Are you trying too hard? Does the Stock Market Fully Value Intangibles? Employee Satisfaction and Equity Prices.

- Alex Edmans

- A version of the paper can be found here.

- Related research reports from UBS can be found here and here.

- Live implementation data can be found at Empirical Finance Data™ (Expected Q2 2011)

Abstract:

This paper analyzes the relationship between employee satisfaction and long-run stock returns. A value-weighted portfolio of the “100 Best Companies to Work For in America” earned an annual four-factor alpha of 3.5% from 1984-2009, and 2.1% above industry benchmarks. The results are robust to controls for firm characteristics, different weighting methodologies and the removal of outliers. The Best Companies also exhibited significantly more positive earnings surprises and announcement returns. These findings have three main implications. First, consistent with human capital-centered theories of the firm, employee satisfaction is positively correlated with shareholder returns and need not represent managerial slack. Second, the stock market does not fully value intangibles, even when independently verified by a highly public survey on large firms. Third, certain socially responsible investing (SRI) screens may improve investment returns.

Data Sources:

The authors examine all non-financial U.S stocks listed on NYSE/AMEX/NASDAQ from June, 30th 1968 through June, 30th 2007. To be included in the analysis companies must have stock return data from CRSP and total assets data from Compustat. The authors also require that firms be listed on Compustat for two years to be in the sample.

Discussion:

People way smarter than us have been debating the role of corporations in society for a long time. One of the more interesting and storied debates is between Milton Friedman and John Mackey. The link to the debate is here.

Admitting my bias up front, I agree with Friedman’s underlying thesis that corporations should focus on maximizing profits in order to best serve society (this is under the assumption that government creates regulations to ensure the costs of any negative externalities are incorporated into the firm’s cost/benefit analysis). Mental midgets will claim that this view is cold-hearted and evil, but that is simply due to a lack of insight–we can’t cure that problem.

So, given that corporations should maximize profits, a knee-jerk reaction is that profit maximizing firms should invest the bare minimum amount of resources in employees to accomplish the mission. Paying for day-care, paid-vacations, health-care, gym memberships, lunch, etc. doesn’t increase the amount of widgets an employee can produce, so it therefore takes away from profits. Why would someone concerned about the bottom line engage in any activity that “wastes” money on employees?

Well, here is a chart of Google’s stock going from ~100 to $570 in 7 years:

Maybe there is something to this concept of taking care of your employees.

Edmans outlines a few arguments of why employee satisfaction matters:

- Having happy employees increases motivation: Why would you slack when you have a job that totally rocks? Also, if you appreciate the fact your firm takes care of you, you may put in the extra effort to help the “team.”

- Retention: happy employees want to stick around.

- Recruiting: Google probably has a lot easier time recruiting employees than Joe’s Sweat-shop factory.

In the end, the question of whether spending money on employee satisfaction is a “waste” of money is an empirical question that is very difficult to address. The reason the question is difficult to address is due to the fact a researcher cannot assess ALL options available to a firm at a point in time. For example, pretend Google had 3 options pre-IPO: 1) invest $10B in employee satisfaction, 2) invest the current amount in employee satisfaction, or 3) cut current employee satisfaction. Because we cannot run a controlled experiment that allows Google to venture down all 3 paths simultaneously, it is difficult to assess whether option 1, 2, or 3 was value maximizing–it certainly looks like option 2 worked out, but maybe if they did option 1 or 3 the stock price would have been at $1000/share.

Unfortunately, stock price observation merely helps us understand how the market prices employee satisfaction investments (overvalues, undervalues, or efficiently prices the information), but it is empirically difficult to assess whether or not employee satisfaction investments are “value-maximizing.”

So while this paper can’t answer the $64,000 question of “what amount of investment in employee satisfaction is optimal,” this paper does do a great job examining whether or not the market prices a firm’s investment in employee satisfaction appropriately.

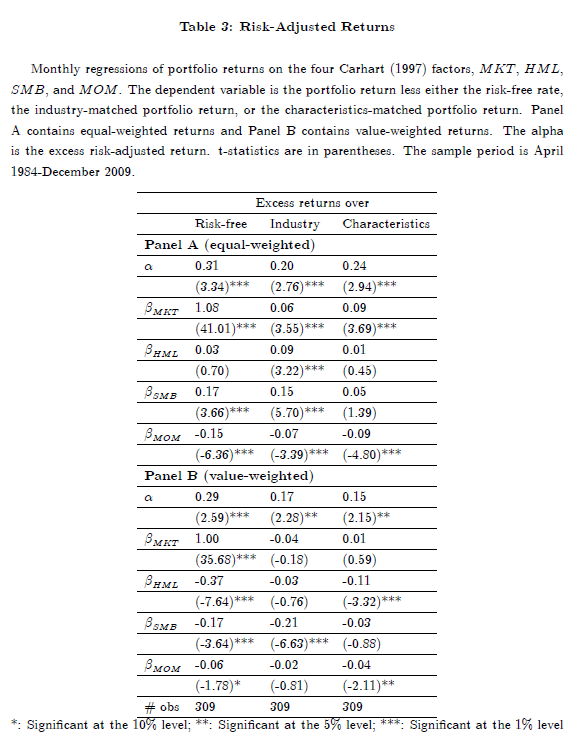

Edmans collects data on the list of the “100 Best Companies to Work for in America” each year from 1984-2009 and does the backtest to see how these companies perform over the long haul. The results are in Table 3.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Investing in employee satisfaction appears to be undervalued by the market. After controlling for a variety of risk factors and industry returns, companies with highly satisfied employees–firms that “waste” a lot of time and effort keeping their employees happy–outperform by 2.1% a year (take the 17bp monthly alpha estimate in panel B and multiply by 12)!

Edmans provides a battery of very insightful tests to make his basic point: investing in human capital is undervalued by the market, on average.

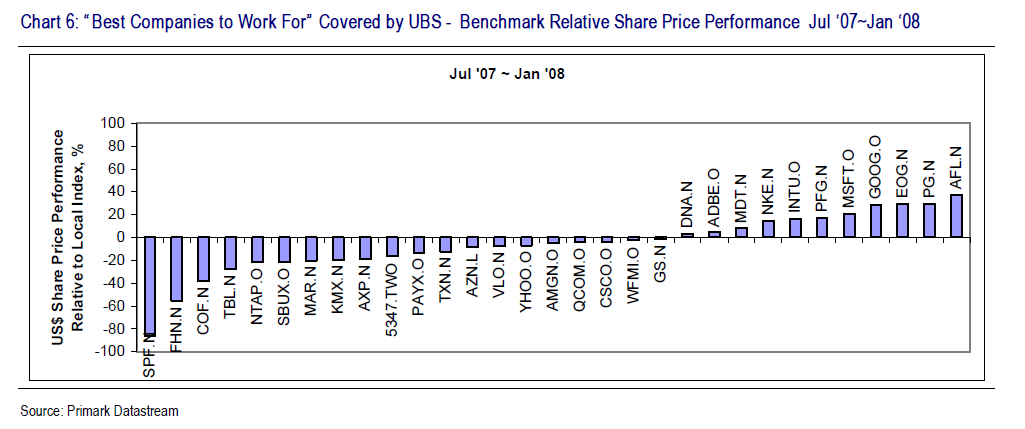

As an ad-hoc robustness test, UBS looks at the performance of 31 firms in the 2007 “100 Best Companies to Work For” list that also happen to be covered by UBS. The authors look at how these stock perform over the July 07′-’08 period. The results don’t look good for the “investing in employee satisfaction is undervalued by the market” hypothesis.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

A few caveats on this somewhat shoddy analysis:

- The authors are only looking at the companies covered in the UBS universe–perhaps their results are not reflective of the entire universe of ‘high employee satisfaction firms’, but rather, these results show that stocks covered by UBS create negative alpha–whoops…UBS might want to rethink publishing these results.

- The “relative performance” aspect of this study is not at the same rigor as that done in the Edmans study. The authors look at “relative index” performance–What index? Were there controls for industry? Size? etc?

So what are we to conclude from this research?

First, a quick side note. My first “real” dive into academic research (11+ years ago) was working under the guidance of Chris Geczy on his paper “Investing in Socially Responsible Mutual Funds.” If you don’t believe me, read the acknowledgements at the bottom of the first page.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

After hand collecting a bunch of data and running a lot of numbers through Matlab, I was convinced at an early age that any socially responsible type investment screen would lead to under performance.

I have now come full circle–to a certain extent…

The evidence in this paper suggests that companies who invest in their human capital, outperform because the market is unable to efficiently incorporate this information into stock prices. And while the alpha is not astounding, the main point is it isn’t negative like previous research would suggest.

Investment Strategy:

- Identify the 100 best companies to work for at http://money.cnn.com/magazines/fortune/bestcompanies/2011/index.html

- Go long firms that “waste” money on employee satisfaction.

- The “wasted” money on employee satisfaction will lead to more earnings announcement surprises (see Table 8 in the paper)

- Outperform.

Commentary:

The benefits of investing in human capital are probably concentrated in industries where human capital is a large component of the business (Google, IBM, MSFT, etc.). Logic would dicate that trading strategies based on employee satisfaction should focus in human capital intensive industries. I would be suspect of any study or economist that suggested a manager should invest heavily in employee satisfaction, when the business exclusively on large fixed-cost capital infrastructure–all else equal, does a manager invest an extra dollar in his widget machine or the easily replaceable guy who pulls the handle on the widget machine? My guess is the marginal dollar should go towards maintaining the capital, and not the labor component, but I guess that is up for discussion.

Unlike the papers we typically review, the “alpha” associated with this strategy is relatively unexciting, however, if your clients want you to invest in “socially responsible ways,” focusing on high employee satisfaction firms may give you a leg up in the battle to outperform. And heck, you’ll actually feel good about doing it!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.