Covered Calls and Their Unintended Reversal Bet

- Israelov and Nielsen

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

Equity index covered calls have historically provided attractive risk-adjusted returns largely because of their joint exposures to the equity and volatility risk premia. However, they also embed exposure to an uncompensated risk, a naïve equity market reversal strategy. This paper provides evidence that the reversal exposure is responsible for about one quarter of the covered call’s risk, but provides very little reward.

Alpha Highlight:

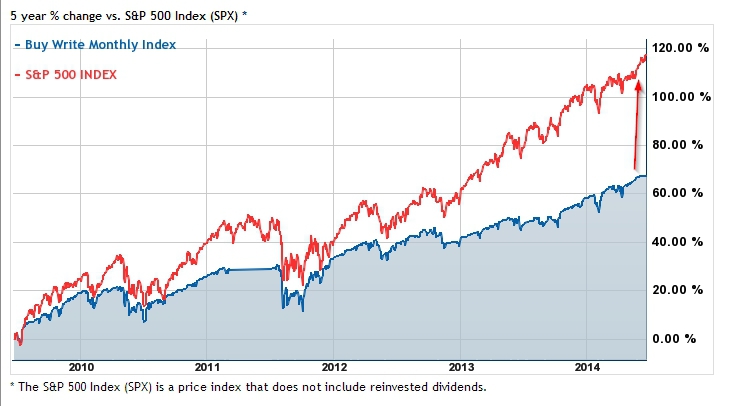

The hunt for “yield” in this market is relentless. The big banks (e.g., Goldman Sachs, UBS, CS, DB, etc.), hedge funds, and now mutual funds and ETFs (examples here, here, and here) have been promoting the idea that buy write call strategies are the best thing since slice bread–get more yield without any real downside. The chart below, written by 3 Goldman Sachs employees and published in the Financial Analysts Journal, highlights the benefit–at least historically–of a strategy that is long stocks, but also writes calls along the way. The paper is well done and addresses the buy-write trade in a professional academic manner: highly recommended reading.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The story of buy write strategies is as follows: The big upside of buy-write is extra income and smoother drawdowns; the big downside (among others discussed below) of buy write strategies is huge underperformance during a bull market.

The chart below is directly from the CBOE website, highlighting the issue with big bull markets and a covered call strategy:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Enter Equity Market Reversal Strategy Risk

The authors highlight that the returns to index covered call strategies are discussed in the context of 2 risk factors:

- Equity premium: arguably low at this point in time.

- Volatility premium: arguably low at this point in time.

But the authors bring up a new risk associated with covered call strategies that are rarely discussed:

- Market timing risk

How does market timing risk work?

If you dust off your options textbook you’ll remember the term “delta,” which refers to how sensitive an option price is to the underlying stock price. For example, if you have an at the money call option on 1 share of the SP 500 and the option has a delta of .5, for every $1 movement, the option will move $.50 (approximately).

Now that we understand delta, we can understand how the call option we sell affects the covered call strategy.

- As the index price increases, the delta on the call option increases because it is more and more likely to expire in the money.

- As the index price decreases the delta moves in the opposite direction to reflect the fact it will likely expire worthless.

Because a covered call option strategy reflects an underlying position in equity (delta = 1) and being short a call with changing delta, we get the following situation:

- Baseline situation: S&P delta = 1 and short call position delta = -.5; net .5 delta

- More equity exposure in a falling market environment: S&P delta = 1 and short call position delta = -.25; net .75 delta, or higher market exposure

- Less equity exposure in a rising market environment: S&P delta = 1 and short call position delta = -.75; net .25 delta, or lower market exposure

The above highlights in Barney-Style terms how this works and avoids extra complication associated (e.g., vega, theta, Gamma, Rho). In the end, a covered call strategy embeds elements of a reversal strategy, not a trend-following strategy. Unclear whether a reversal strategy or a trend-following strategy is dominant, but it is important to know what you are buying!

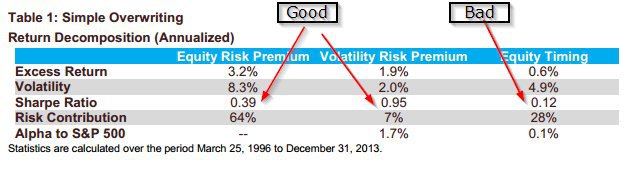

The authors decompose the returns associated with each component of risk associated with a covered call strategy. As the results show (examining the Sharpe Ratio below), the equity and vol premium are good bets, the equity timing component doesn’t produce.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

So next time the peddlers are peddling the amazing power of covered call strategies as a great way to increase yield and print free money, ask them the following:

- What is your opinion on volatility premium? Are you bearish on volatility and think VIX is steady and falling? Bearish volatility implies we shouldn’t do a covered call strategy.

- What is your opinion on equity risk? Are you bearish on the market and think we have hit a permanent peak? Bearish on stock market implies we shouldn’t do a covered call strategy.

- What is your opinion on equity timing? Do you like trend-following? Then we shouldn’t do a covered call strategy.

One must investigate these 3 return/risk drivers for a covered call strategy in order to make an effective decision as to whether a covered call strategy makes sense.

Have fun out there and always remember there are some really smart guys at AQR capital management competing against you in the marketplace!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.