Sports Sentiment and Stock Returns

- Edmans, Garica, and Norli

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

This paper investigates the stock market reaction to sudden changes in investor mood. Motivated by psychological evidence of a strong link between soccer outcomes and mood, we use international soccer results as our primary mood variable. We find a significant market decline after soccer losses. For example, a loss in the World Cup elimination stage leads to a next-day abnormal stock return of -49 basis points. This loss effect is stronger in small stocks and in more important games, and is robust to methodological changes. We also document a loss effect after international cricket, rugby, and basketball games.

Alpha Highlight:

With the World Cup starting today, we wanted to highlight an interesting paper on sports sentiment and its affect on stock returns.

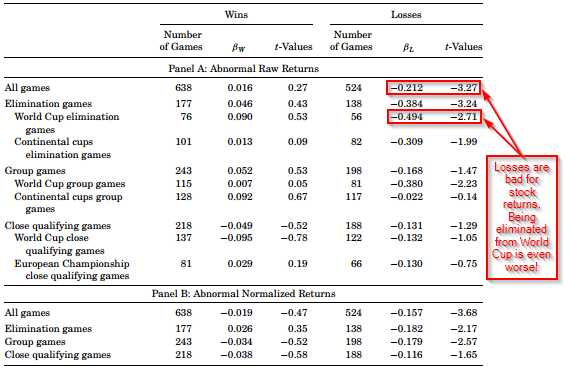

The table below examines how a country’s win or loss in soccer games affect stock returns the next day (US and Canada are excluded). The data is from 8 World Cups between 1974 and 2004.

Two takeaways from the table:

- Winning does not have a statistically significant affect on stock returns, while losing does.

- Being eliminated from the World Cup produces the lowest abnormal returns the next day, at -49.4 bps.

Excited for the World Cup to begin!

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.