So the market took a tumble today–Feeling pain? Feeling emotional? Expecting the downward trend to continue?

Be careful, your system 1 is terrorizing your ability to make effective decisions. To put a -2% day in perspective, let’s review some history related to value investing…

Defining a simple value investor

We define a value investor as one who buys low-priced stocks. Being a value investor has the intuitive appeal of “buying cheap stuff.” Additionally, numerous academic papers have shown the persistence of the “value” premium, which Fama and French famously documented in their 1992 JF and 1993 JFE papers.

So why isn’t everyone buying cheap stocks?

Being a value investor requires some patience and faith that market overreactions will eventually be corrected.

In theory, value investing is easy: buy and hold cheap stocks for the long haul.

In practice, value investing IS ALMOST IMPOSSIBLE.

Using Ken French’s data, we examined some time periods when it was painful to be a value investor.

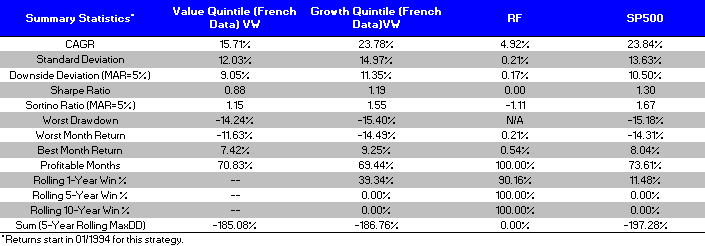

One such period is during the run-up to the internet bubble. We examine the returns from 1/1/1994-12/31/1999 for a Value portfolio (High B/M quintile, VW returns), Growth portfolio (Low B/M quintile, VW returns), Risk-Free return (90-day T-Bills), and SP500 total return.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Talk about a beat-down! Looking at the annual returns, value investing lost every year to a simple market allocation!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Looking back, we now realize that the internet bubble was about to burst, but at the time, value investing was getting criticized. Warren Buffett, arguably the greatest value investor, was criticized in the media for “losing his magic touch.” After the fact, it is obvious that value works, but truly ask yourself:

COULD YOU STICK WITH AN INVESTMENT THAT LOST 6 YEARS STRAIGHT TO THE MARKET?

If you did have the discipline and commitment to value investing you were rewarded.

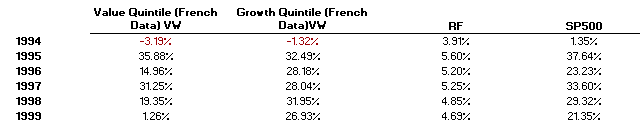

Here are the returns to the same portfolios from 1/1/2000 – 12/31/2013:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

For the next 14 years, value investing was the better bet (we have documented this before).

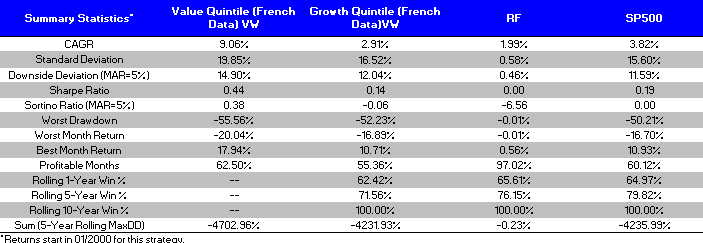

Here are the results over the entire time period from 1/1/1994 – 12/31/2013:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

So while over the entire time period, value investing was optimal, there can be long periods of time (up to 6 years!) where you underperform.

Ask yourself again–and be honest:

Can you withstand the pain of value investing?

Said a different way:

Can you lose for 6 years and stick to the program?

Most of us simply cannot suffer that amount of pain as individuals. And for those of us in the investment advisory business, peddling a strategy with the potential for multi-year underperformance is akin to suicide (and yet, this is exactly what we do as value investors…maybe we need to check ourselves into the asylum!). A -2% day? A big deal? Well, things can get a LOT WORSE! There is one person who can stick with the program and he/she’ll be smiling all the way to the bank!

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.