What Matters to Individual Investors? Evidence from the Horse’s Mouth

- James Choi and Adriana Robertson

- Journal of Finance, 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Finance literature is abundant with theories. As academics, we like to think these theories foster behaviors and choices by investors, which in turn translate into asset prices. To test these theories, scholars typically try to infer the validity of these assumptions by examining outcomes. The authors in this study follow a different and more direct approach: they survey a nationally representative sample of 1,098 U.S. individuals in the RAND American Life Panel to find out how well leading academic theories describe the way they decided:

- What fraction of their portfolio to invest in equities,

- Their beliefs about actively managed mutual funds,

- and their beliefs about the cross-section of individual stock returns.

What are the Academic Insights?

The authors find:

- EQUITY SHARE OF PORTFOLIO:

- 48% of employed respondents say that the amount of time left until their retirement is a very or extremely important factor in determining the current percentage of their investible financial assets held in stocks, and 36% of all respondents say the same about the amount of time left until a significant non-retirement expense.

- Health risk (47% of all respondents), labor income risk (42% of employed respondents), and home value risk (29% of homeowners) are frequently rated as very or extremely important.

- Lack of knowledge about how to invest (36% of all respondents), and lack of a trustworthy adviser (31% of all respondents).

- Needing to have enough cash on hand to pay for routine expenses (47% of all respondents) and concern that stocks take too long to convert to cash in an emergency (29% of all respondents).

- Personal experience of living through stock market returns and personal experience investing in the stock market are rated as very or extremely important by 27% and 26% of respondents.

- Concern about economic disasters as a very or extremely important factor (45% of all respondents).

Although many factors ( out of 34 in the survey) appear to determine portfolio equity shares, only six principal components explain 54% of the variance in whether they were rated as very or extremely important. These components can be roughly interpreted as corresponding to neoclassical asset pricing factors: return predictability and retirement savings plan defaults; consumption needs, habit, and human capital; discomfort with the market; advice; and personal experience.

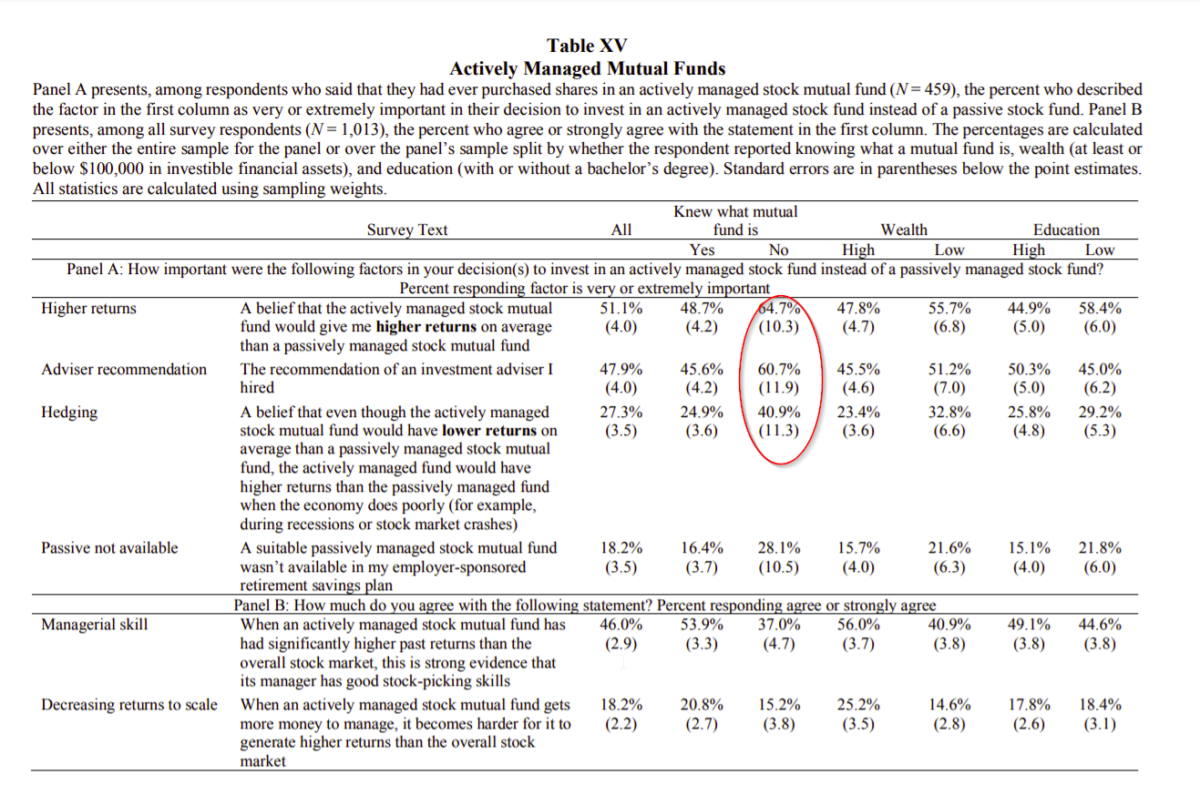

2. ACTIVE MANAGEMENT:

- The belief that the active fund would give them a higher average return than a passive fund (51% of those who purchased an active fund)

- The recommendation of an adviser (48% of active investors).

- A fund having outperformed the market in the past (46% of active investors).

- A hedging motive—the belief that the active fund would have lower unconditional expected returns than the passive fund but higher returns when the economy does poorly (27% of active investors).

- Personal experience of living through stock market returns and personal experience investing in the stock market are rated as very or extremely important by 27% and 26% of respondents.

- Concern about economic disasters as a very or extremely important factor (45% of all respondents).

3. CROSS SECTION OF INDIVIDUAL RETURNS:

- Not consistent with historical data, 28% of respondents expect value stocks to normally have lower expected returns than growth stocks, a proportion not statistically distinguishable from the 25% who believe the reverse.

- Consistent with historical data, more respondents (24%) expect high-momentum stocks to normally have higher expected returns than low-momentum stocks instead of the reverse (14%)

- 44% percent expect value stocks to normally be less risky than growth stocks, while only 14% believe the opposite.

- 25% percent expect high-momentum stocks to normally be riskier, while 14% expect them to be less risky.

Why does it matter?

Despite the fact that survey methodologies can of course have weaknesses such as survey respondents might not be highly motivated to give accurate responses and the meaning of each response category (e.g., “very important”) probably differs across respondents, the ordinal ranking of importance and agreement ratings is informative.

The Most Important Chart from the Paper:

Abstract

We survey a representative sample of U.S. individuals about how well leading academic theories describe their financial beliefs and decisions. We find substantial support for many factors hypothesized to affect portfolio equity share, particularly background risk, investment horizon, rare disasters, transactional factors, and fixed costs of stock market participation. Individuals tend to believe that past mutual fund performance is a good signal of stock‐picking skill, actively managed funds do not suffer from diseconomies of scale, value stocks are safer and do not have higher expected returns, and high‐momentum stocks are riskier and do have higher expected returns.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.