax rates have increased.

In the end, Uncle Sam is a lot like Michael Jordan:

As with Jordan, you can’t stop Uncle Sam, you can only hope to contain him.

How do we contain Uncle Sam from imposing his onerous hedge fund fee structure on our investments?

Choose the Right Investment Vehicle!

Any vehicle is tax-advantaged when talking about buy and hold forever passive index (i.e., S&P 500 index Mutual Fund vs. S&P 500 index ETF).

- ==>lesson learned: avoid transacting.

The real tax advantage shines when we start talking about more actively traded strategies that don’t buy and hold forever.

This is where ETFs come in to the picture.

The key piece of the puzzle involves the in-kind redemption process and how ETFs transact in the underlying securities.

- ==>lesson learned: use ETFs for strategies that aren’t buy and hold forever.

One doesn’t need to truly understand the ETF in-kind process to appreciate the benefits–they simply need to look at the evidence…

Review the capital gains distribution for ETFs in the marketplace. You’ll notice they are approximately ZERO.

An article from ETF.com summarizes the empirical evidence nicely:

iShares, the world’s largest ETF provider, said it expects to have capital gains distributions on five of its 280 U.S.-listed ETFs before the end of the year, with all of the funds with tax consequences focused on the fixed-income space.

5/280, or 1.7% paid capital gains. Enough said.

Here are 7 articles/videos explaining the tax efficiency of ETFs compared to Mutual Funds:

Here is our explanation of the topic, where we explain how this affects after-tax returns.

Other Containment Strategies

Some other structures to help contain Uncle Sam:

- Insurance wrappers (life insurance, annuities, etc.)

- Installment sales

- Tax-deferred accounts (IRA, 401k, 403b, etc)

- High depreciation/depletion up-front, tax-deferred assets (Real estate, resources, etc)

- Build your own business

- Deferred compensation

- Conservation easements

- Structured bank products

- Bank swaps

- Trust structures

- Farm/Ranch

- Anything that minimizes W2 income

If you aren’t containing Uncle Sam, you will be paying Uncle Sam…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.