For the next 30-60 days we’ll be posting a recap research report on classic research related to quantitative value investing. This is the first part of the series. Stay tuned for a whole lot more!

Investment Performance of Common Stocks in Relation to Their Price-earnings Ratios: A Test of The Efficient Market Hypothesis

- S. Basu

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Core Idea:

Basu examines the relationship between stock returns and P/E ratios based on sample from 1957 to 1971. He finds that the Low P/E ratio portfolio earned 7% higher returns than a high P/E portfolio.

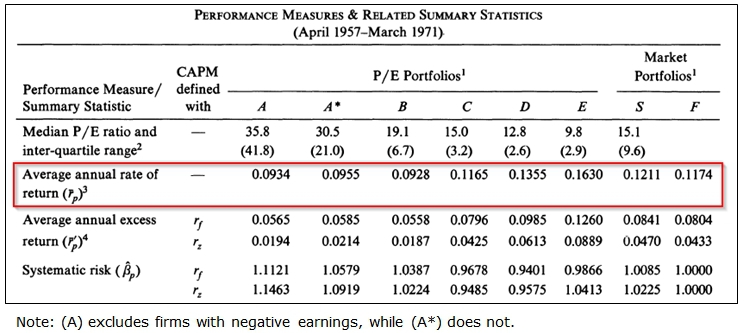

- Stocks are sorted into five equally weighted portfolios based on P/E ratios (A=highest P/E, B,C,D and E=lowest P/E). The table below shows that the highest earnings yield quintile (E) earned 16.30% on average per year compared to 9.34% by the lowest quintile (A), about 7% higher.

- Beta could not explain these return differences; in fact, the low P/E portfolios were associated with lower levels of systematic risk than the high P/E portfolios.

Alpha Highlight:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.