The Greek philosopher Aristotle (348 BC – 322 BC) was a renowned polymath, who studied everything that could be studied at the time. He is thought to have written his many works as teaching aids to his students.

In his work Politics, which covers wide-ranging topics on government and philosophy, Aristotle describes the story of an earlier philosopher, Thales of Miletus (624 BC – 546 BC), who was a great mathematician, but not particularly focused on acquiring wealth.

Aristotle recounts a story about Thales in Book 1:

Thales, so the story goes, because of his poverty was taunted with the uselessness of philosophy; but from his knowledge of astronomy he had observed while it was still winter that there was going to be a large crop of olives, so he raised a small sum of money and paid round deposits for the whole of the olive-presses in Miletus and Chios, which he hired at a low rent as nobody was running him up; and when the season arrived, there was a sudden demand for a number of presses at the same time, and by letting them out on what terms he liked he realized a large sum of money, so proving that it is easy for philosophers to be rich if they choose, but this is not what they care about.

Many believe this is the first recorded discussion of an option trade.

Thales effectively bought a call option – the right, but not the obligation, to use the olive presses. If the olive crop were weak, there might not be enough olives to use the presses, and he would lose the premiums he paid. If the olive crop were strong, however, he could exercise his option, and use the press capacity to generate profits, either by operating them himself, or selling the capacity to someone who was willing to operate them. Luckily for Thales, the crop was strong, and his options finished in the money.

This ancient framework is often applied to modern R&D investments. In R&D investing, firms invest capital up-front, with the hope that the results of the research will enable the firm to commercialize the underlying idea. If the idea turns out to be a good one, the firm can, as Thales did, exercise its option to use it to generate profits, or it can sell the idea to another firm willing to do so. If the idea turns out not to be a good one, then the option expires out of the money, and the firm loses the premium it paid as an up-front R&D investment.

Option theory is really just a way of thinking, but it can be especially useful for valuing certain types of firms, which may not lend themselves structurally to other approaches. For example, traditionally, when valuing projects, financial practitioners have used the discounted cash flow (DCF) methodology; they project cash flows and then apply a discount rate that reflects the riskiness of those estimated cash flows. But the DCF framework has some shortcomings.

Consider the pharmaceutical industry, which consists of research-based firms that are dependent on the success of their research projects. In pharmaceutical R&D projects, DCF valuations do not account for manager’s ability to abandon the project, nor do they distinguish between projects abandoned due to 1) lack of economic viability and 2) safety or efficacy considerations, which have different success rates. Evaluating stages of pharmaceutical R&D projects as compound options allows one to account for these contingent decisions and differentiated risks, and yields higher valuations than does DCF, which systematically undervalues these benefits.

Peter Boehr has written extensively on “real option” theory, which allows a more granular view of contingent value and the value of flexibility. These values can take many forms, such as excess manufacturing capacity, inventory or cash, or such as patents, which confer the right to commercially develop the patented idea.

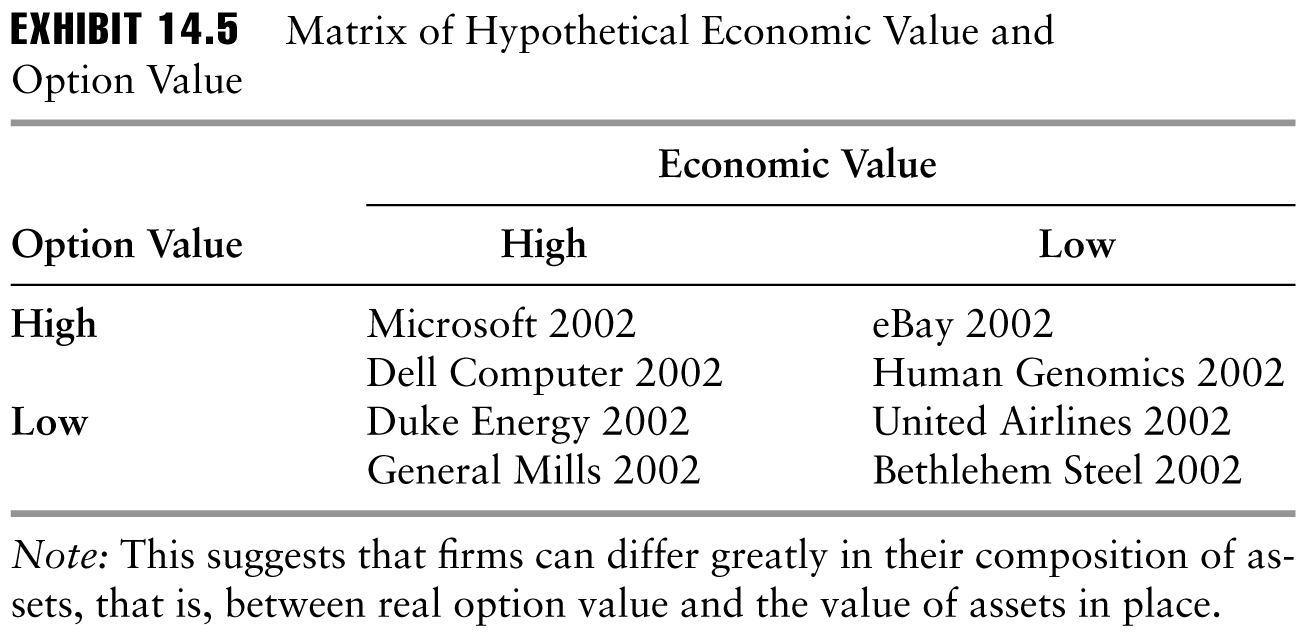

Robert Bruner has even proposed a matrix for thinking about embedded real option value as a component of total value, and as a guide to strategic planning:

In the northeast quadrant, eBay and Human Genomics hold rights to unusual new intellectual property that has yet to be fully developed but that has high commercial potential. In the northwest quadrant, Microsoft and Dell have unusually strong market franchises that grant them some annuity-like business, but also have high option value because of strong flexibility. In the southwest quadrant, Duke and General Mills have strong franchises that grant economic value. And in the southeast quadrant, two bankrupt firms have relatively low economic value and option value. Boer argues that firms can migrate from one quadrant to the next and that strategic planning is about the migration process.

Marcus Shulmerich, in “Real Options Valuation,” describes when a real options approach can be helpful:

- When there is a contingent investment decision. No other approach can correctly value this type of opportunity.

- When uncertainty is large enough that it is sensible to wait for more information, avoiding regret for irreversible investment.

- When the value seems to be captured in possibilities for future growth options rather than current cash flow.

- When uncertainty is large enough to make flexibility a consideration. Only the real options approach can correctly value investments in flexibility.

- When there will be project updates and mid-course strategy corrections.

Options may be an old idea, but are being used today in increasingly sophisticated ways to help us make smart decisions. The applications are practically limitless: insurance, licensing, patents, corporate acquisitions (e.g., buy/build), resource development rights, staged investments. The tools are out there to help, and all that is required is an understanding of how they can be applied. Aristotle and Thales would be proud.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.