Was hanging with the smartest investor I know earlier this week.

As part of any great investment discussion, interest rates quickly bubbled to the forefront of the conversation.

We discussed the unsurprising observation that hedge fund returns have been suffering in the current zero interest rate environment.

Then we talked about the various peddlers of hedge fund products that claim “hedge funds are due for a good 5-year run.”

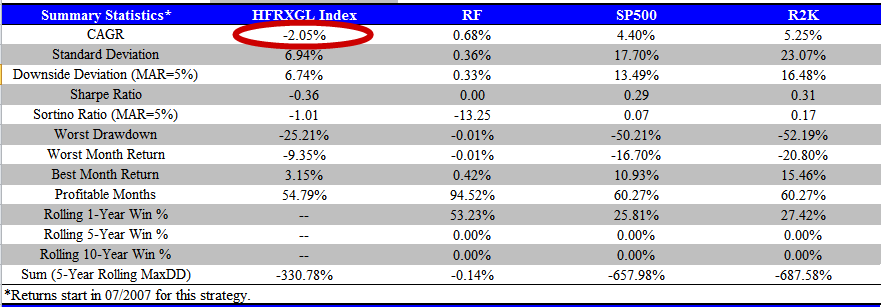

First, some numbers from hedge funds (HFRX Global Hedge Index) the past 5 years (6/30/2007 to 7/31/2013):

-2.05% looks a lot like RF minus hedge fund fees.

Of course, some highly-skilled and a handful of lucky hedge fund managers will go on great 5-year runs, however, one can make a case that hedge fund index returns are probably not going to be inspirational if we maintain a ~0% interest rate policy.

Why might hedge fund returns be low over the next 5-years? Well, “hedge” fund returns (in other words, hedge funds that actually hedge out market risk) are all anchored off the risk-free treasury rate.

Why do risk-free rates matter for hedge fund returns?

Let’s take the most basic hedge fund structure–a Long/Short Market Neutral Equity Hedge fund.

Let’s make our L/S hedge fund real simple: we long the S&P 500 and short the S&P 500.

In other words, we created the world’s worst hedge fund concept. Nonetheless, we’re keeping this example simple to explain why interest rates affect hedge fund returns.

So what does the prolific “2/20 genius” do with our hard-earned money?

Long Trade:

- We fund the strategy with $1.

- The HF manager takes our $1 and buys SPY.

Short Trade:

- The HF manager shorts $1 worth of SPY. The broker uses our $1 long SPY position as collateral for the $1 short SPY position.

- We receive $1 in cash from the sale of SPY.

- WE INVEST THE $1 PROCEEDS IN RISK-FREE BONDS

What’s the return on our Long/Short Equity hedge fund?

First some assumptions:

- Assume a 5% interest rate.

- Assume no interest rate haircut (i.e., if interest rates are 5%, you receive 5% on any short sale proceeds).

- Assume 10% return on the S&P.

- No shorting fees.

Now some calculations:

- The long book is worth $1.1.

- The short book is worth -$1.1.

- The $1 in cash from short book proceeds is worth $1.05 (5% interest earned).

- The NAV of the L/S hedge fund is $1.1-$1.1+$1.05 =$1.05. (Recall that the account was funded with $1, and that the short side required no additional capital to finance it, as it is collateralized by the long securities)

- The return on the L/S hedge fund is %5: $1.05/$1.0 -1. (Let’s pretend the HF manager is nice and doesn’t charge fees.)

Thought experiment: Asset A has no risk and makes a 5% return. We call it the risk-free treasury bill. Asset B is a L/S equity hedge fund that has no risk and makes a 5% return.

- Are asset A and B the same? Well, based on naming conventions, no, but based on financial engineering logic–YES!

And what are the returns on the Long/Short Equity hedge fund when risk-free rates are 0%?

- The long book is worth $1.1.

- The short book is worth -$1.1.

- The $1 in cash from short book proceeds is worth $1.00 (interest rates =0%).

- The NAV of the L/S hedge fund is $1.1-$1.1+$1.0 =$1.0.

- The return on the L/S hedge fund is %0: $1.0/$1.0 -1. (Let’s pretend the HF manager is nice and doesn’t charge fees.)

There you have it folks. Traditional HF manager returns–like all asset returns–are tied directly to the level of risk-free interest rates.

~0% hedge fund returns in the future won’t be that surprising in a zero interest rate environment.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.