Testing Benjamin Graham’s Net Current Asset Value Strategy in London

- Xiao and Arnold

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

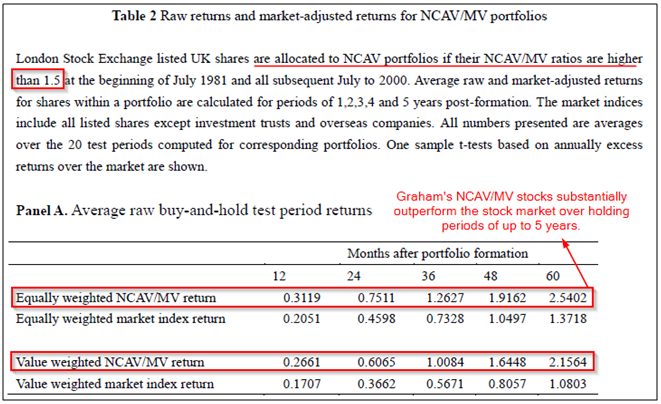

It is widely recognized that value strategies – those that invest in stocks with low market values relative to measures of their fundamentals (e.g. low prices relative to earnings, dividends, book assets and cash flows) – tend to show higher returns. In this paper we focus on the early value metric devised and employed by Benjamin Graham – net current asset value to market value (NCAV/MV) – to see if it is still useful in the modern context. Examining stocks listed on the London Stock Exchange for the period 1981 to 2005 we observe that those with an NCAV/MV greater than 1.5 display significantly positive market-adjusted returns (annualized return up to 19.7% per year) over five holding years. We allow for the possibility that the phenomenon being observed is due to the additional return experienced on smaller companies (the “size effect”) and still find an NCAV/MV premium. The profitability of this NCAV/MV strategy in the UK cannot be explained using Capital Asset Pricing Model (CAPM). Further, Fama and French’s three-factor model (FF3M) can not explain the abnormal return of the NCAV/MV strategy. These premiums might be due to irrational pricing.

Alpha Highlight:

Core Idea:

This paper tests a value metric employed by Benjamin Graham – net current asset value to market value (NCAV/MV) – to see if it is still useful in a modern context.

- Examining stocks listed on London Stock Exchange for the period 1981 to 2005.

- NCAV/MV Security Selection: Only those stocks with NCAV/MV higher than 1.5 are included in the NCAV/MV portfolios.

- Results: Firms with an NCAV/MV greater than 1.5 display significantly positive market-adjusted returns (annualized return up to 19.7% per year) over five holding years.

- Additionally, the differences in returns of the NCAB/MV holdings cannot be explained by the Fama-French three-factor model (which includes size and value factors).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Toby Carlisle, Sunil Mohanty, Jeff Oxman have a paper on the subject in the US market.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.