Are Mutual Funds Sitting Ducks?

- S. Shive and H. Yun

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

We find that patient traders profit from the predictable, flow-induced trades of mutual funds. In anticipation of a 1%-of-volume change in mutual fund flows into a stock next quarter, the institutions in the same 13F category as hedge funds trade 0.31-0.45% of volume in the current quarter. A third of the trading is associated with the subset of 504 identified hedge funds. The effect is stronger when quarterly mutual fund portfolio disclosure is required and among hedge funds with more patient capital. A one standard deviation higher measure of anticipatory trading by a hedge fund is associated with a 0.9% higher annualized four-factor alpha. A one standard deviation higher measure of anticipation of a mutual fund’s trades by institutions is associated with a 0.07-0.15% lower annualized four-factor alpha. The effect is stronger for more constrained mutual funds.

Alpha Highlight:

The authors claim the following result:

Using past work as a guide, our prediction model uses lagged flows and mutual fund returns as predictors and the fact that mutual funds tend to scale their existing portfolios up or down in response to flows. We find that in anticipation of a 1% of volume change in mutual flows into a stock, hedge funds put on trades worth 0.18-0.25% of volume. This type of anticipatory trading by hedge funds is stronger in smaller, less liquid stocks…we show that hedge funds profit from this type of trading: a one standard deviation difference in hedge fund beta (with respect to predicted mutual fund flow) is associated with a 0.53% annualized difference in hedge fund excess return.

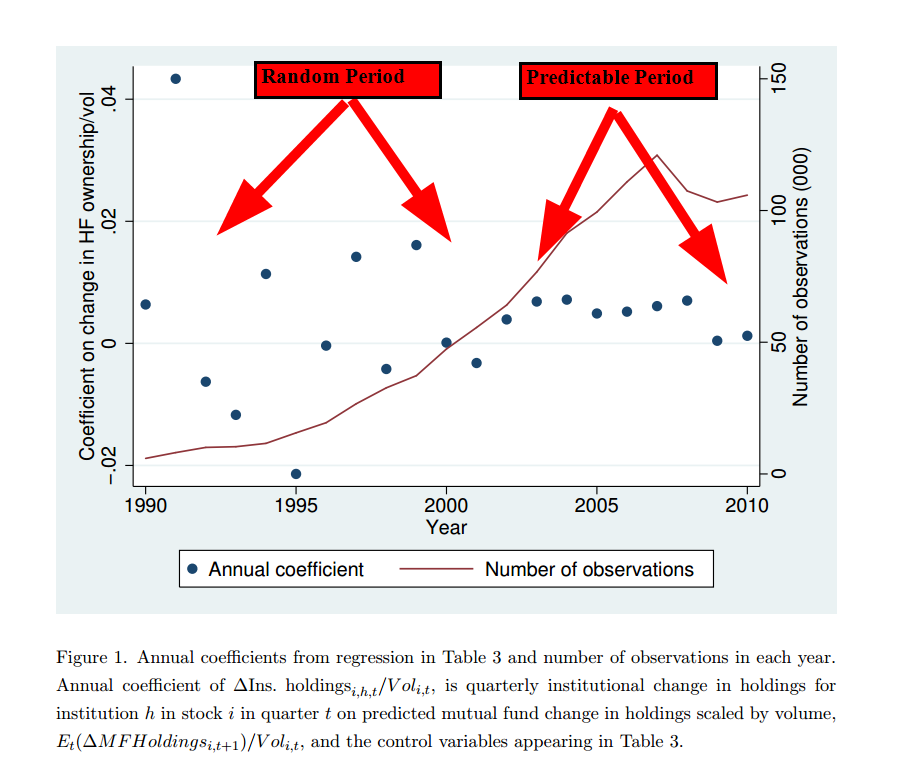

They first highlight that mutual fund trades become more predictable post-2002–notice how the circles stabilize. This more reliable predictability facilitates exploitation by smart investors.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

I’ll spare you the details from Table 3, which highlight the statistics behind the authors claim. Instead, I’ll quote the interpretation of the results from the paper:

The results in the 2003-2010 data are economically as well as statistically significant. A 1% of volume difference in predicted aggregate mutual fund flows into a stock is associated with roughly a 0.00344*0.01 = 0.0000344 proportion of quarterly volume traded by each institution in the prior quarter. Multiplying this by the average number of funds trading each stock in each quarter, 52, yields 0.18% of quarterly volume on average per stock. Summing the institutional trades by stock removes some noise, as shown in the last column of Table 3, Panel A. A 1% of volume difference in predicted aggregate mutual fund flows is associated with a 0.01*0.255=0.00255 or 0.25% of volume in anticipatory trading by institutions.

Comments:

An interesting attempt at identifying if “smart” money exploits the predictability of mutual fund flows. I’m skeptical of the results because of the empirical challenges associated with the question the authors are trying to address. That said, I think this is a commendable attempt at addressing an interesting question.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.