There is a lot of chatter regarding market valuations. Many commentators are very confident that market is overpriced. Overconfidence can be dangerous.

In the words of Twain:

It’s not what you don’t know that kills you, it’s what you know for sure that ain’t true.

Based on the evidence, it is unclear to me that the market is terribly overvalued or undervalued.

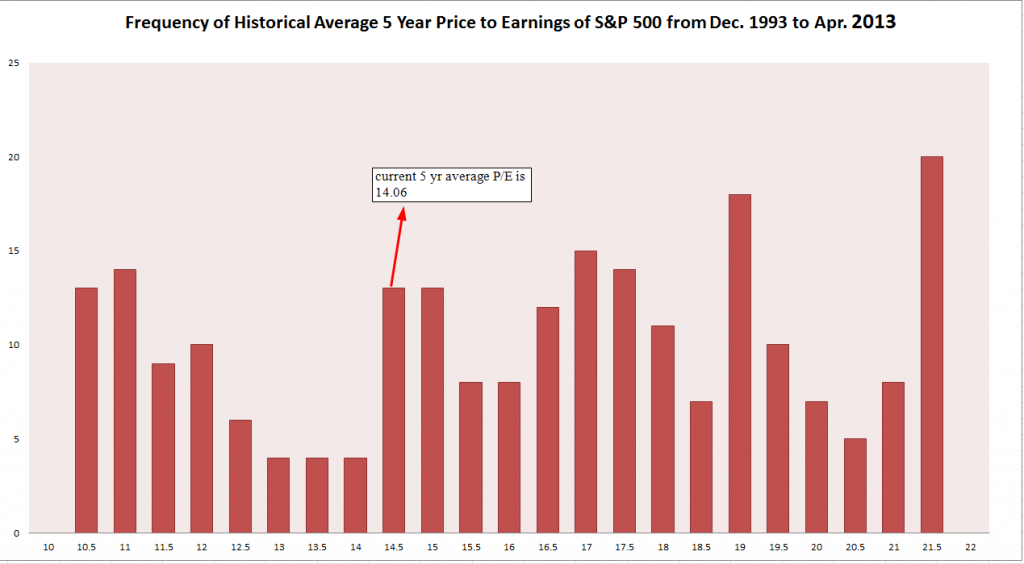

First, a look at price to average 5-year earnings. Nothing pops out as crazy.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

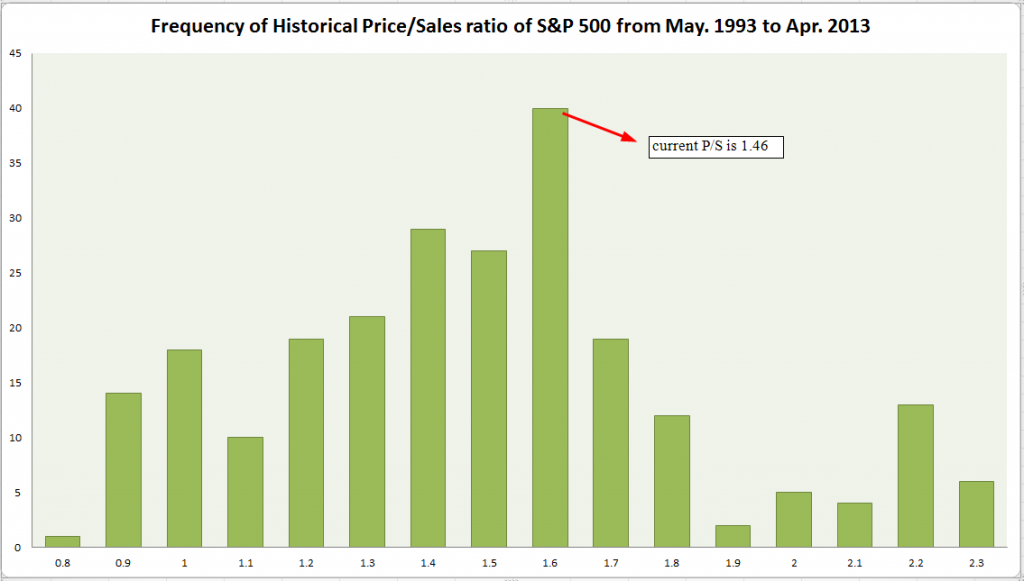

Next, a look at price to sales. Again, nothing extreme.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

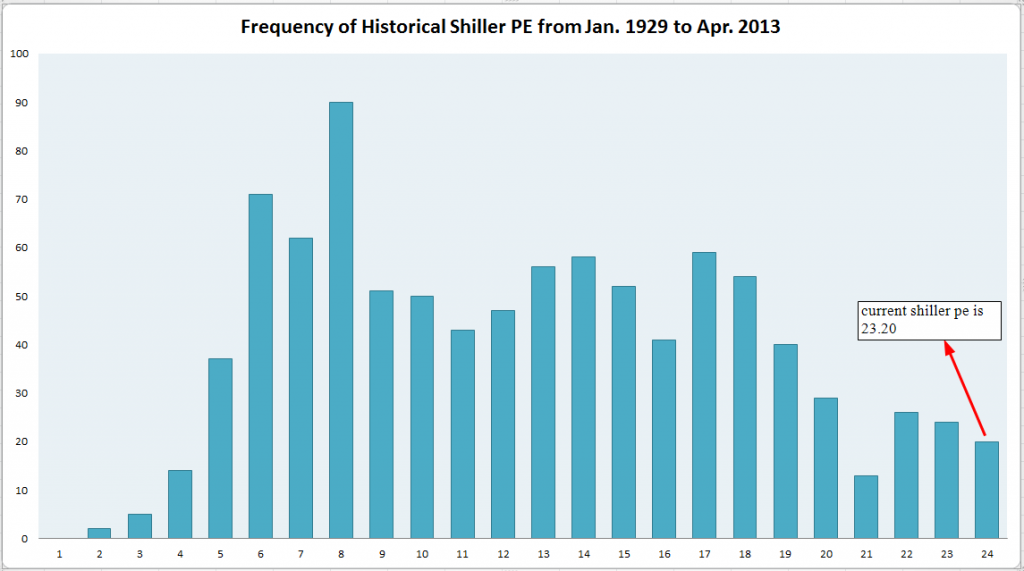

Finally, everyone’s favorite–the Shiller PE. On this metric, things look pricey.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

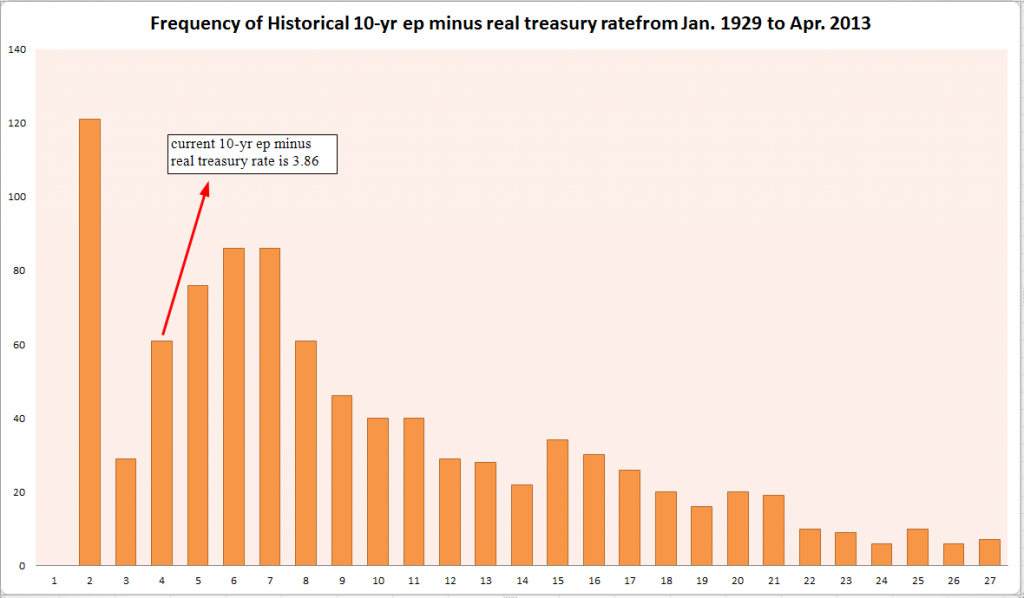

The risk premium as measured by “Shiller yield” minus bonds still looks attractive.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Because the market has been on a tear, everything has been tilted to the right since April 30. Nonetheless, the data are not all screaming that the market looks like he Nasdaq during the Internet craze.

What do you think?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.