Analyst Interest as an Early Indicator of Firm Fundamental Changes and Stock Returns

- Jung, Wong, Zhang

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

In this study, we propose that an increase in analyst interest in a firm — measured by the onset of analysts who do not cover a firm but participate on that firm’s earnings conference call — is an early indicator of improvement in a firm’s future fundamentals and capital market activities. We find that a change in analyst interest is positively associated with future changes in earnings and sales. Analyst interest also precedes changes in capital market activities such as analyst coverage, institutional ownership, and trading volume. Finally, we find that analyst interest is positively correlated with future stock returns. Overall, our results suggest that analyst interest is a leading indicator of firm fundamentals and offers a one-step-ahead advantage in analyzing stock market dynamics.

Alpha Highlight:

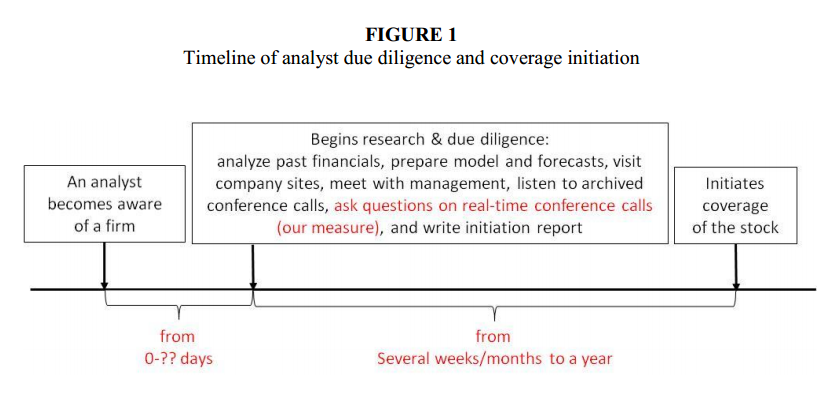

The authors try to identify if analyst interest predicts future stock returns. Analyst interest is defined as a situation where analysts are joining a firm’s conference call, but haven’t yet begun formally covering the stock. The idea is outlined in the figure below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The trading strategy around this concept is super interesting. Note that asking questions on conference calls occurs near the tail end of the coverage initiation process. Thus, you could go long stocks with a lot of analyst interest, because this is an indication some of them might initiate coverage, as they perceive potential good news in the future for the stock.

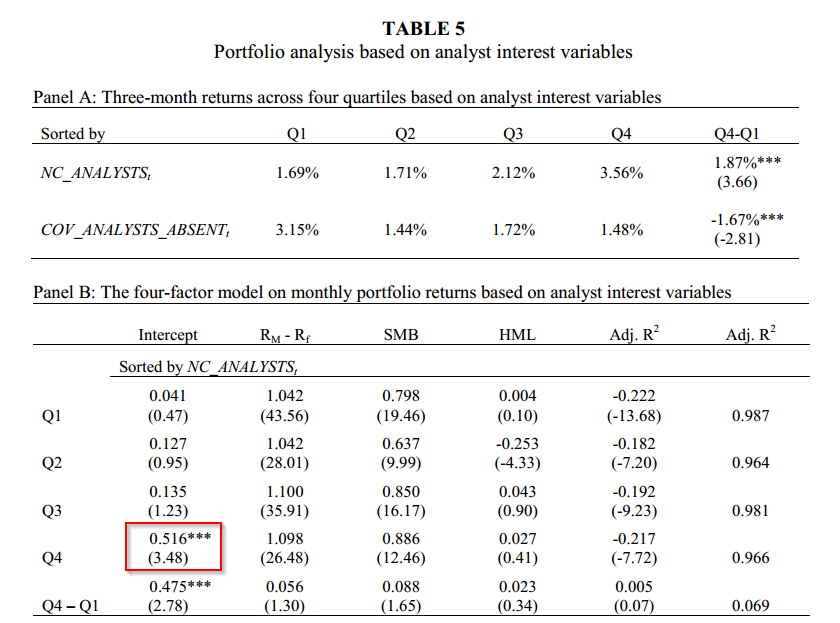

What are the results for a strategy that goes long a basket of “high analyst interest” stocks? The table below suggests 52bps/month, or over 6% a year. The strategy does load on small caps, so you might run into some liquidity issues, but overall, not bad!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Start paying attention to who is on the conference call, as you just might be picking up on a valuable signal!

Anyone toyed with this idea in the past?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.