The Cost of Capital for Alternative Investments

- J Jurek and E Stafford

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

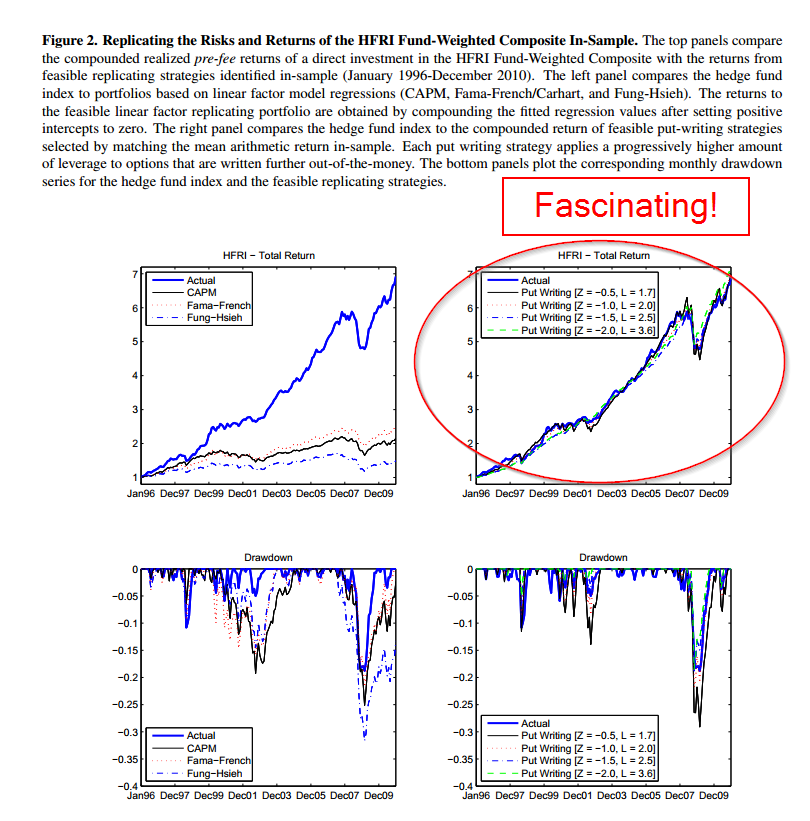

We document that the risks and pre-fee returns of broad hedge fund indices can be accurately matched with simple equity index put writing strategies, which provide monthly liquidity and complete transparency over their state-contingent payoff profiles. This nonlinear risk exposure combines with large allocations, typical among investors in alternatives, to produce required rates of return that are more than twice as large as those implied by popular linear factor models. Despite earning annualized excess returns over 6% between 1996 and 2010, many hedge fund investors have not covered their proper cost of capital.

Alpha Highlight:

The authors show that broad hedge fund returns can be captured via a simple equity index put writing strategy. If you’d like to implement a form of this strategy, CBOE has an index on it: http://www.cboe.com/micro/put/. You’ll have to do your own research on the product, but seems interesting. Here is the CBOE backtest on the strategy:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

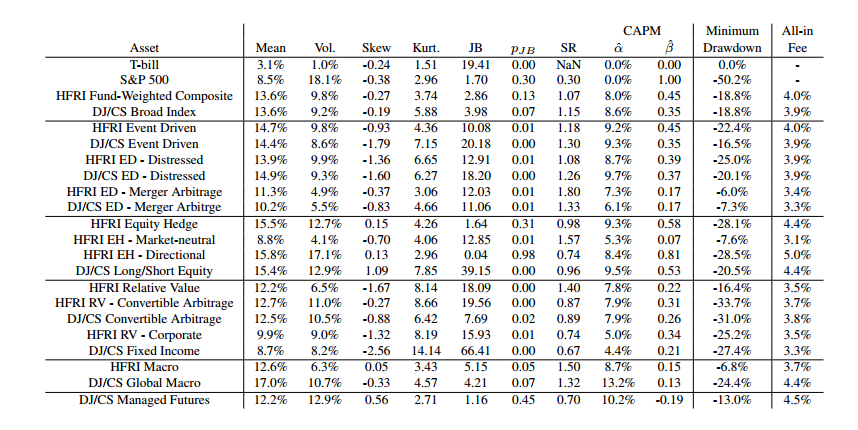

The authors post a great summary of various hedge fund returns:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

How does the replication work?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Comments:

Wow. Replicated by a simple model. Gonna be harder and harder to justify “2/20” these days. Thoughts?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.